How Should I Prepare My Portfolio for What’s Next?

2020 has been a whirlwind for investors.

March was one of the fastest bear markets in history. The run-up since then has been historic.

Some investors can’t wait to get in on the action while others are nervous for what is ahead.

Full Transcript:

Alex: Hi there, and welcome to One Degree Advisors where we help families cut through the noise to make confident financial decisions. 2020 has been historic on many levels. March was one of the fastest bear markets in history and the run-up since then has been quite historic.

We’ve had things like the coronavirus the presidential election this year And so there’s a lot of worriedness in the markets a lot of anxiousness and investors are feeling it, you know pre March the place to be were big US. Tech stocks post March it seems like that’s still the place to be. So the question becomes what should we do next to position our portfolio for long-term success, of course, we don’t know exactly what lies ahead in the future but we do know that there are Sound Investment principles that we’ve used on our clients over the past several decades to guide them to long-term success.

Assessing Your Emergency Needs [00:53 – 1:29]

Alex: One of those first principles is Assessing Your Emergency Needs

Anthony: Yeah having cash reserves helps you prepare for uncertainty. Getting rid of high interest debt. It reduces those obligations so through the uncertainty and really at any time. I mean emergencies come up repairs are needed jobs are lost. So being able to fall back on that cash is really important. I mean if you were if something happens say in March when stocks ar down 35% you really want to avoid selling stocks at a 35% discount or even worse taking out of a retirement plan where you’re also paying taxes and penalties on top of that.

Alex: Yeah. That’s very good.

Understanding Your Time Horizon and Needs [01:30-02:25]

Alex: The second thing is understanding your time Horizon and needs.

Anthony: Yeah, where are you at in the in the process? Are you a growth investor where you’re putting into your 401k every two weeks if that’s the case volatility in the markets is not a bad thing because you’re really buying it lower prices when it is down.

If you’re a retiree being set up to say, okay. I do have my growth Investments so I can outpace inflation meet my long-term obligations, but at the same time being able to meet income needs in the short-term from a more stable pool of assets and then the other thing to be considering is time in the market is really more important than trying to time the market because trying to get out get back in is very difficult. You really have to get it right on both sides.

Alex: Getting in and out both have to be timed correctly.

Anthony: Yeah, and that’s really tough because there’s no all-clear sign when it comes to trying to get back in anything that’s addressed through that really needs to be done through a very systematic process trying to do it based on emotion is extremely difficult if not impossible.

Diversify Globally [02:28-03:34]

Alex: Yep, and then the final thing is Diversify Globally

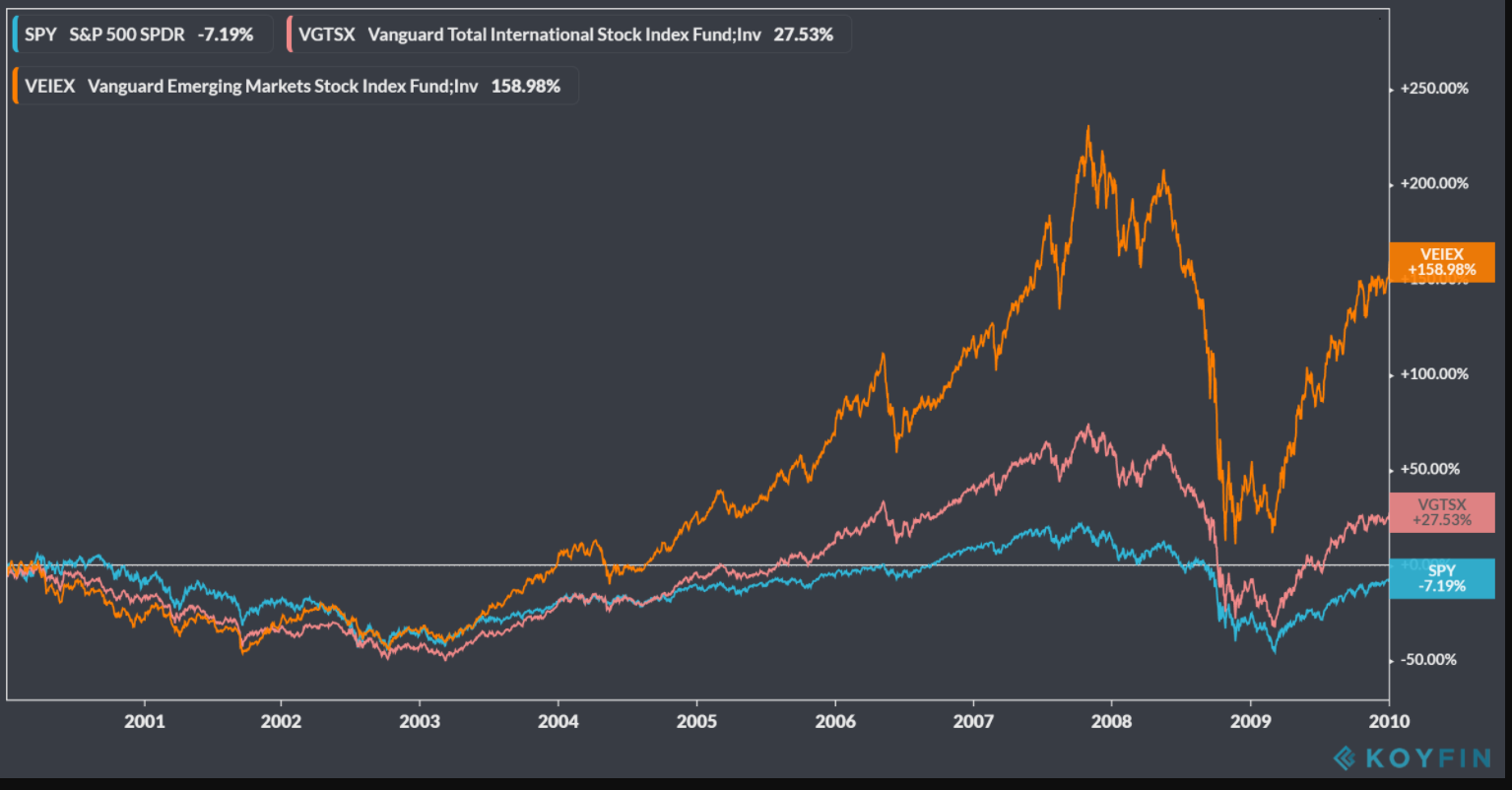

Anthony: Yeah, if we look. The US Stocks over International stocks have done quite well over the last 10 years. Yep. Now the previous 10 years it was it was the opposite and if you look back at Market history that leadership does change it’s not based on any given exact time frame and it’s very difficult to predict.

So being more globally Diversified can really help over a long-term time frame. Unfortunately, most people tend to chase the performance of whatever has done best lately. So US Stocks could continue to outperform and persist for a while. We don’t know that so we want to keep that exposure there. But at the same time when it does change, we want to have that diversification Internationally.

Cut Through The Noise Of 2020

Alex: Absolutely. So again, those three principles are understanding your emergency needs and reserves understanding your time Horizon and needs from the portfolio and then finally diversifying globally, you know again when we’re looking to close out 2020 here pretty soon.

A lot of worry and anxiousness and investors want that clarity they want that confidence. And so what do we recommend? I think first and foremost you do need to seek out wise counsel talk to your trusted advisor making sure that they have your best interest at heart because again with all the uncertainty and volatility at this time.

Let’s get to know you better. Schedule a complimentary call with an advisor here

More Reading: Government Shutdowns, Bonds, and When To Retire: Cut Through The Noise