Bear Markets in stocks can often make investors feel like they are losing all that they previously gained.

I’ll expand on the following points to address that concern and how to reframe your expectations for success.

- Most investors incorrectly define what “long-term” means and therefore set unrealistic expectations.

- Baseball batting averages exemplify the volatility of stock returns in the short-term but approach expected averages over time.

- Diversification is wise and necessary even though it may make it more challenging to understand your progress.

- The feeling of giving up your gains in every bear market can be overcome by understanding favorable math.

Want to understand investing? Look at baseball.

At the start of every baseball season, it is not uncommon to see the game’s brightest stars with a batting average near zero. Meanwhile, some guy you’ve never heard of is hitting near 1.000.

During those initial games, batting averages spike and crater -or- some stay high and others low. In other words, those batting averages are all over the place.

But as the season progresses, batting averages do what they do – average out. And, by season’s end, the game’s biggest stars are hitting near .300 while common players are hoping to stay solidly above .200.

How the stock market relates to batting averages

In the short-term, investment returns, specifically stock market returns, are all over the place. A sound investment strategy may be down 30% or more in a year and a bad strategy could earn a great return.

From 1928 to 2021, the stock market, as measured by the S&P 500, had negative returns in 25 calendar years. In 11 of those years, the decline was greater than 10%.[i] This does not include the many intra-year declines that recover into positive territory by calendar year-end.

You’ve probably heard the sage advice for stock declines:

- Wait it out

- Focus on long-term returns

The advice is good. The understanding and implementation, however, is often wrong.

What is long-term?

It’s like watching my hometown San Diego Padres open with a series against the Diamondbacks, followed by a series against the Giants, before heading up to L.A. to face the Dodgers.

By the end of 9 or 10 games, some fans want to get rid of Manny Machado because maybe he’s hitting .150.

The regular baseball season is long – 6 months – not including playoffs. A few series, or even a month of games, does not determine a player’s batting average.

The stock market operates in cycles often measured by decades, but investors often judge their returns on three years or five years or even ten years. In the present, those seem like a long time.

Stock market returns are anything but average

Ben Carlson, in his post, Stock Market Returns Are Anything But Average, says, “From 1926-2020, the average return for the U.S. stock market was basically 10% per year.”

Many people know this statistic. But therein lies the danger. Carlson points out,

“If we look at the calendar year returns plus or minus 2% from the 10% average (so 8% to 12%) this has happened in just 5 calendar years. So around 5% of all years since 1926 have seen average returns. In fact, there have been just as many yearly returns above 40% as returns in the 8% to 12% range.”

It can take a long time to achieve those averages.

Let’s look at recent history:

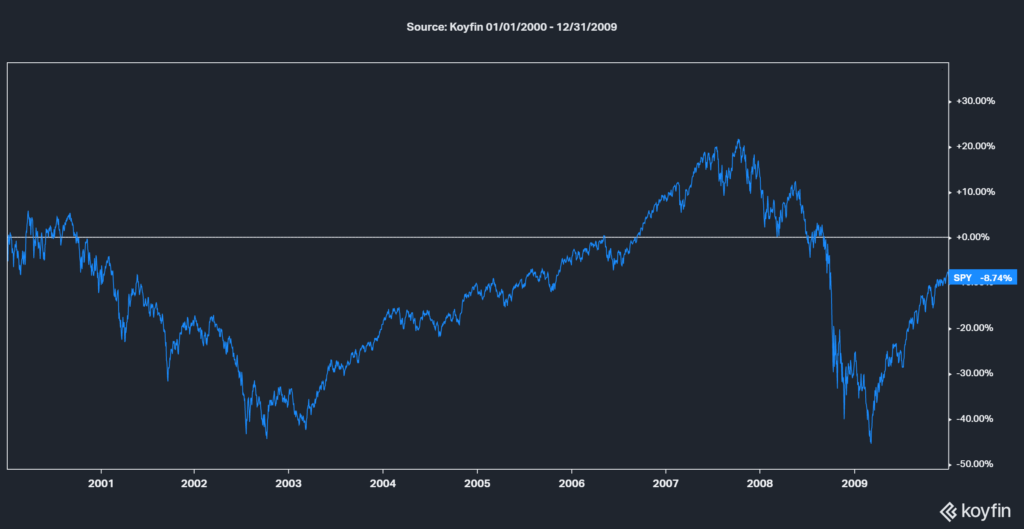

The 10-year period from 2000 to 2009 is aptly called “The Lost Decade” for stocks. The S&P 500 posted a slightly negative return during that 10-year period.

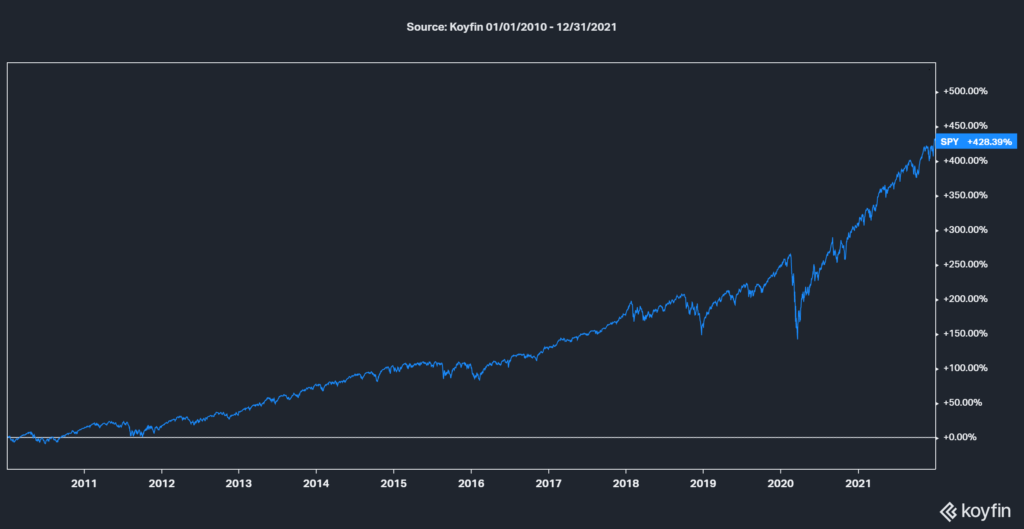

However, from 2010 through 2021 (12 years), the S&P 500 returned 428%!

So, what’s it going to be? 400% or 0% every 10 to 12 years? Unfortunately, the market is ruthless and it’s not going to tell us!

(I illustrated beginning and end of year dates. Using timeframes with market tops and bottoms would make the upside and downside even more extreme, but I think you get the point.)

Combining those charts (2000 through 2021), it’s easy to see how waiting it out (22 years!) would have paid off. But investors were not feeling so optimistic in 2009.

Three, five, or even ten years are not adequate long-term measures. Staying the course can address that issue. But how does adding different asset classes, such as international stocks or bonds complicate matters?

Diversification

That sage advice of waiting out the bad times and focusing on long-term returns should also be accompanied by the wisdom of diversification. “Don’t put all your eggs in one basket” is the adage.

Carlson posted, “Is Diversification Finally Working?” while the stock market was still strong in 2021 but previously unloved asset classes started to outperform.

“Spreading your money across a wide range of investments, asset classes, and geographies is the ultimate form of saying, “I have no idea what’s going to happen in the future. For those of us who cannot predict the future, we diversify.”

In hindsight, it’s easy to see where you should have invested. From 2000 to 2009, investing in U.S. stocks was not the place to be.

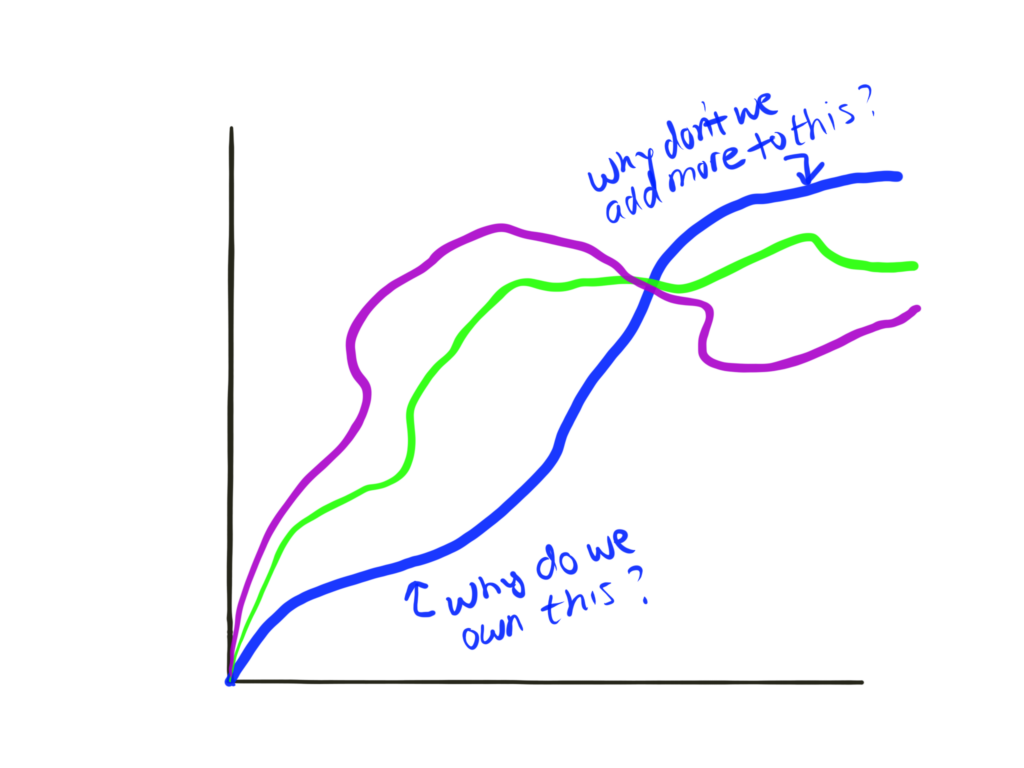

While U.S. stocks came roaring back in the following decade, international stocks have significantly trailed.

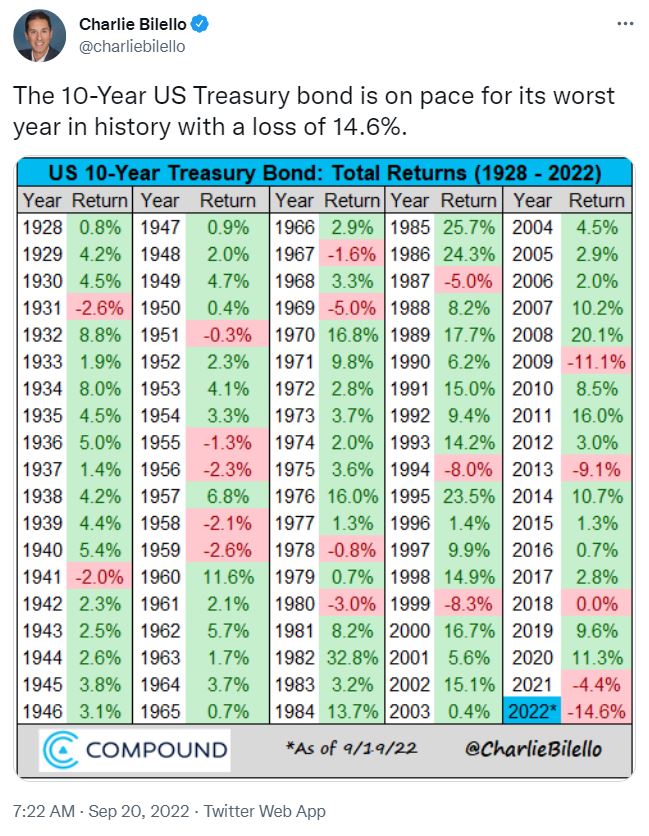

More recently, bonds have had one of their worst years in history due to rising interest rates to combat inflation.

[Watch Alex and I discuss, “Losing Money in Bonds? What Retirees Should Know” to learn more about how changes in interest rates affect bonds.]

The reality of diversification is you can always be unhappy with something in your portfolio. If you measure success against the U.S. stock market, the last 12 years might appear less fulfilling if you held international stocks. Over the last two years, bonds have contributed negative returns.

Conversely, owning international stocks, and especially bonds, in the first decade of the 2000s was comparably good.

But, as those asset classes cycle differently from one another and each “have their day in the sun,” this can function to smooth out the ride to some degree and optimize risk and return.

Prepare your expectations

Prepare your expectations

When markets are strong, we talk to our clients more about preparing for the next bear market. It’s not that we have a pessimistic view of the future. Rather, the most important factor of investment success is creating a solid plan and staying the course. To do this, you must prepare your expectations for reality.

To our clients’ credit, many of them have been investing for decades and are unfazed by down markets. They are experienced in long-term investing.

The message in 2021 may have been about preparing for the next bear market. In 2022, the message is about staying the course and setting up for the recovery.

If you are a long-term investor, investing may feel like ‘not getting ahead’ until you realize it’s more like ‘two steps forward, one step back.’

In the end, that is favorable math. Stay the course.

The One Degree Blog

Not signed up yet? Get weekly financial insights right to your inbox.

Subscribers also gain access to our private monthly client memo.

Stadium Photo by Derek Story on Unsplash

[i] https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html