Join Alex as he breaks down social security benefits in a case study.

Resources:

Maximizing Social Security Benefits: A Strategic Approach to Retirement Planning

Making decisions about when to start collecting Social Security benefits can significantly impact your financial stability during retirement. Many retirees are advised to delay benefits until age 70 to maximize monthly payouts. While this strategy has its merits, it may not always be the best choice for everyone. Let’s explore a scenario involving Don and Lisa, highlighting their financial considerations and how they navigated this critical decision.

Understanding the Social Security Benefit Dilemma

Don, at 65, and Lisa, at 63, faced a common dilemma: when to start receiving Social Security benefits. Their primary goals were to manage their tax liabilities, optimize their retirement income, and leave a financial legacy for their children.

Financial Snapshot

Investments: They held $1,425,000 in stocks geared for growth and $475,000 in bonds and cash for stability and income.

Other Income: They anticipated $1,000 per month from rental properties.

Expenses: Monthly living expenses of $10,000 plus mortgage payments and annual travel costs of $12,000.

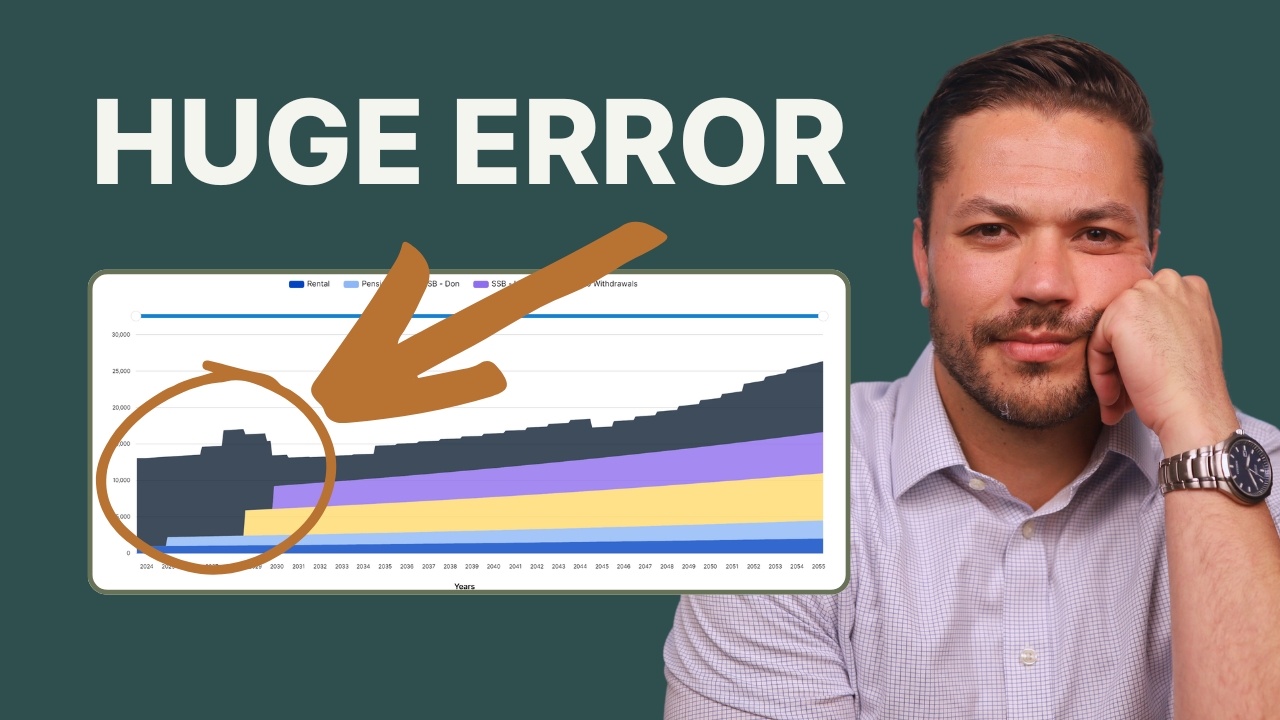

Initial Withdrawal Needs

To meet their $10,000 monthly expenses, plus additional financial obligations, they initially required withdrawals totaling approximately $166,000 annually from their portfolio. This represented an 8.7% withdrawal rate, mainly from their bond and cash holdings.

The Case for Delaying Social Security

Typically, delaying Social Security until age 70 increases monthly benefits by about 8% annually beyond full retirement age (FRA). This strategy aims to secure higher guaranteed income in later years, which can be crucial for long-term financial security.

Challenges with Delaying Benefits

However, delaying benefits also means relying more on their investment portfolio in the early years of retirement. With only about three years of withdrawals readily available in stable investments, their portfolio could face strain, especially if the markets experience volatility or downturns.

Tax Considerations

Another critical factor in their decision was tax efficiency. By delaying Social Security, they would need to draw more from their taxable accounts initially. This could potentially push them into higher tax brackets sooner, particularly with uncertainty surrounding future tax rates after 2025.

The Optimal Strategy: Starting at Full Retirement Age (67)

Given their financial situation and goals, Don and Lisa opted to start collecting Social Security benefits at their full retirement age of 67 instead of waiting until 70. This decision was driven by several factors:

- Portfolio Sustainability: Starting benefits earlier relieved pressure on their investment portfolio, reducing the risk of having to sell assets during market downturns.

- Tax Management: Initiating benefits at 67 allowed them to manage their tax liabilities more effectively over the long term. It balanced their income sources to potentially lower lifetime taxes compared to waiting until age 70.

- Financial Stability: By starting benefits earlier, they ensured a more stable income flow from multiple sources, easing financial strain in the initial years of retirement.

Conclusion

Don and Lisa’s approach highlights the importance of personalized financial planning in retirement. While delaying Social Security can increase monthly benefits, it’s essential to weigh this against immediate financial needs, tax implications, and overall portfolio sustainability. By carefully evaluating these factors, retirees can make informed decisions that align with their specific goals and ensure a more secure financial future.

Seek Professional Guidance

Navigating retirement decisions can be complex. Consulting with a certified financial planner can provide personalized insights and strategies tailored to your unique circumstances. Whether you’re nearing retirement or planning ahead, expert advice can help you optimize your Social Security benefits and achieve greater financial confidence in your retirement years.

Plan Your Retirement with Confidence

At One Degree Advisors, we specialize in helping individuals and families navigate retirement planning with confidence. Our team of experienced financial advisors can assist you in developing a comprehensive retirement strategy that aligns with your goals and priorities. Visit our website to learn more about our services and schedule a consultation today.

This post integrates key insights from Don and Lisa’s situation, providing a clear, informative guide for readers considering their own retirement planning strategies.

The Retirement Recap

Join the 964+ other retirees and get weekly articles and videos to help you retire with confidence.

Subscribers also gain access to our private monthly client memo.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures