Planning how to withdraw your savings during retirement is one of the most important financial decisions you’ll make. A well-thought-out retirement income strategy can ensure your money lasts a lifetime while giving you the freedom to enjoy the retirement you’ve worked so hard to achieve. With a variety of methods available, it’s essential to choose the approach that best fits your lifestyle, financial goals, and future needs. In this post, we’ll explore some popular withdrawal strategies, highlight their strengths and weaknesses, and introduce a cutting-edge approach that could help you achieve the secure and fulfilling retirement you deserve.

Resources:

Choosing the Right Retirement Income Strategy for a Fulfilling Retirement

One of the most critical decisions retirees face is determining how to withdraw money from their savings in a way that lasts a lifetime while still enjoying their retirement. With so many strategies available, it’s essential to understand which retirement income strategy aligns best with your goals, lifestyle, and financial situation. Let’s explore some of the most effective withdrawal strategies, including a newer method that may offer the perfect balance of security and flexibility.

Why the 4% Rule May No Longer Be Enough

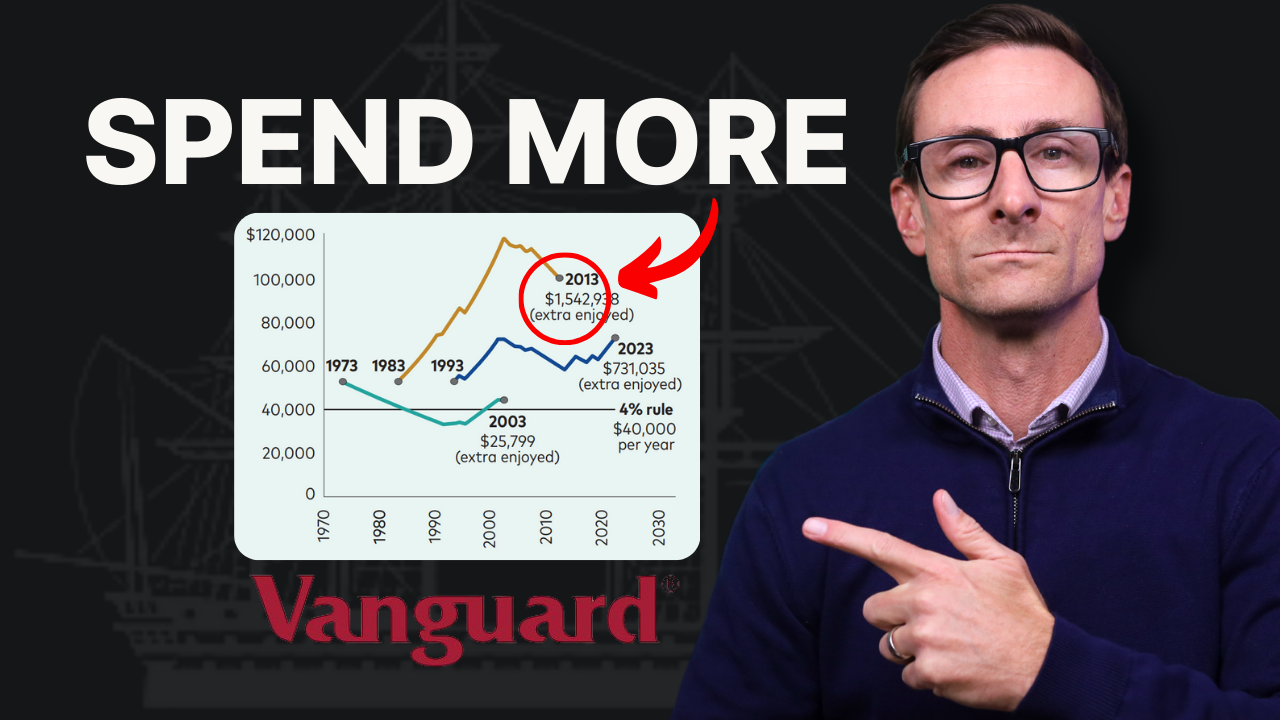

The 4% rule has been a long-standing guideline for retirees. It suggests withdrawing 4% of your portfolio in the first year of retirement, then adjusting for inflation annually. While straightforward, this retirement income strategy assumes that market conditions and spending habits remain steady throughout retirement, which is rarely the case.

Modern retirees often encounter unpredictable market shifts, rising healthcare costs, and evolving personal needs. Sticking rigidly to the 4% rule might leave you unprepared for the unexpected, whether it’s an extended bear market or increased travel expenses in early retirement. While it’s a helpful starting point, most retirees today need a strategy that evolves with them.

Vanguard’s Flexible Withdrawal Strategy

Vanguard offers a lesser-known retirement income strategy that adjusts withdrawal rates based on your portfolio’s performance. Instead of a fixed percentage, this method calculates withdrawals annually, ensuring you don’t overdraw during market downturns or leave too much unused during periods of growth.

This flexibility allows retirees to adapt their spending to the realities of their investments, offering peace of mind when markets fluctuate. However, it requires a level of financial oversight that may not appeal to everyone. For retirees who prefer a more hands-off approach, this strategy might feel cumbersome. That said, it’s a great option for those who value adaptability and are willing to monitor their finances actively.

Introducing the Risk-Based Guardrail System

The risk-based guardrail system takes retirement income strategy planning a step further. This approach establishes clear boundaries for withdrawals based on your portfolio’s performance. If your portfolio grows, you can increase your spending slightly. If it shrinks, the system prompts you to reduce withdrawals to preserve your savings.

What makes this strategy stand out is its ability to offer stability without sacrificing flexibility. You’ll have a clear plan in place, but you’ll also know exactly when and how to adjust if the market changes. This method reduces the stress of guessing whether you’re spending too much or too little and helps you maintain a sustainable withdrawal rate over time.

Finding the Right Balance for Your Retirement

There’s no one-size-fits-all solution when it comes to finding the best retirement income strategy. Each strategy—whether the traditional 4% rule, Vanguard’s flexible method, or the guardrail system—has unique strengths that can match different financial goals and lifestyles.

The key is understanding your priorities. Are you looking for simplicity, or do you want a strategy that evolves with your circumstances? Do you prefer predictable income, or are you comfortable with some variability? By aligning your retirement income strategy with your personal needs and preferences, you can create a retirement plan that allows you to enjoy life confidently and sustainably.

Retirement isn’t just about making your savings last—it’s about making the most of the time you’ve earned. With the right retirement income strategy, you can achieve both.

Seek Professional Guidance

Join the 964+ other retirees and get weekly articles and videos to help you retire with confidence.

Subscribers also gain access to our private monthly client memo.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures