Value Investing: Will Big, Growth Companies Continue to Dominate?

A New Era for Investing?

As the stock market recovers from it’s low in March of 2020, much of the recovery in the S&P 500 has come from five of the largest growth companies in the United States. Year-to-date Facebook, Amazon, Apple, Microsoft, and Google account for a +35% return, while the remaining 495 companies are still down -5%. We continue to see growth investing outperform, while value investing has lagged.

With the extraordinary performance of a handful of tech-giants, it leads many investors to wonder if we should expect these stocks to continue such strong performance going forward.

Big Company = Better Stock Performance?

A handful of large companies atop the stock market is nothing new. For example, at the end of 2019 Apple (AAPL) made up 4.1% of the US stock market while in 1967, IBM represented 5.8%. In other words, it is not particularly unusual for the market to be concentrated with a handful of large “tech” stocks.

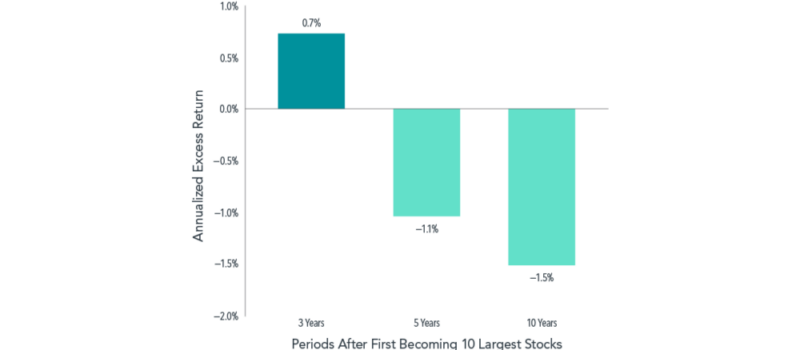

There is no doubt, the stock performance of these companies has been extraordinary. However, consider the following evidence from DFA:

“…charting the performance of stocks following the year they joined the list of the 10 largest firms shows decidedly less stratospheric results. On average, these stocks outperformed the market by an annualized 0.7% in the subsequent three-year period. Over five- and 10-year periods, these stocks underperformed the market on average.”

Growth vs. Value Investing

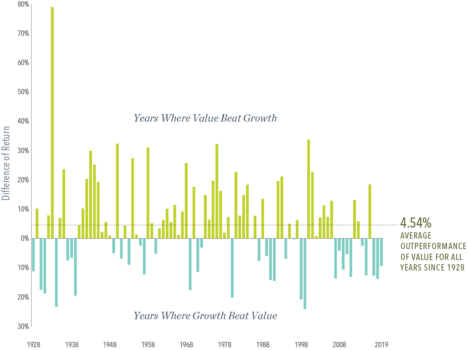

There is strong historical evidence of value stocks outperforming growth stocks over long periods of time (a quick recap the difference between growth and value). But there can be periods when growth outperforms value, as we are seeing now. In 1999, The Wall Street Journal wrote a piece titled, “What’s Wrong, Warren?” which describes the prolific value investors recent lackluster performance relative to the S&P 500.

“Shares in Buffett’s Berkshire Hathaway are set to experience their first annual decline since 1990, and their second-worst year of performance, relative to the Standard & Poor’s 500 Index…Berkshire’s Class A stock is off 23% in 1999, against an 18% return for the S&P 500…”

Looking back, we see what happened in the markets as the tech bubble burst in 2000. While history does not always repeat, it does rhyme. DFA shows in data covering nearly a century in the US and five decades of market data outside of the US, the notion that value stocks have higher expected returns. Of course, past returns are no guarantee of future performance.

Bringing It All together

It may seem like “this time it’s different”, especially when these mega companies have an enormous impact on our lives and a global footprint. So, investors have a choice to make; adhere to time tested principles, such as diversification, or go all in on handful of highly successful tech giants.

We certainly do not know what the future holds. However, we believe investors have the greatest chance for long-term success by:

- Using history as a guide

- Utilizing low-cost, tax-efficient investments

- Tilting towards value

- Investing globally and diversifying

- Managing risk

Alex Okugawa

San Diego Financial Planner. I write about financial planning topics to guide families in making a greater impact with their wealth.