Should you own International Stocks?

You may be in a position where your investment portfolio is not keeping up with the Dow or S&P 500 indices, even if you are a growth-oriented investor.

This is probably because you own international stocks which have not only trailed U.S. stocks this year but have had a negative return year-to-date.

The question often arises in these situations: Why do I own international stocks if U.S. stocks have outperformed? What gives the question more fervor is that U.S. stocks have significantly outperformed, in aggregate, for 9 years.

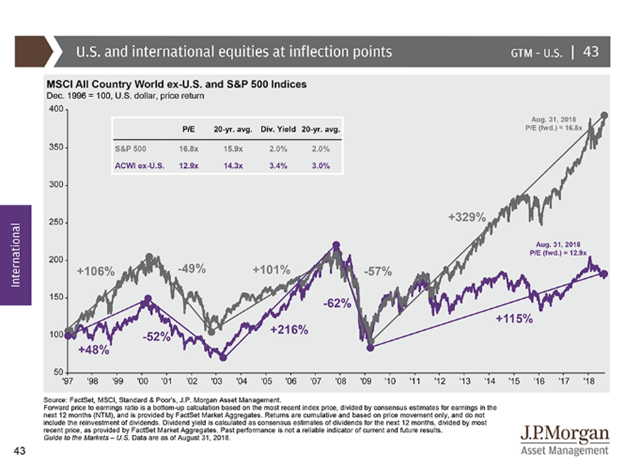

You can see this divergence shown in J.P. Morgan’s Guide to the Markets report:

Doesn’t this show the U.S. market is clearly better than international markets? Not really. It’s quite normal for U.S. and International markets to trade taking the lead.

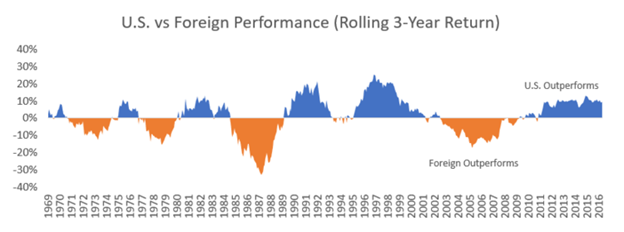

Ehren Stanhope at O’Shaughnessy Asset Management in his blog at factorinvestor.com shows that over the last 4 ½ decades, the pattern of leadership has shifted multiple times usually after long durations.

In this context, two things are apparent:

- The current run for the U.S. could have reasonably been expected given the historical pattern.

- The duration of these runs is uncertain and therefore difficult to time.

International stocks are again likely to reclaim their leadership role if history rhymes.

But, since timing the shift is difficult (at best), it seems wise to own both as part of a diversified plan and run with them for a long period of time.

If you feel you must make a tactical shift, I would suggest tilting toward your preference instead of eliminating one category.

A diversified approach means you’re likely to always be happy with one and frustrated with the other.

As financial author, Nick Murray, has said, “Diversification is the conscious choice not to make a killing, in return for the blessing of never getting killed.”

While diversification can apply to more than just U.S. vs International stocks, owning both can help smooth out the ride, and still allow you solid long-term global stock market returns.

The chart below from Fidelity shows competitive annualized returns in the globally balanced portfolio with lower risk as measured by standard deviation resulting in a better risk adjusted return (Sharpe ratio). Keep in mind, this measurement runs through 2016 — many years into the current U.S. streak.

“Divide your portion to seven, or even to eight, for you do not know what misfortune may occur on the earth.” Ecclesiastes 11:2.

Spreading out your risk is a wise principle and may help you sleep better at night. And, more than anything, if that helps you stick to your plan, it’s well worth it.

Anthony Saffer

Principled Prosperity is focused on equipping those who choose to ignore the noise. The world of finances can be complex, but basic truths have persevered over time, across cultures, and in spite of changing circumstances. Anthony Saffer writes on his experiences in personally working with families to coordinate principled financial and investment solutions.

3 Comments

Comments are closed.

[…] be – spread your risk. An all-or-nothing approach can backfire enormously. As financial author, Nick Murray, has said, “Diversification is the conscious choice not to make a killing, in return for the blessing of […]

[…] such as real estate and commodities. Additionally, interest rates vary all over the globe. Solely focusing on the United States for bond and/or stock exposure limits potential and prohibits the ability to take advantage of […]

[…] Should you own International Stocks? […]