The challenge of successfully investing in a pandemic

Over the recent week, the stock market has dropped swiftly attributed to concerns over the spread of the Coronavirus (Covid-19). Specifically, the virus poses risks to the Chinese and global economies. Prognostications, no matter how confidently communicated, are simply guesses, which is why it is important to prepare investment portfolios for these types of occurrences ahead of time. In other words, we are already prepared even if navigating through market declines may be challenging.

To move forward with confidence, let’s look at three pertinent questions:

- How is the current positioning of your investment portfolio already prepared for a downturn?

- How concerned should you be if your investments give up recent gains?

- How have viruses or similar health-related issues affected the market historically?

How is the current positioning of your investment portfolio already prepared for a downturn?

Toward the end of 2018, stocks dropped around 20% but many investors hardly noticed because of two things: 1. The news had a hard time relating the downturn to anything specific, so media reports were generally less intense. 2. Stocks rebounded just as swiftly as they dropped erasing any concerns. While it remains to be seen how swiftly we may rebound from this downturn, the news is intense and more acutely striking emotions. Moving forward from 2018, the stock market has largely been full steam ahead.

For retirees (and those taking income from the investments), we have discussed why we remain diversified, specifically, with an allocation to bonds. Anthony Saffer, CFP® wrote about Why the dollar amount of bonds in your investment portfolio matters. In short, if you are drawing income from your investments, it is preferable to have an allocation toward stable assets like bonds. This allows stocks to recover and avoid selling while they are down in value. Over the recent week, bonds had a positive return. This provides stability of income while not sacrificing the long-term sustainability of your investments.

For accumulators (or those who are working and adding to their investments), diversification is still important. However, a downturn in stocks increases expected long-term returns and provides an opportunity to buy at lower prices. In other words, accumulators should welcome market corrections for their long-term performance. While it might be difficult to accept lower values on your statements, history has shown that it is best to stay the course and keep accumulating shares at lower prices.

Additionally, we most often add two other major categories to investment portfolios. The Flexible category, which can feature a combination of different strategies and risk levels, but overall is focused on the ability to adapt to the market environment. And, we include the Diversifier category, which includes such things as Real Estate and strategies that generally align less strictly to traditional stock and bond categories to help spread risk and deal with uncertainty. The diversification plan is intentional to help capture growth in good times and be prepared for downturns before they happen.

How concerned should you be if your investments give up recent gains?

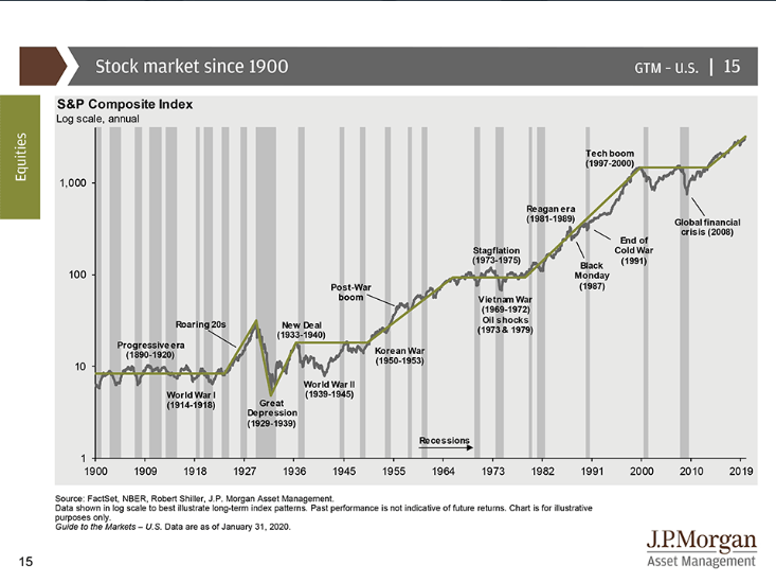

Outstanding stocks returns like we experienced in 2017 and 2019 can make us question why we own anything else besides stocks! On the other hand, when we experience a serious drawdown in one week it can seem like we never get ahead. Take a look at the chart below from J.P. Morgan’s Guide to the Markets. The gray market return line shows a bumpy ride in the short-term while the overlaying green trend line almost looks like a staircase. In both cases, the short-term rarely looks attractive. The long-term, however, illustrates significant growth IF one can successfully see past the short-term feeling of ‘one step forward, one step back.’ The long run is more accurately depicted by ‘two steps forward, one step back’, which is substantially rewarding.

How have viruses or similar health-related issues affected the market historically?

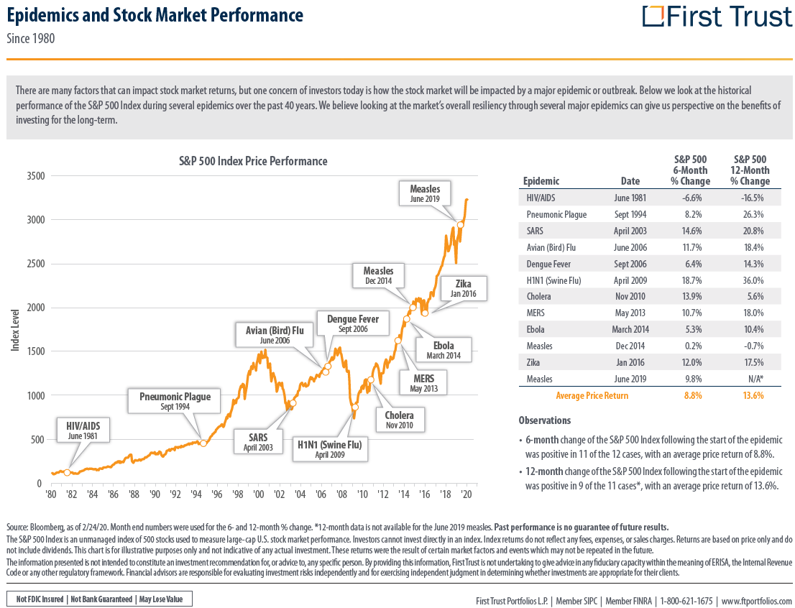

A virus outbreak can strike fear because of uncertainty. While no two cases are the same, epidemics are no stranger to headline news. Recent outbreaks, such as Swine Flu (H1N1), SARS, and Ebola, caused global concern. The chart below from First Trust shows the performance of stocks for 6 months and 12 months after an outbreak. Historically, headline epidemics have rarely caused a significant long-term downturn in stocks.

While many people will predict “what’s next,” successful investors make objective decisions through uncertainty and stay true to their plan. Events like this underline the importance of seeking wise financial counsel. Our clients understand investments are a tool to accomplish life’s priorities and that market correction can and will happen.