Is it better to take Social Security at age 62 or age 70?

In today’s video, Anthony assesses the factors that can hopefully put more money in your pocket through retirement.

When to Take Social Security? Start at Age 62 or 70?

Resources:

- FREE RETIREMENT READINESS REPORT

- Social Security Website

- Should I Collect Social Security and Invest it? (Before Social Security Runs Out)

- DOWNLOAD OUR FREE GUIDE: 5 RETIREMENT MISTAKES TO AVOID

Summary

In today’s discussion, we will thoroughly examine the critical decision of Social Security timing. Your choice regarding the timing of your Social Security benefits can have a profound impact on your retirement finances. Let’s explore the factors that can guide you in making the best decision tailored to your unique circumstances.

Understanding the Basics of Social Security Timing

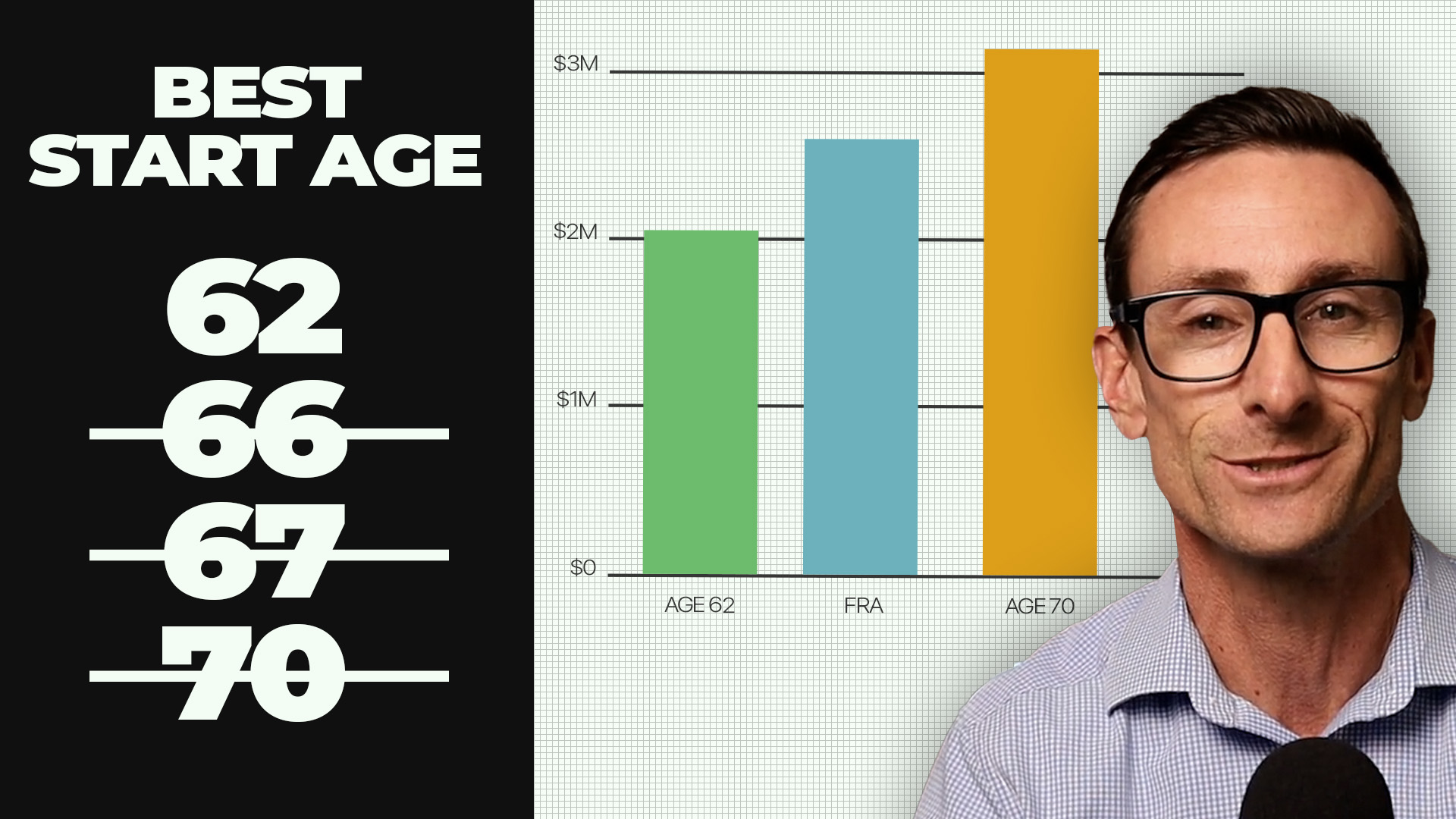

The decision of Social Security timing is pivotal in your retirement planning. Your Social Security benefits are determined by your full retirement age, a figure dependent on your birth year. Think of this as your base amount. The earliest age at which you can commence receiving Social Security is 62. However, taking it before your full retirement age incurs a reduction in benefits.

Exploring the Option of Taking Social Security Early

The idea of commencing your Social Security benefits at age 62 is attractive for one primary reason – it provides you with funds earlier. However, there’s a significant downside: a reduction of approximately 30% in comparison to your full retirement age benefit. Moreover, if you decide to continue working before reaching your full retirement age while collecting Social Security, there’s a cap on the earnings you can make before deductions apply.

Considering the Benefits of Delaying Social Security

On the flip side, delaying your Social Security benefits beyond your full retirement age can be highly advantageous. With each year of delay, your benefits increase by roughly 8%, culminating at age 70. However, this approach necessitates waiting several additional years before you can begin enjoying these benefits.

The Dilemma: Early or Late?

The quandary that confronts many is whether to opt for early Social Security and receive lower annual payments or delay and receive more substantial annual benefits. The decision primarily hinges on your life expectancy. We will delve deeper into this choice shortly.

Frank and Jennifer’s Scenario

Let’s delve into the case of Frank and Jennifer, both aged 61 and contemplating retirement at 62. They possess $1.4 million in investments and own their home mortgage-free. Their monthly expenditure amounts to $7,000, considering a 3.7% inflation rate for expenses and a 2% cost of living adjustment for Social Security.

The paramount factor in determining your ideal strategy for Social Security is your life expectancy. If you anticipate a shorter life, the early option may be preferable. Conversely, for those with expectations of a lengthier life, deferral may be more financially beneficial.

Navigating the Crossover Point

Typically, a crossover point arises in your early eighties, contingent on life expectancy. This juncture helps determine which strategy, early or late, holds greater financial merit.

Tailoring Decisions to Individual Scenarios

It’s crucial to recognize that each situation is unique. For couples like Frank and Jennifer, the decision may rely on the life expectancies of both spouses. In some instances, one spouse may benefit from an early start, while the other may opt for deferral.

Additional Considerations

Various other factors come into play in your decision-making process. Factors such as inflation assumptions, investment returns, savings, liabilities, and other income sources all play a role in shaping your personalized plan.

The Future of the Social Security Trust Fund

One factor that could influence your decision is the status of the Social Security trust fund. Projections indicate that it may run out of funds by 2035, prompting some individuals to consider taking Social Security early.

Conclusion

In summary, the decision of when to commence your benefits is a multifaceted one, strongly influenced by your life expectancy. Crafting an informed decision necessitates a careful evaluation of your unique circumstances and financial objectives. While the future remains uncertain, comprehending the factors at play will guide you in making the best choice for your retirement.

The Retirement Recap

Join the 964+ other retirees and get weekly articles and videos to help you retire with confidence.

Subscribers also gain access to our private monthly client memo.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures