How much money you need to retire is a uniquely personal calculation.

Retirement can be the most significant financial transition of your life, so your calculation has major implications.

How much money do you need to retire?

In this post, I will outline 3 methods to determine your expenses in retirement. Hopefully, this can guide you to plan and retire successfully.

I recommend using all three methods to determine how much you need to retire with #3 being the most important and accurate, in my opinion.

Method #1: The “80% of your income” rule of thumb

The rule is this: Take your income and multiply it by 80% to get what you would need to live on in retirement. The thinking is that (generally) expenses will naturally reduce by 20% in retirement.

Calculating your retirement needs with a simple percentage is overly casual unless you are flexible with spending and purposefully relaxed in your planning. Despite its oversimplification, the 80% rule can be a worthwhile point of confirmation to methods #2 and #3 below.

Method #2: Add up your expenses

It makes sense that the way to answer how much you need to retire is simply to add up what you will need to spend.

The main problem with this method is most people underestimate their spending, often considerably. This is because of variable expenses such as gifts, entertainment, and maintenance and repairs on a home and vehicles. Alex Okugawa wrote about hearing that dreaded sound in his truck in Unexpected Expenses and Worry.

I imagine you do not want to retire and go back to work because you have severely underestimated expenses. So, here are some tips to improve accuracy.

When you are projecting expenses, use actual spending figures.

Let us take car maintenance and repairs as an example. First, you need a reasonable amount of time to measure this, like a full year or more. (How much you spent last month tells you nothing because of the up and down fluctuation of such expenses.) Of course, this requires you to track those expenses over the year.

If you are a super organized accountant-type expense tracker, you might have a reliable number. But before you write it down, give it the “eyeball test.” Consider if it was a high or low expense year. Did you somehow avoid tires and brakes over an entire year? Are you accounting for the occasional major repair?

If you are less-than-accountant organized, apply the same questions, but increase your figures for the expenses you undoubtedly missed. In other words, add a cushion just in case.

Method #3: Calculate your current standard of living

This method is not only a lot easier than #2 but it is also more accurate.

We apply this method for the many families we have helped transition into retirement. Because no single method is completely accurate, we ask these same families to add up their projected expenses (#2), so we can compare.

Here is how method #3 works:

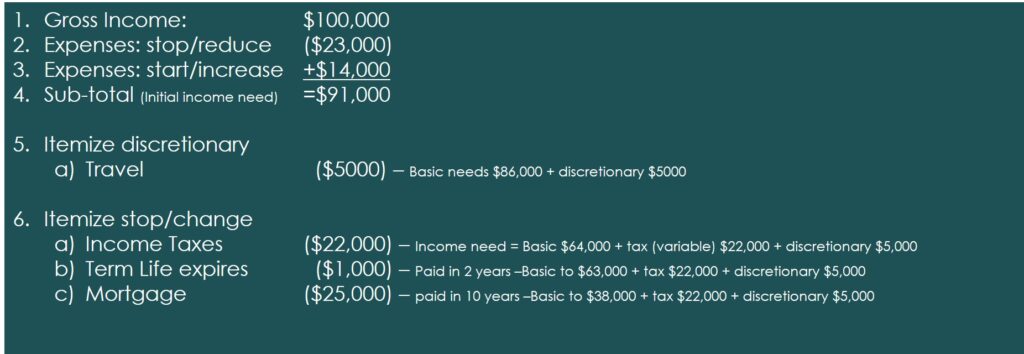

1. Add up gross income.

2. Subtract expenses that will stop immediately when transitioning into retirement.

Examples: Payroll tax (FICA/Social Security and Medicare on your paystub) and retirement savings, such as 401(k) contributions.

3. Add expenses that will start (or increase) in retirement.

Example: If you plan to increase your travel budget from $2000 per year (while working) to $5000 per year once retired, add $3000 for travel.

4. Sub-total these figures.

This is your initial income need. Easy, right? The objective here is simply to sub-total what you are already spending and replicate this standard of living in retirement.

You can skip to the conclusion if you prefer. However, if you want to fine tune your sub-total, read steps 5 and 6.

5. Itemize discretionary expenses (optional).

Examples: Entertainment, travel, charitable giving, etc.

You may choose to separate these expenses because they are under your control. Think of it like turning a faucet on, off or somewhere in between.

6. Itemize expenses that will stop or significantly change while in retirement.

Examples: A mortgage that is paid off 10 years after initially retiring. You will need income for this expense for those first 10 years but not after it is paid.

If you plan to carry Term Life Insurance for several years in retirement, it could also apply.

Income taxes can also be itemized because they may change based on the income sources and their specific taxability. The point of separating the income tax expense is to calculate the amount each year rather than lump one flat amount into your expenses.

Conclusion and Next Steps

These methods can help answer, “How much money do you need to retire?” While I have boiled this down to a math problem, no calculation will be perfect initially nor as life inevitably changes. A successful retirement, therefore requires flexibility, oversight, and discipline.

Congratulations – you made it this far! Your next step is determining how you will meet your expense need. What are your available income sources? What is the most appropriate, tax-efficient, sustainable strategy for income?

Inflation and taxes must also be accounted for over the long-term. They are commonly underestimated.

Want personal retirement guidance?

A quality financial planning process can help coordinate your need with the appropriate strategy while factoring in estimated taxes, inflation, and investment returns. If you would like to talk with a Certified Financial Planner™, Get Started by scheduling a quick call with a CFP™ at One Degree Advisors.

Photo by Simon Migaj on Unsplash