Planning your retirement spending is key to enjoying a financially secure and fulfilling life after you stop working.

Resources:

How Much Can You Spend in Retirement with $2.3 Million?

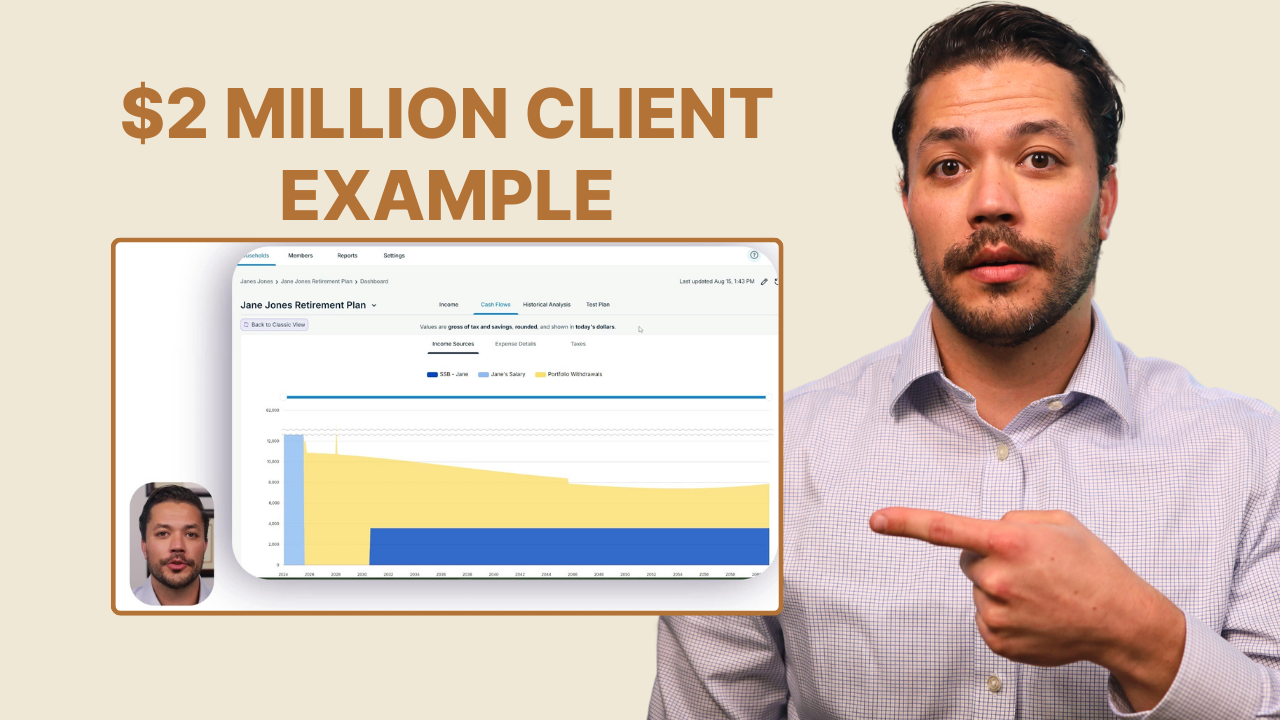

When it comes to retirement spending, having a clear understanding of your financial situation is crucial. Many retirees worry about whether they have enough saved and how much they can safely spend without running out of money. Let’s break down how you can confidently approach your retirement spending with a $2.3 million nest egg.

The Importance of Stress Testing Your Retirement Spending Plan

Even with a solid retirement plan, many people feel uncertain about what would happen if the markets take a downturn. Jane, for example, had saved diligently and was ready to retire, but she was still concerned about her financial future. She wondered what would happen if another major market event, like the Great Financial Crisis, occurred after she retired.

To address these concerns, we stress tested her unique income plan against historical market events. This analysis allowed us to see how her retirement spending would perform under different scenarios. We discovered that if she had retired just before the Great Financial Crisis, she would have needed to reduce her retirement spending by about $2,500 per month to avoid running out of money.

This reduction would likely have meant cutting back on travel and reducing living expenses. For Jane, who didn’t have any debts, the idea of cutting back was manageable and far preferable to working longer. This kind of stress testing can provide peace of mind by showing how flexible your retirement spending plan is and what adjustments may be necessary in tough times.

Creating a Flexible Retirement Spending Plan

Retirement is not static, and neither should your retirement spending plan be. Jane’s plan was designed to adapt to changes in the market and her personal needs. By building a dynamic, risk-based approach to her income, we could make real-time adjustments. For instance, if her portfolio dropped significantly, we knew she might need to cut her income slightly. Conversely, if the markets performed well, she could afford to increase her retirement spending.

This approach gave her confidence. Instead of feeling restricted by a rigid plan, she knew she could enjoy her retirement, knowing her retirement spending could be adjusted based on the current financial environment.

Managing Taxes and Investment Strategies for Better Retirement Spending

One of the key strategies we used to maximize Jane’s retirement income was managing her taxes effectively. By planning strategic Roth conversions, we were able to reduce her lifetime tax liability. This meant that more of her money could stay invested and grow tax-free, ultimately giving her more income over the course of her retirement.

We also restructured her investments to support this strategy. We kept a conservative portion of her brokerage account for immediate needs, while aligning her IRA and Roth IRA for growth over the long term. This allowed her to take advantage of market opportunities without taking unnecessary risks with the money she needed for retirement spending on day-to-day expenses.

Calculating Retirement Spending Accurately

One of the biggest pitfalls in retirement planning is underestimating expenses. We used the “Live, Give, Owe, Grow” model to get a clear picture of Jane’s spending needs. This model helped us account for all her expenses, including future costs like a new vehicle and healthcare before Medicare kicked in.

Many people miscalculate their retirement spending, leading to financial stress later on. By accurately assessing her current and future expenses, we were able to create a retirement spending plan that matched her lifestyle without compromising her financial security.

Building Confidence in Your Retirement Spending Plan

With her plan in place, Jane was able to retire confidently, knowing she had a robust strategy that would allow her to enjoy her retirement while being prepared for potential challenges. By regularly reviewing and adjusting her retirement spending plan, she could continue to live the life she wanted without the constant fear of running out of money.

If you’re planning your retirement, it’s essential to go beyond basic assumptions and build a flexible, well-tested plan that accounts for your unique situation. With the right guidance and strategies, you can manage your retirement spending with the confidence that your money will last as long as you need it.

For more insights and strategies to maximize your retirement planning, consider consulting a financial advisor who can tailor advice to your unique situation.

Seek Professional Guidance

Join the 964+ other retirees and get weekly articles and videos to help you retire with confidence.

Subscribers also gain access to our private monthly client memo.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures