The annual 401(k) contribution limits are often too low for high income earners. In this post, I am going to breakdown a little-known strategy, often dubbed a Mega Backdoor Roth.

If you are a high-income earner who easily maxes out their 401(k) each year, keep reading.

401(k) Contribution Limits for 2021

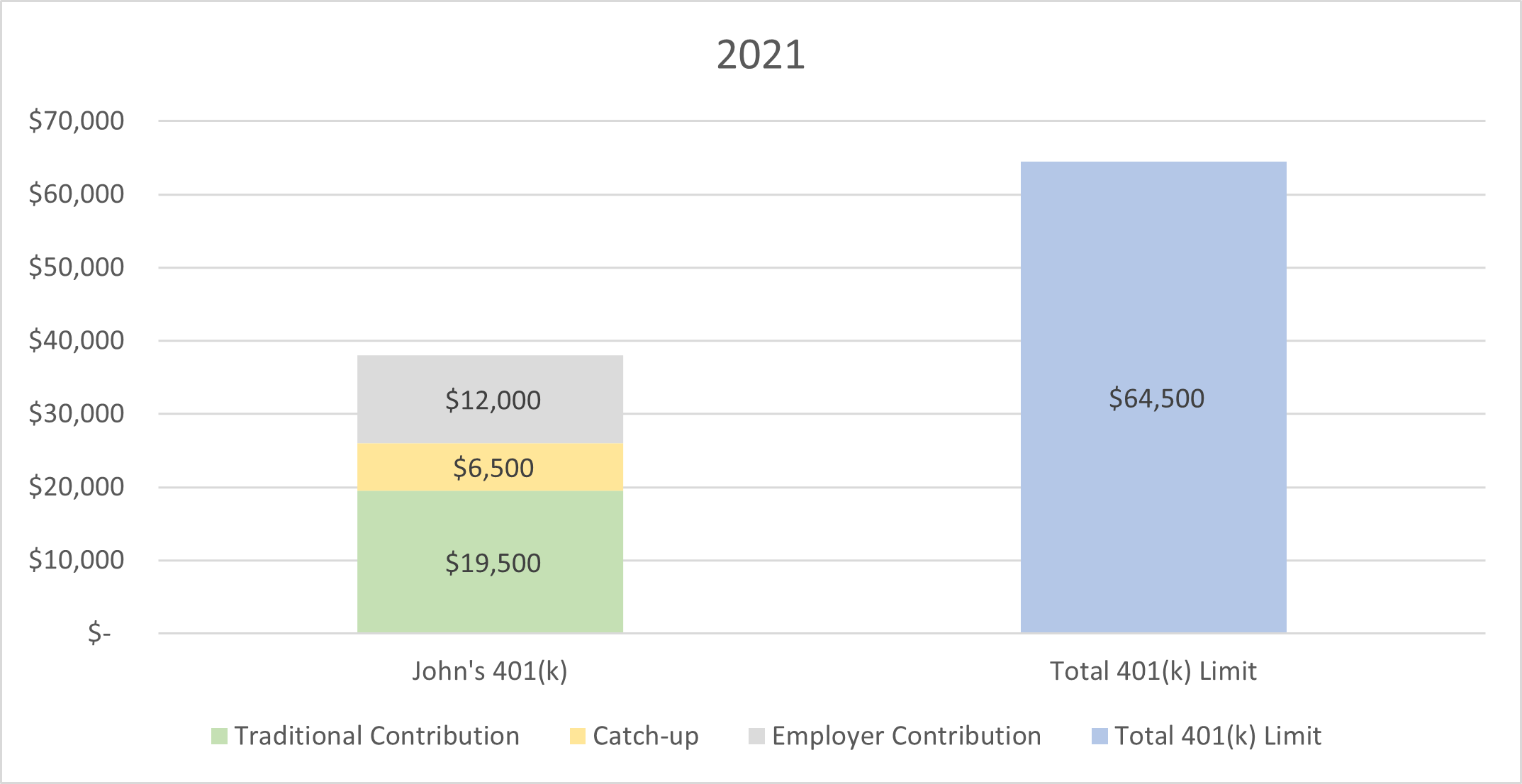

In 2021, the annual 401(k) contribution limit is $19,500. If you are age 50 or older, you can contribute an additional $6,500, for a grand total of $26,000.

For high-income earners, this annual savings may not be enough. To make matters worse, high-income earners are also typically restricted from making tax-deductible IRA or Roth IRA contributions.

The beauty of a 401(k) plan is your contributions are not limited due to your income. Together, you and your employer cannot contribute more than $58,000 ($64,500 including catch-up contributions).

John has a 401(k) plan through work. He is age 55 and a high-income earner, making $400,000 a year. In 2021, he will contribute the maximum amount, $19,500 and an additional $6,500 catch-up contribution, for a total of $26,000. His employer provides a dollar for dollar match up to 3% of salary, contributing $12,000 into the plan. The total contributions into the plan between John and his employer total $38,000.

Because of John’s Modified Adjusted Gross Income, he is prohibited from making a tax-deductible IRA or Roth IRA contribution in 2021.

Introducing the Mega Backdoor Roth

A Mega Backdoor Roth strategy is a specific type of 401(k) rollover strategy. To utilize this strategy, your 401(k) plan must have two specific provisions:

- After-tax non-Roth contributions: Although it may sound similar, this is not a Roth contribution. This specific type of employee contribution is not subject to the traditional limit.

- In-service withdrawals: Many, but not all, 401(k) plans allow you to take withdrawals from your 401(k) while you are still employed. However, for this strategy to work your plan needs to allow for non-hardship withdrawals of after-tax contributions.

This information will typically be found within your 401(k) information packet, or more specifically, the Summary Plan Description.

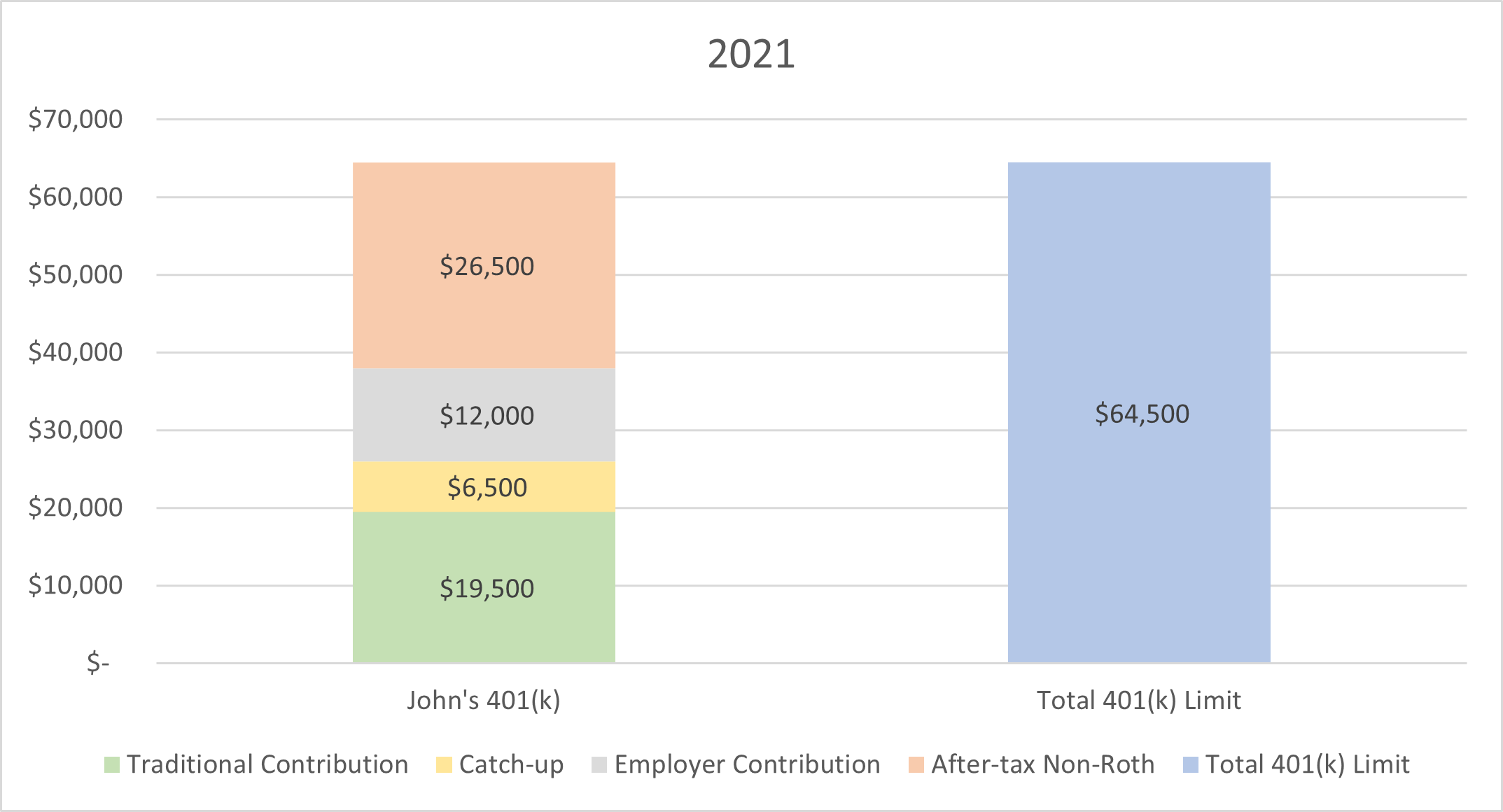

Let’s assume the same example as before, but John’s employer allows for after-tax non-Roth contributions and non-hardship in-service withdrawals. After he contributes the maximum amount for his age ($26,000), he also contributes $26,500 of after-tax non-Roth dollars into his 401(k). The employer contributions plus his own will total $64,500 for the year.

It is important to note that you should only consider making after-tax non-Roth contributions if you have already maxed out your traditional 401(k) contributions.

Once John has made his after-tax non-Roth contributions into his 401(k), once per year, he instructs that the after-tax non-Roth contributions be rolled into a separate Roth IRA account. Now that those funds are in his Roth IRA, they will grow tax-deferred and can be withdrawn tax-free in retirement.

The Benefits of the Mega Backdoor Roth

Recall that the Roth IRA is a powerful and unique retirement account. Investment growth in the account is tax-deferred, and qualified withdrawals are tax free. This is an incredibly powerful combination.

The mega backdoor Roth strategy allows you to fund your Roth IRA, even if your Modified Adjusted Gross Income would traditionally prohibit you from making a Roth IRA contribution.

It’s important to periodically rollover your after-tax non-Roth contributions into a separate Roth account. If the after-tax non-Roth contributions are simply left in the 401(k), the tax advantages of the strategy are mostly lost.

Who Should Consider the Strategy?

This strategy works best for high income earners who have extra cash and have already maxed out their traditional 401(k) contributions, but are unable to contribute to a Roth IRA or make tax deductible contributions to an IRA.

In addition, we find this strategy is best utilized after other key financial goals have been addressed, such as maintaining an emergency cash reserve, funding your HSA if you have a high deductible healthcare plan, etc. Customized coordination of these savings priorities can be addressed through the financial planning process.

Finally, the mega backdoor Roth should be primarily used for retirement savings. If you want or need the flexibility to access the funds sooner, a taxable brokerage account might be a better solution.