How Charitable Stacking Can Benefit You

If you’re like most, you give financially because you are passionate about a certain cause. The tax benefits of charitable stacking are a nice incentive but not the sole reason you are generous.

Many people believe they will receive a deduction for their gifts, but due to recent tax law adjustments, the benefit may be lost.

All too often we find people with charitable hearts losing out on thousands of dollars each year.

Careful planning is required to maximize your giving and tax deductions.

A Quick Background

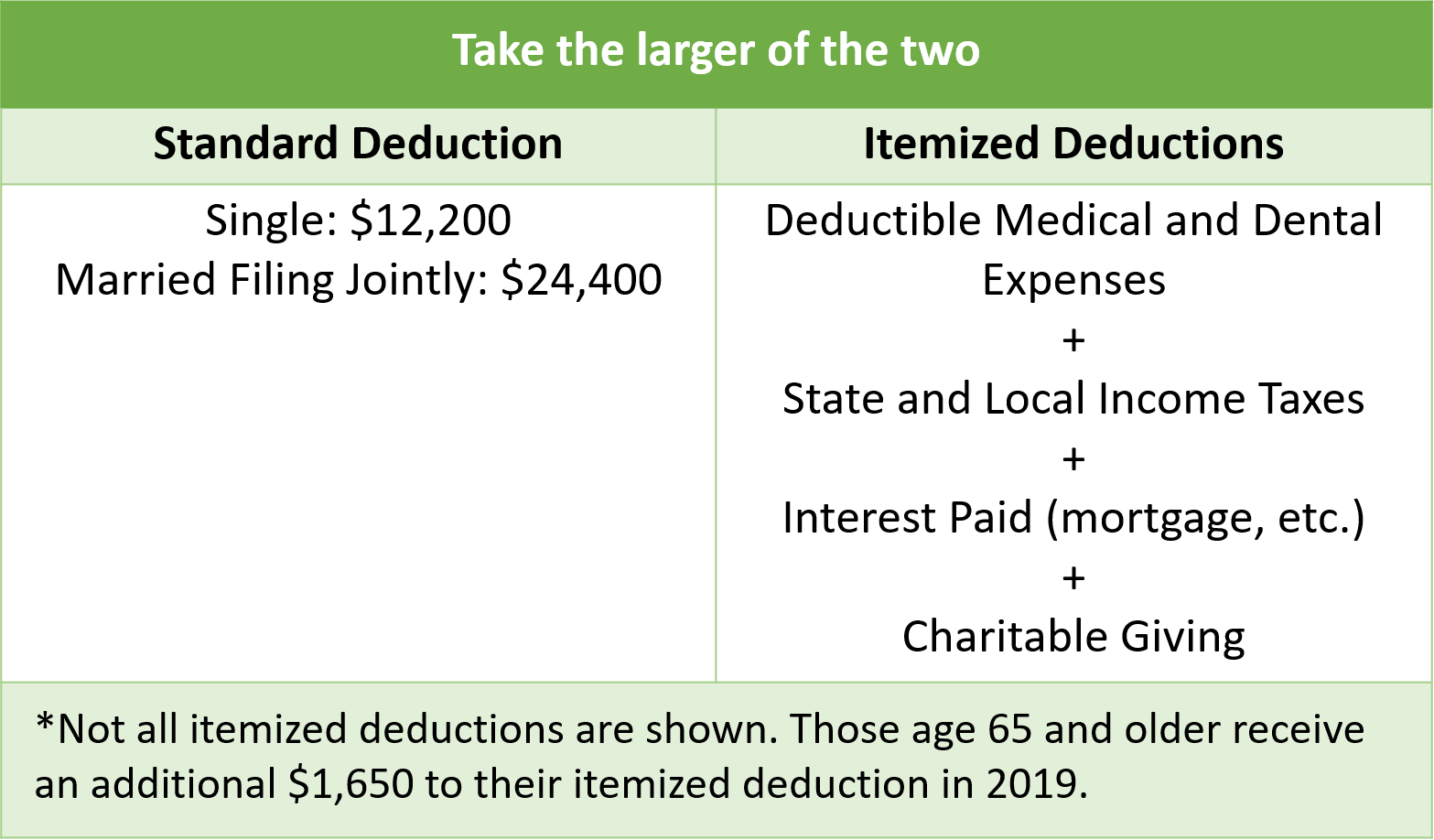

When you file your taxes, there is a key decision to make: take the Standard Deduction or Itemize Deductions.

More people are now taking the Standard Deduction because it increased under recent tax reform.

When the Standard Deduction is larger than Itemized Deductions charitable giving deductions are no longer useful.

What Changed?

There are two main factors that have caused people to take the Standard Deduction rather than Itemize, like they have in the past:

- The Standard Deduction is nearly double the size it was in the past.

- State and Local Income Tax deductions have been capped at $10,000. For high-wage earners in states like California and those with large property tax bills, this was a dramatic reduction.

Strategy: Stacked Giving

A strategy to maximize your giving and tax deductions is to stack your giving into specific years.

It’s not complicated.

Depending on your tax situation, stacking multiple years of giving into one year may push your itemized deductions high enough to take advantage of the giving deduction.

Consider the following example:

Bob and Mary give $8,000 to their local church every year.

As you can see in the above example, Bob and Mary lose the deductible value of their $8,000 gift through normal giving.

When Bob and Mary combine two years’ worth of giving, which is $16,000, into one year they can capture the deductible value of their charitable contribution by itemizing their deductions.

Bob and Mary can also utilize a Donor Advised Fund, that will allow them to make two years’ worth of contributions in one year, but distribute the money to the charities of their choice at their preferred pace.

In this case, Bob and Mary receive the maximum tax benefit and the charity can continue receiving money as normal.

Stacked giving is one of many powerful strategies to maximize your gifts and tax deductions.

Depending on your unique situation, it may make sense to gift appreciated stock to avoid capital gains.

If you’re over 70.5 and taking Required Minimum Distributions (RMDs), it may make sense to give your RMDs directly to charity.

This strategy is also a great way to keep Medicare premiums under control. Giving creatively takes proactive planning but is well worth the effort for both you and the charity!

Talk with us about your portfolio or financial plan here: Talk with an advisor

More Reading: First Time Homeowners: Should I Help My Children Buy A Home?

Receive posts like this directly to your inbox. Subscribe here.

Advisory services offered through One Degree Advisors, Inc. For a full list of disclosures please see our website at onedegreeadvisors.com

One Degree

We help families cut through the noise to make confident financial decisions.