Should you invest internationally? Today we are going to breakdown what you need to know about investing outside of the United States.

Just about everyone suffers from home country bias. In other words, most people are too concentrated in their own country.

Watch here:

Audio Only:

Show Notes:

- The global case for strategic asset allocation and an examination of home bias

- Should you own International Stocks?

Transcript:

Anthony: Should you invest in stocks internationally? What does it take to invest outside the United States? Today we’re going to break that down. Stay tuned.

Country Bias

Anthony: Okay Alex. Many would argue that most Americans are invested too heavily too concentrated in the United States. Can you explain why?

Alex: Well, the basic reasoning behind this is most people suffer from what’s called a “home country bias”. And really, what that means simply is you have a bias towards your country. You invest more heavily in your home country.

Anthony: No Matter where you are.

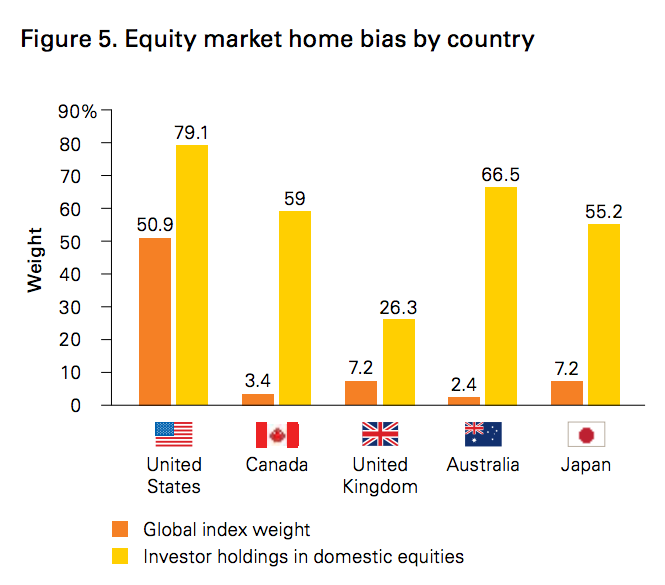

Alex: Exactly. And we’ll throw up a graph real quick to show you.

Alex: So really what happens here is as you can see in the orange bar. The orange bar represents the weight of a country’s market.

While the yellow bars are how much people in that specific country invest in their Homeland.

So as you can see here, Australia is the worst offender. Their stock market makes up a fraction of the global market. Yet its citizens invest predominantly in their home country.

Anthony: Okay, but is this a bad thing? Why is it bad?

Alex: Well, Yes and no. The US market specifically when we think about US citizens, US market has done phenomenally over the past 10 years and so that’s worked out quite well.

I would say that that’s more luck than strategic skill and what’s been accomplished. Investing in US markets overweighting. But regardless, it’s worked.

Now over long periods that may not necessarily be the case. US markets and international markets tend to Ying and Yang.

Sometimes international will take the lead and sometimes domestic will take the lead. You’ve written an article on this. Which we’ll post in the show notes.

How it Relates to Retirees

Anthony: The study and the point of that research were that it wasn’t easy to determine when that leadership was necessarily going to change.

Alex: So Let’s even think about a retiree. Over the past 10 plus years, the US market has done well. What do the next 10 plus years look like?

In the early two thousand? That’s what’s called the lost decade if you will. Because during that period, US stocks, while they were moving a lot over those 10 years, were relatively flat. While international markets did quite well.

So again, you don’t know when the lead is going to change, but when it does, it’s typically relatively quick. And you can’t predict it.

What About US Companies That Do Business Globally?

Anthony: So people also ask, well, what if I just invest in large multinational companies? Those big local companies that are represented here, but they do a bunch of their business globally

Alex: Yeah, and that’s a really good point. So large US companies, think of maybe Apple or Amazon. They do have a global footprint.

They’re involved in a lot of different countries and economies, but it’s still not the same as investing in international markets and things are easier now than ever.

You can invest in an international ETF or mutual fund very simply and get that broad international exposure without having to pick individual stocks and mess with that kind of stuff.

So it’s not the same and you need to be investing internationally.

Anthony: It’s also a good diversifier for if the dollar drops in strength. Some people have been asking that type of question. International can do that no doubt. It’s just one factor.

So these are the types of things that we discuss with families that are looking to invest for their future. How do we diversify properly? What’s appropriate? What’s the right mix between US & International? Even getting other asset classes involved.

If you have any questions, if you’d like to talk to us, go to our website and schedule a call with us.

Talk with us about your portfolio or financial plan here: Talk with an advisor

More Reading: Successful Investing Lessons from 2020

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. See our website at onedegreeadvisors.com for full disclosures.