Can you rollover a 401(k) to a Roth IRA? Yes, you can. But just because you can, does not mean you always should!

Misclassifying your retirement account can have significant and irreversible tax consequences.

In this post, I’ll explain why understanding the rules and the character of your retirement money is important to make the best decision.

The Basics of the 401(k) and Roth IRA

What is a 401(k)? Identified by its tax code reference, a 401(k) is a popular employer-sponsored retirement plan. Typically, contributions are deducted directly from an employee’s paycheck and contributed to the plan’s investments. Often, the employer will “match” contributions by adding money into the plan.

You can learn more here: What is a 401(k)?

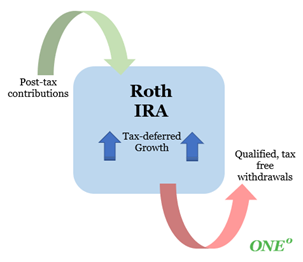

What is a Roth IRA? While tax deductions are not permitted for contributions into this account, qualified withdrawals are tax-free if certain conditions are met. Tax-free withdrawals coupled with tax-deferred growth make a Roth IRA especially attractive for people wanting to limit the taxes they pay in retirement.

You can learn more here: What is a Roth IRA?

3 Types of 401(k) contributions

Understanding the character of your 401(k) contributions is important when asking if you can rollover a 401(k) to a Roth IRA. There are potentially three contribution types you can make into your 401(k): pre-tax, Roth, and after-tax.

1. Pre-tax

Pre-tax, also called Traditional, is most common. These contributions reduce the amount of taxable income from your paycheck and grow tax-deferred. Eventually your contributions and earnings are taxed when you withdraw money from the plan. Employer contributions to your account, such as a match of your contributions, would also receive tax-deferral and therefore be included in this pre-tax characterization.

What happens if pre-tax money is rolled into a Roth IRA?

Because you have not paid tax on pre-tax contributions, rolling the contributions and earnings on these funds into a Roth IRA is considered a taxable conversion in the year of occurrence. This is because moving funds from pre-tax to a Roth changes its tax character. In other words, the government did not receive any tax dollars when pre-tax contributions were made, so they collect tax on the amount you rollover into a Roth.

This creates a big decision. Should you continue to defer the tax (maintain the pre-tax character) or take the tax hit now (convert to Roth) for the benefit of tax-free withdrawal later?

Factors to consider for pre-tax to Roth rollover would include:

- How much tax will you pay?

- Are you in a high or low tax bracket currently? What will your tax bracket be in retirement?

- Will the increase in income cause you to lose tax benefits elsewhere on your tax return or perhaps increase Medicare premiums? (Remember that deductions, credits, etc. tend to phase out with higher income.)

- Do you have the cash to pay this extra tax? (It does not make mathematical sense to pay the tax from retirement funds.)

- Does it work better for you to incrementally convert pre-tax money to a Roth in small amounts over time (rather than a huge lump sum, possibly pushing you into a higher tax bracket)?

Learn more about Avoiding Roth IRA Conversion Tax Traps.

2. Roth

Roth contributions can be made directly into the 401(k). These contributions do not reduce the amount of taxable income from your paycheck. However, the benefit of these contributions is they grow tax-deferred and qualified withdrawals are tax-free.

What happens if Roth 401(k) money is rolled into a Roth IRA?

If contributions go into the 401(k) with the Roth characterization, those contributions and earnings should be rolled into a Roth IRA upon separation from employment. Because the tax nature is the same, this rollover is not considered a conversion and no additional tax is applied.

3. After-tax

After-tax contributions are generally made into the 401(k) after the employee has maximized their pre-tax and/or Roth contribution(s), which combined have limits of up to $19,500 (and an additional catch-up contribution of $6,500 for those age 50 or older) in 2021. Some 401(k) plans do not allow after-tax contributions.

After-tax contributions, like Roth contributions, do not reduce the amount of taxable income from your paycheck. Unlike the Roth, however, earnings on the after-tax contributions are taxable upon withdrawal.

You can learn more about after-tax contributions here.

The contribution amount of after-tax contributions is limited. When totaling employee contributions (i.e., pre-tax and Roth), plus employer contributions and after-tax contributions, the total cannot exceed $58,000 in 2021 ($64,500 with “catch-up” for those age 50 or older).

You can read more on the overall limit on contributions from the IRS. It is best to confirm with your 401(k) administrator that you are not exceeding limits.

What happens if after-tax 401(k) money is rolled into a Roth IRA?

After-tax contributions can and should be rolled into a Roth IRA. The earnings, however, generated by the after-tax contributions should be rolled into a pre-tax (traditional) IRA. Failure to properly separate the two could result in unintended tax consequences from conversion of the earnings.

Some people get this wrong and roll one big check into their pre-tax IRA without noting or remembering that they already paid tax on these contributions. Therefore, they pay tax again when withdrawing from the IRA. Additionally, they pay tax on all the earnings from that portion of the rollover which could have been growing entirely tax-free in the Roth IRA!

See Rollovers of After-Tax Contributions in Retirement Plans to learn more.

Because this after-tax to Roth IRA combination can be a powerful strategy, high income earners with income capacity and desire use this as a purposeful strategy often called a mega backdoor Roth strategy. This linked post by Alex Okugawa, CFP® further describes the benefits of the mega backdoor Roth strategy as well as what your 401(k) plan must allow for this to be a viable strategy.

401(k) Case Study

John has worked for ZYZ company for 30 years. Over his career he has participated in his company 401(k). With retirement rapidly approaching, he is curious how to rollover his 401(K). He worked with the 401(k) administrator to obtain the following information:

- $320,000 classified as pre-tax 401(k) contributions and earnings

- $170,000 classified as Roth 401(k) contributions and earnings

- $80,000 classified as after-tax contributions

- $30,000 classified as earnings from after-tax contributions

After working with his advisor, they determined that they did not want to create any current taxes by rolling over his accounts. Therefore, they moved his 401(k) into the following accounts:

- Pre-tax IRA: $320,000 pre-tax 401(k) contributions and earnings and $30,000 classified as earnings from after-tax contributions

- Roth IRA: $170,000 Roth 401(k) contributions and earnings and $80,000 classified as after-tax contributions

This allowed John to continue to defer taxes. Later, they could strategically execute partial Roth conversions if it could help John lower his overall lifetime tax bill.

Roth Solutions Summary

Can you rollover a 401(k) to a Roth IRA?

Yes, but the nature of your 401(k) contributions will determine whether the rollover will be taxable (thus requiring analysis and a decision) or not taxable (and therefore a no-brainer to roll it into a Roth IRA).

If you determine a conversion (pre-tax to Roth) is not in your best interest because of current taxes, consider alternatives.

Contributions to the Roth 401(k), Roth IRA (if income eligible) or through after-tax (mega back door Roth strategy) are potential solutions to accumulating within the Roth characterization for the benefit of tax-free growth.

Cautions:

- Consult with your 401(k) administrator or employer benefits department about plan features and contribution limits.

- Upon rollover, be proactive in your requests. Do not assume that the 401(k) administrator will delineate your pre-tax and Roth decisions for you.

- Consult your financial and tax advisors for the most appropriate strategy for you because the laws can be complex.

- Generally through the context of a financial plan these strategies and decisions are best made.

The tax-free growth potential of the Roth IRA is attractive. Therefore, thoughtfully consider Roth strategies as part of an overall retirement strategy.