Developing and Sustaining a Successful Investment Plan

Executive Summary

Philosophy

- Understand what is important to you and what you want to achieve to form the foundation of your investment plan.

- Diversify investments to asset classes we believe will perform well over time (even if at different times).

Portfolio Construction

- Target diversification within asset categories, particularly: Broad Market Stock, Broad Market Fixed Income, Focused Factor and Tactical.

- Tilt toward dimensions of higher expected returns (using historical evidence).

- Emphasize low costs and tax efficiency.

Process

- Develop and maintain an investment plan by including the following key components: Risk assessment, discipline, rebalancing, consistency, and clear communication.

- Adhere to factors that have demonstrated measurable value.

Embedded links provide further depth of research.

Successful investing is less about supreme skill and more about clear objectives, realistic expectations and unwavering discipline to follow a plan. In this paper, we will share principles that shape our investment philosophy, portfolio construction and process. Our goal is to provide investment guidance in your best interest shaped by these principles.

If you don’t know where you are going, any road will get you there. – Lewis Carroll

Investing is muddled by unclear expectations to many people. Influence from media, family, and friends shape measurements of success that often lead to feelings of regret and misdirected responses. This can be minimized when a plan is built on time-tested principles you trust and follow – even when it is difficult.

Philosophy

Comprehensive Approach

Understanding what is important to you and what you want to achieve form the foundation of your investment plan. As Certified Financial Planner™ professionals, our advisors are experienced in coordinating financial and investment plans.

Among the benefits are capitalizing on the characteristics of different account types, quantifying timeframes and appropriate savings, and transitioning from a growth phase to an income phase.

Allocation

Regret is common when an investor thinks they should have picked a winner prior to increase and/or sold a loser prior to decline. Like the general economy, investment asset classes cycle up and down, but the timing of these trends is nearly impossible to predict with consistency.

Rather than attempting to guess when or what will perform best at any given moment, we diversify investments to asset classes we believe will perform well over time (even if at different times). We pursue a smoother path while working toward achieving successful investment outcomes.

The stock market is a device for transferring money from the impatient to the patient. – Warren Buffett

Portfolio Construction

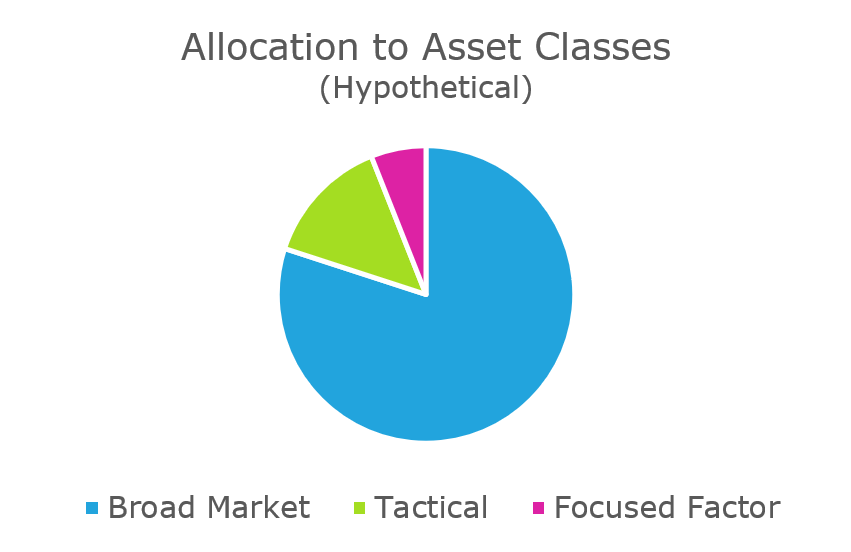

We generally construct investment portfolios with elements of the following three asset categories:

I. Broad Market

The foundation of the investment portfolio is built on broad exposure to global stock and bond markets. Markets work to generate powerful long-term returns. Within the broad market framework. we tilt slightly toward stocks with characterizations that have historically outperformed over long periods of time.

The primary Broad Market decision is how much to allocate to stocks, aimed at long-term growth, and how much to allocate to bonds, aimed at stability. Stock exposure covers the globe, including the United States, International Developed Countries, and Emerging Markets. Bond exposure leans toward high-quality, shorter-term holdings.

We utilize low-cost mutual funds and exchange-traded funds (ETF’s) which hold thousands of stocks or bonds to capture broad market exposure.

II. Focused Factor

The Focused Factor component takes a quantitative, concentrated approach to Value and Momentum investing. Factor investing seeks stocks associated with characteristics of historically higher returns. Proper execution requires rigorous, data-driven research -and- a disciplined and repeatable process.

Summary Videos: Value Investing & Momentum Investing

III. Tactical

The Tactical component is designed to manage risk, seeking to provide exposure to risky assets while decreasing the likelihood of incurring a large drawdown. Using a systematic process, the tactical portfolio actively shifts between an offensive and defensive composition.

Summary Video: Tactical (Trend) Investing

Evidence

Data shows certain characteristics of stocks can produce surplus returns over time. These include:

-

- Value Premium: Given a stream of earnings and fundamentals, buy at a cheaper relative price.

- Small-Cap Premium: Small company stocks outperform large company stocks, over time, on average.

- Profitability Premium: Companies with higher profitability tend to have higher returns than those with lower profitability.

- Momentum Premium: Focus on stocks that are “winning” by exhibiting relative and steady strength compared to other stocks in the market.

Earning these “premiums” takes discipline and patience as these characteristics are not always apparent in the short term. For a greater overview of evidence-based investing, read What Is Evidence-Based Investing?

The best way to invest is to structure a portfolio along the dimensions of expected returns. – David Booth

Low Costs

Expenses within funds, including management fees and trading costs, impact your bottom line. We believe you should pay for things that bring you value and avoid those that do not. Many mutual funds charge substantial management fees for essentially aligning with an index.

Morningstar concluded in their research of mutual fund peer groups, “The expense ratio is the most proven predictor of future fund returns.”[1] Considering internal costs is a top priority in our investment selection process.

Tax efficiency

Investments may perform well, but without a watchful eye on minimizing taxes, returns can be eroded. Several key strategies are considered depending on your specific circumstances:

-

- Positioning tax efficient investments (e.g., low turnover strategies, municipal bonds) in taxable accounts while holding highly taxable investments in tax-deferred retirement plans.

- Utilizing the tax efficiency of an ETF over a mutual fund when appropriate.

- Harvesting taxable losses while replacing positions sold with comparable investments to capture a potential recovery.

- Harvesting taxable gains to maximize lower tax brackets.

- Determining appropriate retirement plan contributions or withdrawals given your current and expected future tax situations.

- Gifting appreciated shares to charity (to avoid capital gains) while using cash to repurchase these shares resulting in a higher cost basis.

Cash Reserves

In coordination with a long-term investment plan, we recommend maintaining appropriate cash savings for near-term and unexpected expenses. Cars and washing machines break, roofs need replacement, and health issues are largely uncontrollable.

Avoiding withdrawals from long-term investments for unexpected expenses can better allow the investment plan to work as intended. The priorities of cash reserves are preservation and availability over the rate of return.

Process

Evaluate Risk Tolerance

It is commonly said fear and greed drive the markets. Typical investors are fearful when they see their investments drop in value beyond a threshold. Conversely, they can aggressively pursue high returns and ignore key risk factors when markets are increasing significantly.

It is difficult to anticipate the range of emotions and reactions during volatile markets, but we can help prepare for those times. We focus on three primary areas to determine your proper risk budget:

-

- Your financial plan. (Determined by the elements and objectives of your financial life.)

- Risk assessment. (Measured through hypothetical risk and reward scenarios.)

- Investment experiences. (Guided by previous responses to market behavior.)

Discipline

With information at our fingertips, many investors instinctively desire immediate results. Seeing lagging short-term returns, they are tempted to act with a miscalculated response.

Discipline – specifically, controlling behavior instead of acting on emotion – is a significant advantage. From Alpha Architect, read about how the Marines shaped their disciplined investment philosophy.

Capital Group, in their piece called “Time, Not Timing, Is What Matters[2],” reports:

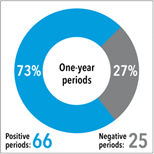

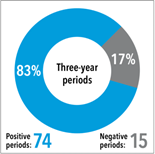

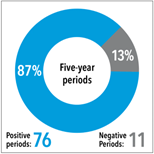

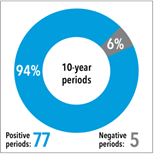

Over the past 91 years, the S&P 500 has gone up and down each year. In fact, 27% of those years had negative results. As you can see in the chart below, one-year investments produced negative results more often than investments held for longer periods.

If those short-term one-year investors had held on for just two more years, they would have experienced nearly half as many negative periods.

And the longer the time frame — through highs and lows — the greater the chances of a positive outcome. Indeed, over the past 91 years, through December 31, 2018, 94% of 10-year periods have been positive ones.

Investors who have stayed in the market through occasional (and inevitable) periods of declining stock prices historically have been rewarded for their long-term outlook.

History has shown the longer the period, the greater the chances of a positive outcome:

Source: Thomas Reuters and S&P 500 Index

The individual should act consistently as an investor and not as a speculator. – Benjamin Graham

Rebalance

Investment allocations drift with rising and falling performance. Periodically rebalancing your investments to the targeted allocation resets the plan to the intended risk level.

Rebalancing may also provide return advantages, especially during volatile markets. Investors who fail to rebalance may find themselves overexposed or underexposed depending on the asset class.

Consistent Process

In addition to continuous monitoring of our clients’ investment strategies, our investment committee meets quarterly to review market performance, conditions, model strategies, and individual investment holdings. These meetings provide a structured framework to adjust portfolios as needed.

The plans of the diligent lead surely to advantage, but everyone who is hasty comes surely to poverty. – Proverbs 21:5

Clear Communication

It is our goal to make the complex simple to understand. We do not expect you to become investment experts. However, we believe communication through review meetings, update calls, and simple, practical reports are important.

We also provide you with a personal financial website, One View, which acts as a central and secure hub for your financial accounts, including your 401(k), bank accounts, mortgage, and more.

Ongoing Advice

Vanguard researched the value of working with a personal financial advisor. Their conclusions were quantified by adherence to defined factors (many of which are specified in this summary). Here is their determination:

We found that working with an advisor can add ‘about 3%’ in net returns when following the Vanguard Advisor’s Alpha framework for wealth management, particularly for taxable investors.

This 3% increase in potential net returns should not be viewed as an annual value-add, but is likely to be intermittent, as some of the most significant opportunities to add value occur during periods of market duress or euphoria when clients are tempted to abandon their well-thought-out investment plan.[3]

Changing long-standing money habits and behaviors can be hard to sustain. Being encouraged by someone who is on your side, and to whom you can be accountable, can keep you on track. – Jason Butler

The value of a quality financial advisor is not in predicting the direction of markets nor in picking outperforming stocks but rather in aligning a sound investment plan with a personal and purposeful financial plan.

Our name, One Degree Advisors, comes from the belief that every degree matters. A plane intending to fly from Los Angeles, California to Sydney, Australia will land in the ocean or the outback if it continuously flies just one degree off course.

Your resources have a better chance of helping you reach your intended destination with a sound investment plan aligned with your financial plan. Together, we can help you pursue your most important priorities in life.