The Dog Years of International Stocks

It’s hard to believe we are nearly halfway through 2019. The United States’ stock market has outperformed the aggregate International stock market. At the time of this writing, the S&P500 TR Index is up 13.67% and the MSCI EAFE TR Index is up 9.69% year-to-date.

It seems we’ve been telling the same story the past several years. Investors may be reconsidering the benefits of investing outside of the US. Even the most disciplined investors, grounded in the long-term benefits of diversification, can get frustrated. While international returns may be lackluster relative to the US over the past several years, it’s important to remember:

- Non-US stocks provide diversification benefits

- Recent performance is not a reliable indicator of future returns

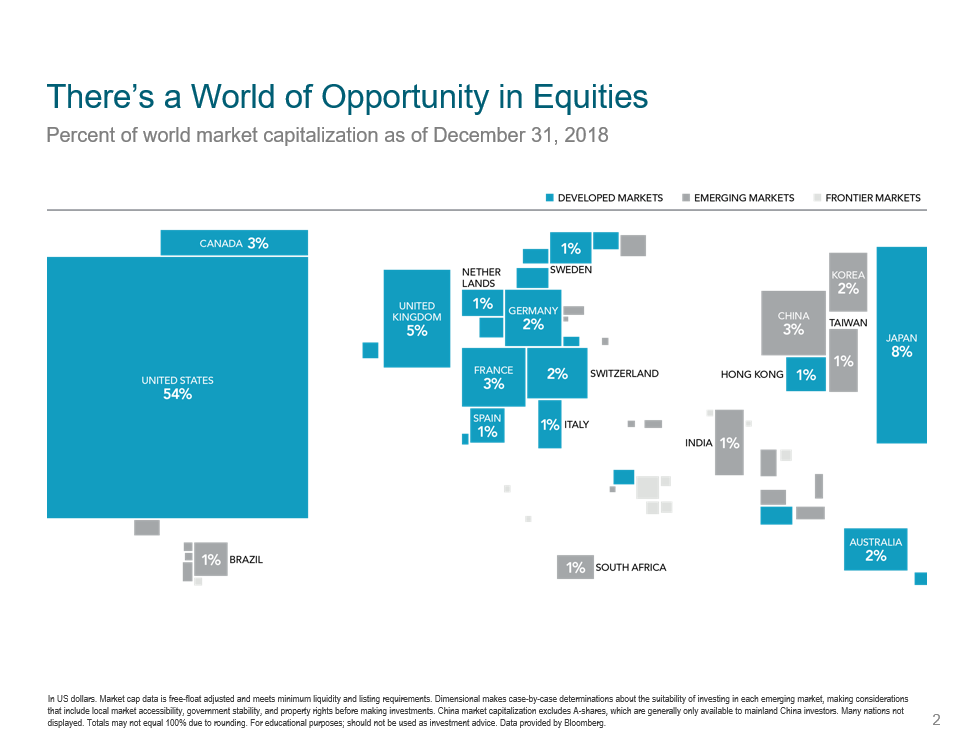

Consider the world stock market. Most investors typically have a home bias, allocating a greater weight in their portfolio to their home country. The US market is large but it’s still only 54% of the global equity market. In other words, there is another 46% of the world equity market to be invested in.

By holding a globally diversified portfolio, investors are positioned to capture returns wherever and whenever they may occur. As Anthony Saffer points out in his article, “Should you own International Stocks?”, US and International market performance have traded off taking the lead for decades.

There is no reliable evidence this variance of performance can be predicted in advance; in other words, trying to time the market by investing solely in US markets during an upswing and investing solely in International markets as leadership shifts. By investing with a global approach, diversification can help reduce risk and maximize returns over the long term.

Talk with us about your portfolio or financial plan here: Talk with an advisor

More Reading: International Stock Markets: Should I invest internationally?

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. See our website at onedegreeadvisors.com for full disclosures.

One Degree

We help families cut through the noise to make confident financial decisions.