We’ve all heard the expression, it’s better to give than to receive. Not only is it wonderfully rewarding to see a person’s face as they open a gift, but it turns out giving is also good for your health. A study conducted by Queensland University of Technology found those who are more generous experience lower levels of stress. Here is a strategy to help maximize your giving and minimize taxes

With lower stress comes lower blood pressure and a host of other positive health benefits. It’s fair to say we could all use lower levels of stress in our lives and generosity may be one more way for us to achieve that. Those who are generous often choose to give by opening their checkbook, but they are often unaware of ways to give that could further their tax benefits as well.

Giving appreciated stock is a powerful tool to help maximize your giving and tax deductions. As your investments have grown, so too have the tax ramifications if you decide to sell outside of retirement accounts. The benefits are twofold: 1) the organization you give to will receive the full value of the stock being gifted, and 2) you pay no capital gains tax and remain eligible to receive a deduction. This is a big advantage. For stocks you’ve held more than one year, your deduction is equal to the value of the stock on the date of gift. For stocks you’ve held less than one year, your deduction is reduced to your cost basis (how much you paid for the stock).

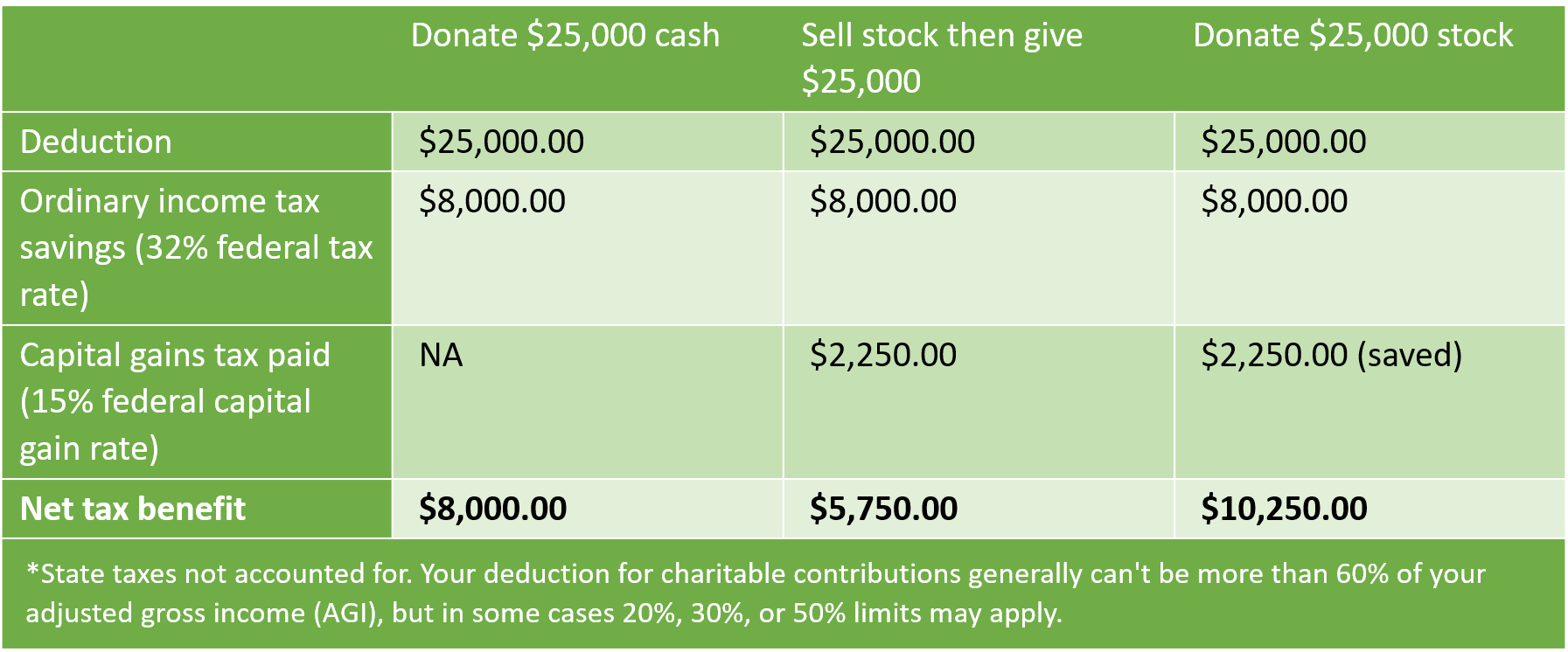

As an example, look at these tax savings, assuming you purchased stock 10 years ago at $10,000 that is now worth $25,000.

Why don’t you take the next step and consider gifting your appreciated assets like stock to maximize your giving? Even if the charitable organization is not set up to receive stock, tools such as Donor Advised Funds can allow you to easily direct the stock sale and gift. Make the greatest impact with your giving and at the same time contribute to your mental and physical well-being!

For tax-efficient giving within retirement accounts: Giving Mandatory IRA Distributions Directly to Charity Just Got Better