Are you considering hiring a new financial advisor? Avoid hiring a bad financial advisor by asking these questions.

Resources:

How to Idhttps://youtu.be/QokmkojIJj4entify and Avoid Bad Financial Advisors: A Simple Guide

When it comes to managing your finances, finding the right financial advisor can make all the difference. Some people rave about their financial advisors, while others warn that they should be avoided at all costs. The reason behind this disparity is simple but often overlooked. Here’s a straightforward guide to help you identify and avoid bad advisors, ensuring you make the best choice for your retirement planning.

Know What You’re Looking For

Before you even consider speaking with a financial advisor, it’s crucial to know exactly what you need help with. This step is often skipped, leading to costly mistakes and frustration down the line. Ask yourself, “What do I need and want help with?”

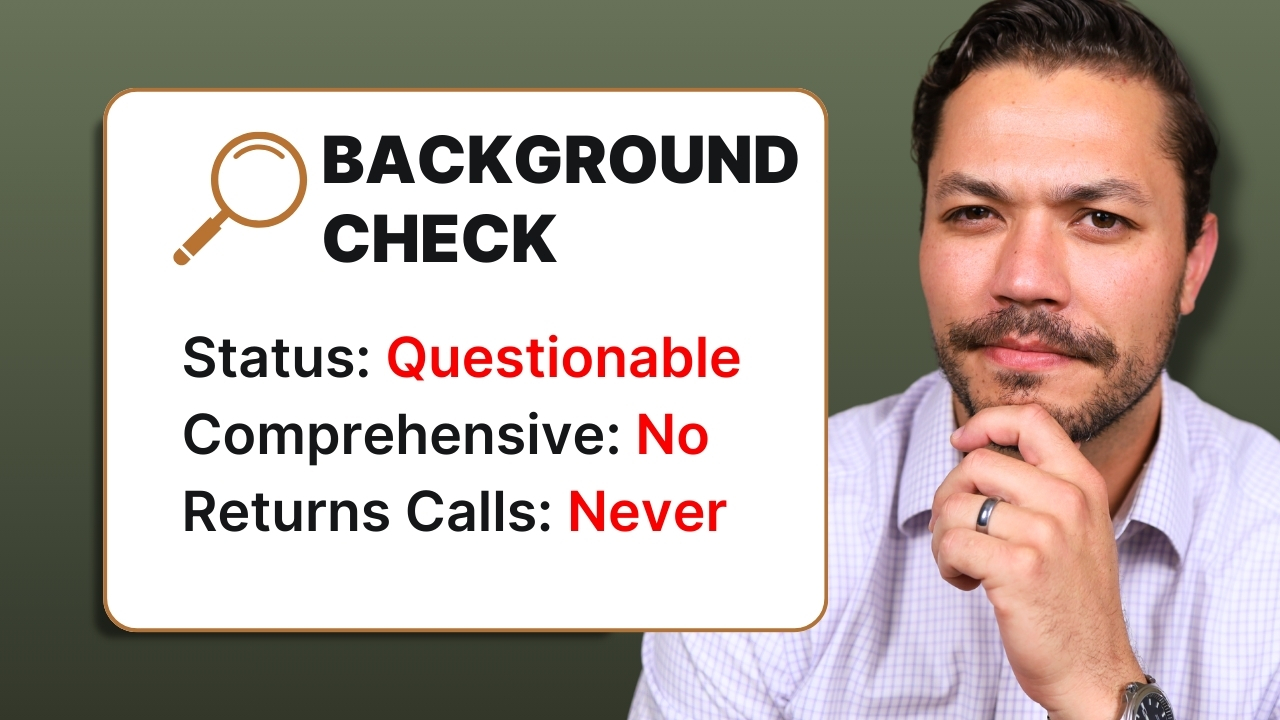

Some advisors may not return your calls or might push products like annuities without addressing your broader financial needs. To avoid bad advisors, be specific about what you’re looking for. Do you need a comprehensive retirement plan? Help with tax strategies? Or perhaps you only need assistance with investments? Clarifying your expectations upfront will save you from future headaches and ensure you find the right fit.

Red Flags to Watch For

Even if you’re clear about what you need, there are certain red flags that can help you quickly eliminate bad advisors from your list. Here are some common warning signs:

- Lack of Listening: If during your initial conversation, the advisor does all the talking without giving you a chance to explain your needs, that’s a bad sign. You need someone who listens and understands your unique situation.

- Expectation of Blind Trust: If an advisor expects you to trust them without providing clear answers to your questions, it’s time to move on. Trust is earned, not demanded.

- Lack of Credentials: The barrier to entry in the financial advising industry is low, meaning almost anyone can call themselves a financial advisor. However, credentials like the CFP (Certified Financial Planner) designation are a good indicator of an advisor’s knowledge and commitment to the profession. Always check if an advisor’s credentials are in good standing through reliable sources like the CFP Board or the SEC’s advisor database.

The Key Questions to Ask

To further ensure you’re choosing the right advisor, there are key questions you should ask during your initial discussions:

- “Are your recommendations in my best interest?” This question is critical because it determines whether the advisor is a fiduciary—someone legally obligated to act in your best interest. The answer should be an unequivocal “yes.”

- “Will your recommendations be comprehensive or focused on one area?” Most people want advice that covers more than just investments. A good advisor should offer comprehensive services, including tax planning, estate planning, and more. Be wary of generic answers and look for specific examples of how they plan to address your needs.

- “What will be my total investment expense, how much will you be compensated, and where can I see this in writing?” Transparency is key. If an advisor is hesitant to discuss their fees or claims you won’t pay anything, consider that a red flag. It’s essential to understand the costs involved and ensure that the value you receive exceeds the fees charged.

Conclusion

Finding the right financial advisor is a crucial step in ensuring a secure and enjoyable retirement. By knowing what you’re looking for, being aware of red flags, and asking the right questions, you can avoid the pitfalls of bad advisors and find an advisor who genuinely has your best interests at heart. Always do your due diligence, and don’t be afraid to walk away if something doesn’t feel right. Your financial future depends on it.

Seek Professional Guidance

Join the 964+ other retirees and get weekly articles and videos to help you retire with confidence.

Subscribers also gain access to our private monthly client memo.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures