If you’re like me you’ve probably heard quite a few wild crypto stories in the past few years:

- Teenager’s becoming crypto multimillionaires.

- Countries accepting bitcoin as legal tender.

- A JPEG (image) selling for $69 million.

- The internet almost bought the constitution.

- People losing their life savings in crypto.

To say cryptocurrency seems like the wild west is an understatement…

Will this phenomenon be another fad or will it survive the next decade?

After all, I don’t want to sound like David Letterman in his interview with Bill Gates in 1995, comparing this “internet thing” to radio and tape recorders.

https://www.youtube.com/watch?v=gipL_CEw-fk

Bottom line: We are still in the early innings of this space and nobody knows which crypto coins or projects will prevail and which will be worthless in a few years.

I am not here to tell you which specific cryptocurrencies I believe will prevail, but rather to explain why crypto may slowly mature into a legitimate asset class.

Many of the examples I use will be in reference to bitcoin: the original and most popular cryptocurrency.

Here are three ideas to consider:

Crypto “Use Cases” Are Growing But Still Unclear

Two years ago, I thought crypto was a complete scam.

As a financial professional, often hearing of the latest fad or another wild claim, my radar naturally went up when I first learned of it.

There are now over 100 million crypto users and the crypto market is now valued over $2 Trillion.

It’s clear that despite the volatility, crypto adoption is still growing.

The question still remains…. why does crypto have value and what is it used for:

- Digital Gold?

- Store of value?

- Decentralized banking?

- Payment?

I know there are many different types of cryptocurrencies, tokens, and NFTs. But the true value and utility isn’t definitively clear for most consumers.

It is likely that crypto will remain highly speculative for a long time.

If you are able to tolerate risk, theoretically, adding a crypto like bitcoin can yield some diversification benefits when combined with a traditional asset portfolio.

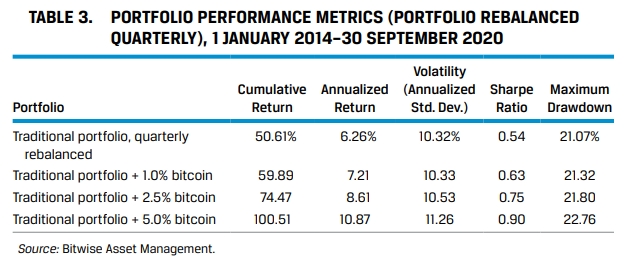

According the the CFA Institute Research Foundation,

“adding Bitcoin to a portfolio has historically had a positive impact on long-term portfolio returns on both an absolute and a risk-adjusted basis. As a result, the Sharpe ratio expanded from 0.54 to 0.75.”

From January 2014 to September 2020, a 60/40 portfolio would have the following returns with a small allocation to bitcoin.

This study illustrates that the impact of bitcoin on a diversified portfolio may yield some diversification benefits, so perhaps more consumers begin to have a small allocation towards bitcoin.

As crypto markets mature, it quite possibly could invite greater adoption over the next decade. But this is no indication of the predictive value of bitcoin in the future.

It’s Still Peanuts Compared to Global Wealth

It’s important to put into perspective the size of the crypto market.

In 2020, global wealth reached over $418.3 Trillion dollars, with financial assets held by individuals totaling $250 Trillion.

The total market size of cryptocurrency as a whole is currently around $2 Trillion. That’s less than 1% of global financial assets.

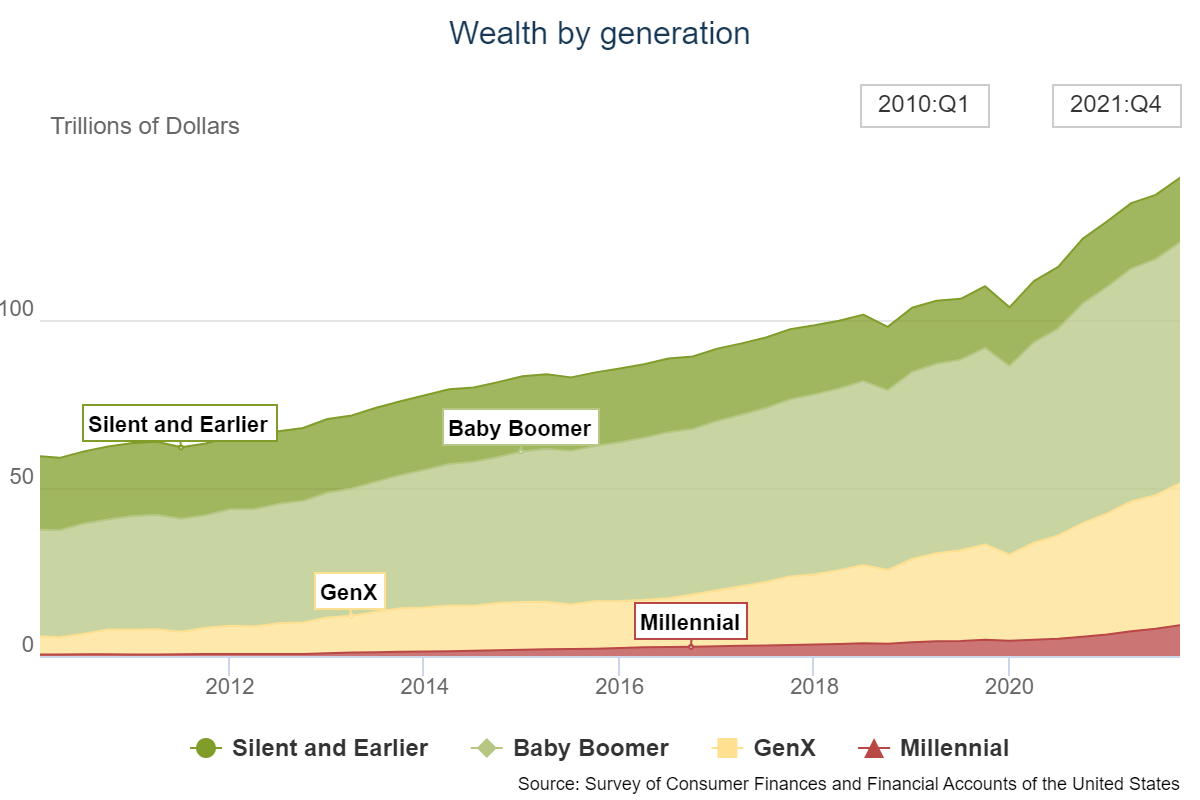

Currently, traditional financial assets are largely held by the boomer generation.

And personally, my parents who are in the boomers, are still getting accustomed to the internet…

I’m not convinced most boomers are ready to dive head first into blockchain technology just yet.

Therefore, it’s clear the future of crypto is dependent on digital natives.

According to a CNBC survey, 83% of millennial millionaires own cryptocurrencies. But it’s important to remember that while millennials now outnumber the boomers, boomers still hold most of the financial assets

So millennials just don’t move the needle quite yet.

And you can see in the chart below that millennials only own a small proportion of total financial assets in the US.

The wealth transfer is going to move at a glacial place as people are living longer than ever before.

The shift in wealth may take a few decades.

Crypto is not for the faint of heart

Investing in crypto is not for the faint of heart.

The odds of crypto continuing to have massive drawdowns is a high probability in our lifetimes.

According to research, bitcoin’s price has gone through six different peak-to-trough drawdowns of more than 70%.

As Table 2 shows from research at the CFA Institute,

“bitcoin has experienced 15 negative-return quarters since its inception, along with two negative years, including 2018’s 73.71% pullback.”

There are going to be crashes and bone-crushing volatility in this space, because it’s an emerging asset class.

When investing in crypto you should be comfortable with it going to $0.

It has the ability to violently turn south on a dime and do so 24/7.

I’m still not sure how crypto will play out in the coming years, but I don’t think volatility will be going away anytime soon.

One thing is for certain: the emergence of this new asset class has been an entertaining event, and it will be interesting to see where it goes a decade from now.

Sources:

- This 19-year-old bitcoin millionaire offers ‘crucial’ advice for young people looking to invest

- Man Loses Life Savings to Phony Bitcoin iOS App- Over a Million Dollars in BTC Drained

- El Salvador’s leader hopes bitcoin can lift the country out of the Third World

- Millennials and cryptocurrency

- ConstitutionDAO raises $46 million in bid to buy a rare copy of the US constitution

- Cryptoassets – CFA Institute

- Total Global Wealth Rose to US$431 Trillion in 2020

- Global crypto adoption

- Wealth by Generation

Want tax, investment, and planning strategies like this right to your inbox? Subscribe below!

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures