Markets continue to throw investors in a tailspin as volatility picks up. It’s just what the doctor ordered. Worries over the direction of Federal Reserve Board policies, a partially inverted yield curve and international trade relations (among other things) have turned Wall Street red. After an uncharacteristically smooth 2017, markets are back to normal behavior: going up, down and sideways. Although volatility is normal it doesn’t make it any easier. Markets of this nature are good to bring people back down to reality. Most investors became too content with risk.

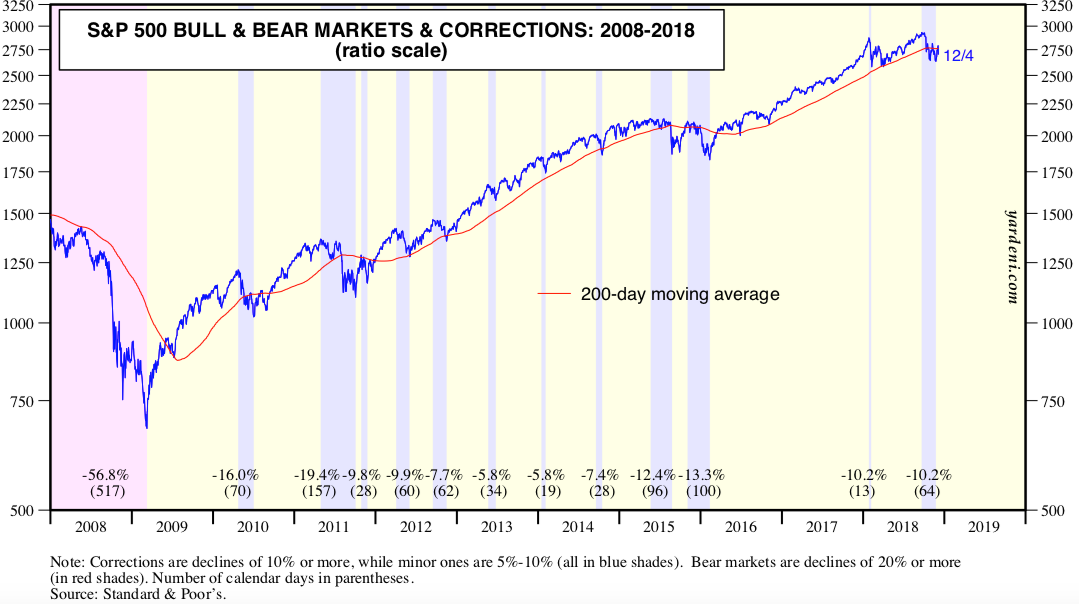

As shown in the market research conducted by Yardeni Research, the entirety of 2017 and nearly all of 2016 did not experience a market correction. Further, the correction at the beginning of 2018 only lasted 13 days. Although sharp and severe, the pain was temporary. It’s when corrections extend over long periods of time people begin to worry. It’s in the slow agony people begin asking why they didn’t see it coming and make rash portfolio decisions.

Looking over a stretch of ten years, it’s evident the recent market run-up with little volatility created a sense of comfort. Investors were willing to ratchet up risk in their portfolio because they forgot how markets normally behave. They forgot what volatility feels like watching your portfolio lose value day after day. When the good times are rolling it’s difficult to avoid chasing returns or imagine a declining market. After all, nobody likes seeing their less than intelligent neighbor or co-worker make more money than them.

So, this current market volatility is a good thing and just what the doctor ordered. We are witnessing this turbulence bring investors back down to reality. It’s easy to feel like an investing guru in a raging bull market. But those who said they could stomach portfolio declines are no longer experiencing hypotheticals (risk tolerance questionnaires) but the real thing. Without guidance of an advisor most investors change their investment strategy and is why the average investor under performs. Making money in the markets doesn’t come easy. So as markets continue to pick up volatility, ground yourself in a disciplined and structured investment philosophy. If markets do continue to decline it will be the north star to keep you on course.

Talk with us about your portfolio or financial plan here: Talk with an advisor

More Reading: Time to Go to Cash?