You have questions,

we have answers.

How does One Degree compare?

What type of people do you work with?

We partner with diligent savers, often business owners and retirees, who have accumulated at least $1 million in investable assets and want to delegate the complexities of financial management. They value clarity, stewardship and living a life of impact.

Who is not a good fit to be a client of One Degree?

We work best with people who want to delegate the complexity of wealth management to a trusted partner. If you’d rather manage every detail yourself, or if you’re looking for one-off advice instead of an ongoing relationship, we’re probably not the right fit. That said, if you want to stay focused on living your life while knowing that your financial plan and investments are being proactively managed with skill and care, then we may be exactly the right fit.

What do people have to say about you?

We’re humbled by the kind words our clients share. You can read our client reviews on Google for a fuller picture. Click here.

Is it better to work with a local advisor or someone virtually?

The best advisor is the one who understands you and has the expertise you need, regardless of geography. However, if you’re not comfortable using technology, such a virtual meeting tools like Zoom, seeing a local advisor may have it’s advantages. We work seamlessly with clients both locally and across the country.

How do I know if my financial advisor is good?

Advisors come in all shapes and sizes. And it’s important to find the right one that has your best interest in mind. Look for someone who is a fiduciary, has respected credentials (like CFP®), provides transparent pricing, and takes time to understand your goals. A good advisor educates you, communicates proactively and has a proven process that integrates investments with tax, retirement and estate planning. All Advisors at One Degree are trained using our Compass System so that every clients gets the same great experience and technical expertise.

Can you prepare and file my taxes?

We specialize in tax planning—helping you reduce future taxes and integrate tax strategies into your overall plan. We do not prepare or file tax returns, but we collaborate closely with your CPA or can recommend one if needed, ensuring your planning and filing work hand in hand.

Do you offer proactive tax planning?

Absolutely. We look ahead to help you minimize taxes going forward. We identify strategies to optimize your income, charitable giving and investment decisions, and we coordinate with your tax preparer to ensure your plan is carried out effectively.

What is a CFP®?

CFP® stands for Certified Financial Planner™, a professional designation that requires rigorous education, experience and adherence to a strict code of ethics. CFP® professionals are trained to provide holistic financial planning, and our advisors hold this designation.

Can you help with insurance planning?

Yes. We review all types of insurance—long‑term care, life, disability, umbrella and more—to ensure you’re properly protected. Since we are not in the business of selling you insurance, our role is to help you evaluate your options and right-size your coverage. We can refer you to trusted professionals or collaborate with your existing insurance agents and specialists.

Do you help with estate planning?

We don’t draft legal documents—that’s the role of an attorney. What we do is help you think through the big picture: how your assets should be structured, who you want to provide for, and the legacy you’d like to leave. We identify potential gaps, explain your options in plain language, and then collaborate with estate attorneys to ensure the legal documents match your wishes. In short, we guide the strategy and partner with legal professionals to put it into action.

What is the Certified Kingdom Advisor® designation?

The Certified Kingdom Advisor® (CKA®) is a professional credential for financial advisors who are trained on how to apply biblical wisdom into financial planning. For clients who value this approach, we bring those principles into their plan. At its core, the designation is about helping people align their finances with their values.

I’m interviewing other advisors. How should I be thinking about making the right decision on who to hire?

That’s a great approach, and we completely respect that you’re taking the time to explore your options. Many of the clients that have had a successful relationship with us did the same exact thing. What we encourage folks to do is interview them, then interview us, and whoever delivers more value, that’s who you need to hire. Here is a resource with 7 Questions to Ask Any Financial Advisor to help you compare.

What is your planning process?

How is One Degree different than any other financial advisor?

A lot of advisors can invest your money. Some will even check in once or twice a year. But we believe to be a great advisor we must take the time to truly understand your life, create a personalized plan, and walk with you through every decision. That’s why we built our Compass System™, a planning process designed to look at your whole financial picture, not just your portfolio. From taxes and retirement income to estate planning and family legacy, we make sure nothing slips through the cracks.

Here’s how we compare with traditional firms and robo-advisors:

| Traditional Investment Firm | DIY and Robo-Advisors | ||

|---|---|---|---|

| Personalized and Holistic Advice | ✔ | ✔ | ✖ |

| Proactive Strategy Meetings | ✔ | ✔ | ✖ |

| Comprehensive Tax Planning | ✔ | ✖ | ✖ |

| Tax-Smart Investment Planning | ✔ | ✖ | ✔ |

| Retirement Income Planning | ✔ | ✖ | ✖ |

| Social Security Optimization | ✔ | ✖ | ✖ |

| Estate Plan Analysis | ✔ | ✖ | ✖ |

| Tailored Investment Portfolios | ✔ | ✔ | ✖ |

| Evidence-Based Investing | ✔ | ✔ | ✔ |

| Family Legacy Planning | ✔ | ✖ | ✖ |

Can you give a quick overview of how the process works?

First we connect to ensure we’re a good fit. Next, you share your financial details so we can complete a holistic analysis. We then present your initial strategy in the form of a One Page Plan that aligns with your “why” and walk alongside you to implement it. Meetings are more frequent at the outset and move to a rhythm of ongoing bi-annual strategy sessions and on‑call guidance.

What does the Compass System planning process include?

Your plan is built around every facet of your financial life. From optimizing taxes and withdrawals to reviewing insurance, estate documents and purposeful legacy goals, we leave no stone unturned. We even provide guidance on your current employer retirement plan (e.g., 401k) so that your entire financial picture works together in harmony.

What can I expect if we work together?

You’ll work with an independent fiduciary team whose loyalty is to you alone. We begin by listening to your story—your dreams, concerns and values—then craft a plan that serves your life, not a product list. Whether you meet with us virtually or in person, you can expect genuine care, transparent advice and a clear path forward.

Do I have enough money to become a client?

Most of our clients have accumulated at least $1 million in investable assets (not counting certain retirement accounts, real estate or 529 plans) and are ready to hand off the day‑to‑day management.

What’s the best way to create income in retirement?

There’s no one‑size‑fits‑all answer. A sound retirement income strategy often blends diversified investments, tax‑efficient withdrawals, Social Security timing and, in some cases, pensions or annuities. The “best” approach depends on your goals, risk tolerance, longevity expectations and tax situation. We invest in top research and tools to give our clients the best possible income experience.

What’s the best way to invest?

In our view, the most reliable way to build wealth is through disciplined, long‑term investing in low‑cost, diversified portfolios tailored to your objectives. Avoid chasing fads or trying to time the market; instead, focus on an evidence‑based strategy that you can stick with through market ups and downs.

What is your investment philosophy?

We believe in simplicity, efficiency and sustainable income. Instead of chasing performance or timing markets, we build low‑cost, diversified portfolios—often using ETFs and Mutual Funds—tailored to your needs, tax situation and goals. Whether we work with your existing holdings or reposition your assets, our priority is to support your lifestyle for the long haul. For a deep dive on our investment philosophy please click here.

Do you manage all my investments?

For the best results we typically manage all assets under our purview to ensure your strategy is cohesive and your risk properly aligned. If you have smaller, personal holdings that don’t impact your overall plan or a 401(k) that we can’t manage because you are still employed, we’re flexible. Our aim is thoroughness, clarity and peace of mind—not control.

Who will we be working with?

You’ll be paired with a dedicated lead advisor who embodies our planning philosophy and brings their own expertise and personality to the relationship. Behind them is a full support team, so you receive comprehensive care without having to re‑explain your story.

What else does One Degree do to help clients optimize their investing?

We harness powerful technology to monitor portfolios and identify tax‑saving opportunities while our advisors remain firmly in the driver’s seat. This combination of human insight and sophisticated tools helps ensure your investments stay aligned with your strategy, capturing opportunities like tax‑loss harvesting along the way.

How does transferring money work?

Transferring your accounts is simple and secure. We use the ACAT system, which transfers your investments “in-kind.” That means nothing gets sold through the transfer process. We don’t make adjustments until we’ve built and reviewed a personalized plan with you — one that aligns with your goals and tax strategy. For more complex account transfers, our Client Service Team monitors the process and does as much of the legwork as possible for you.

Will you sell my taxable investments and trigger big tax bills when we work together?

We won’t just liquidate your portfolio and create a big tax bill. If you have investments with large gains, we’ll carefully evaluate and build a tax-efficient plan. We leverage technology to help us position your portfolio to meet your goals, even down to the tax lot level. Every move we make is coordinated with your tax picture, so you’re not surprised by unnecessary costs.

How good are your financial advisors?

Our firm has been around for over two decades and has built systems and processes to make sure every financial advisor is equipped to guide clients properly. Our advisors are among the most qualified and compassionate in the industry. They combine rigorous technical knowledge with the ability to guide life decisions with empathy and clarity. Each team member completes external certification education (e.g., CFP®) and our internal training, ensuring they can handle complex tax and investment strategies while helping you pursue your goals with confidence.

How do I “break up” with my current advisor?

We do the heavy lifting of helping you coordinate the transfer paperwork and communicate your decision thoughtfully. We can provide a template to respectfully communicate to your current advisor.

How often do we meet?

At a minimum we schedule two strategy meetings per year—often strategically in the spring and fall to align with tax planning. During your first year, we may meet more frequently to get your plan established. Beyond scheduled meetings, we’re available anytime life throws you a curveball.

Am I limited to the number of meetings with my advisor?

We meet at times that work for you, whether in person or virtually. While our Spring and Fall meetings are carefully timed to deliver the most strategic value, real life doesn’t always follow a calendar. When the unexpected arises—retirement transitions, health, time-sensitive decisions—we’re here to meet.

Does your software make you better than other advisors?

We use top-tier, cutting-edge software to serve our clients, but here’s the truth: software changes all the time. A year from now, we might be using something even better. What doesn’t change is the advisor behind the software — the experience, wisdom, and discipline we bring to help you make the right decisions. Tools matter, but it’s the craftsman using them that makes all the difference.

What are your costs & fees?

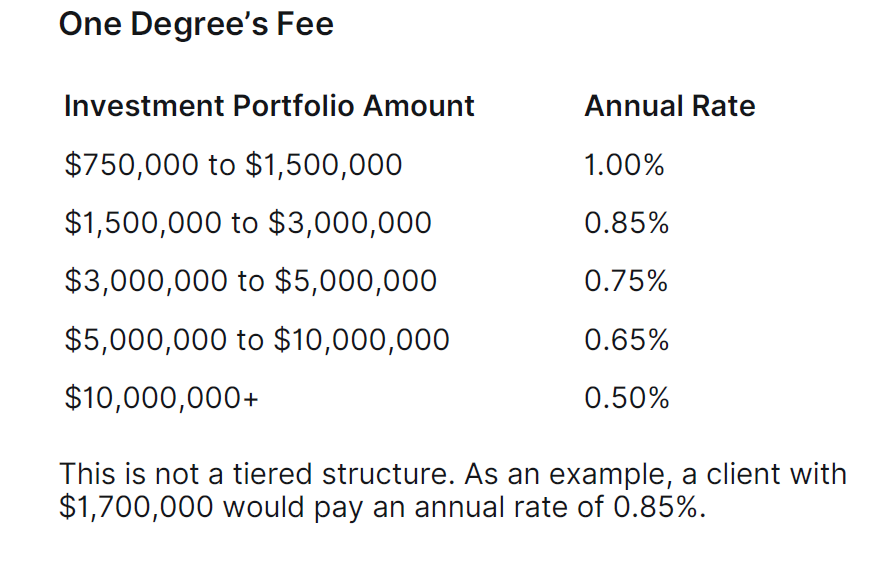

What is your fee schedule?

We charge a transparent, flat percentage based on the assets we actively manage. There are no hidden fees, no commissions, and no extra charges for tax or estate planning—just straightforward pricing that aligns our success with yours.

How much will this fee cost me over the course of my retirement?

Fees are one of the main things you can control in investing, so it makes sense to be cautious. Our job is to make sure the value we deliver far outweighs the cost. Vanguard’s well-known Advisor’s Alpha study found that good financial planning and behavioral coaching can potentially add about 3% in net returns per year — through smarter tax strategies, disciplined investing, and retirement income planning. In other words, while there is a fee, the potential benefit of avoiding costly mistakes, optimizing taxes, and keeping your plan on track can more than offset it. Think of it as an investment in peace of mind and long-term financial outcomes.

How does your cost compare to other advisors?

Financial Advisors typically charge anywhere from 0.25% to 3.0% of the assets they manage. We’re competitively positioned — not the cheapest, but far from the most expensive. Most retirees don’t want to entrust their life savings to the bargain option, and there’s no reason to overpay either. More importantly, our clients hire us because the value we deliver — in tax savings, investment discipline, and peace of mind — can outweigh the cost.

Is hiring a financial advisor worth it?

Not always. If you’re just getting started, have simple finances, and/or you want to spend your time to educate yourself being your own advisor, it’s not worth it. A great advisor does more than manage investments. They help you avoid costly mistakes, optimize taxes, make informed decisions, and stay focused on what matters most. If you find that the value—both financial and emotional—far exceeds the cost that is when an advisor is worth it. Especially when it frees you to live confidently and generously.

Can I get a fee discount?

Who doesn’t love a good deal! We work with a lot of really sharp people just like you. We’d love to provide a discount to people we truly love to working with but here’s the thing: If we offered one client a discount, we’d feel morally obligated to offer the same to all our other clients. That wouldn’t be fair to them, and it could compromise the level of service and resources we provide. Our fee reflects the value of the time, expertise, and personalized service we deliver to every client.

How do I know you won’t run off with my money?

Your assets are held in your own name at a well‑known custodian like Charles Schwab and Co. Charles Schwab and Co. administers more than $7.65 trillion in assets (as of 5/31,2023 using company reports). As custodian, Charles Schwab and Co. holds your funds and provides reporting to you and the IRS. Your accounts can be viewed at any time at https://client.schwab.com/ We never take custody of your funds; we simply have limited authority to manage investments according to the plan you approve. As fiduciaries, we’re legally and ethically bound to act in your best interest, and we undergo rigorous regulatory reviews.

Why not just use AI to be my financial advisor?

AI is incredible. It can crunch data in seconds, run projections, and even surface insights that would’ve taken teams of analysts days to uncover in the past. In fact, we use technology, including AI-driven tools, inside our process. It helps us analyze tax scenarios, optimize portfolios, and ensure no detail gets overlooked. As fiduciary advisors, we don’t just calculate; we listen, interpret, and help you make decisions in the real context of your life; having worked with hundreds of people in your situation. Put simply: AI can be a helpful assistant, but it can’t sit across the table, understand your story, and walk alongside you through life’s transitions. That’s what we do.

What do you do to avoid me becoming just another number?

Unlike large cookie cutter firms in the industry we purposefully limit the number of clients we take on. You’re paired with a dedicated lead advisor and support team who get to know you deeply. We start with your “why” and keep your personal goals at the center of every conversation. We measure our success by your confidence and progress—not by our headcount.

Is there a long‑term contract?

No long‑term contract is required. Our services are billed quarterly, and you’re free to leave at any time. We believe in earning your trust through consistent value, not by locking you in. Many of our clients have worked with us for decades.

Don’t see an answer to your question?

Send an email to admin@onedegreeadvisors.com