December 26, 2022

Is Long-Term Care Insurance Worth The Cost? (2023)

A long-term healthcare need can wipe out retirement assets. With the rising cost of Long-term care insurance, is it still worth the cost?

December 21, 2022

Lump-sum vs Annuity: How to Maximize Your Pension Benefit in 2023

Lump-sum vs Annuity - Should you take the lump sum or the annuity option on your pension? Today Alex & Anthony discuss.

December 19, 2022

How to Address The Endless Pursuit of Money (2 Solutions)

In this video, we’ll discuss why addressing this question of ‘how much is enough?’ can help you pursue peace of mind.

December 15, 2022

Retirees: Take Advantage of Donor Advised Funds for Tax-Advantaged Giving!

In this video, we will show you the advantages donor advised funds, and how to start making gifts to make an impact with your wealth.

December 12, 2022

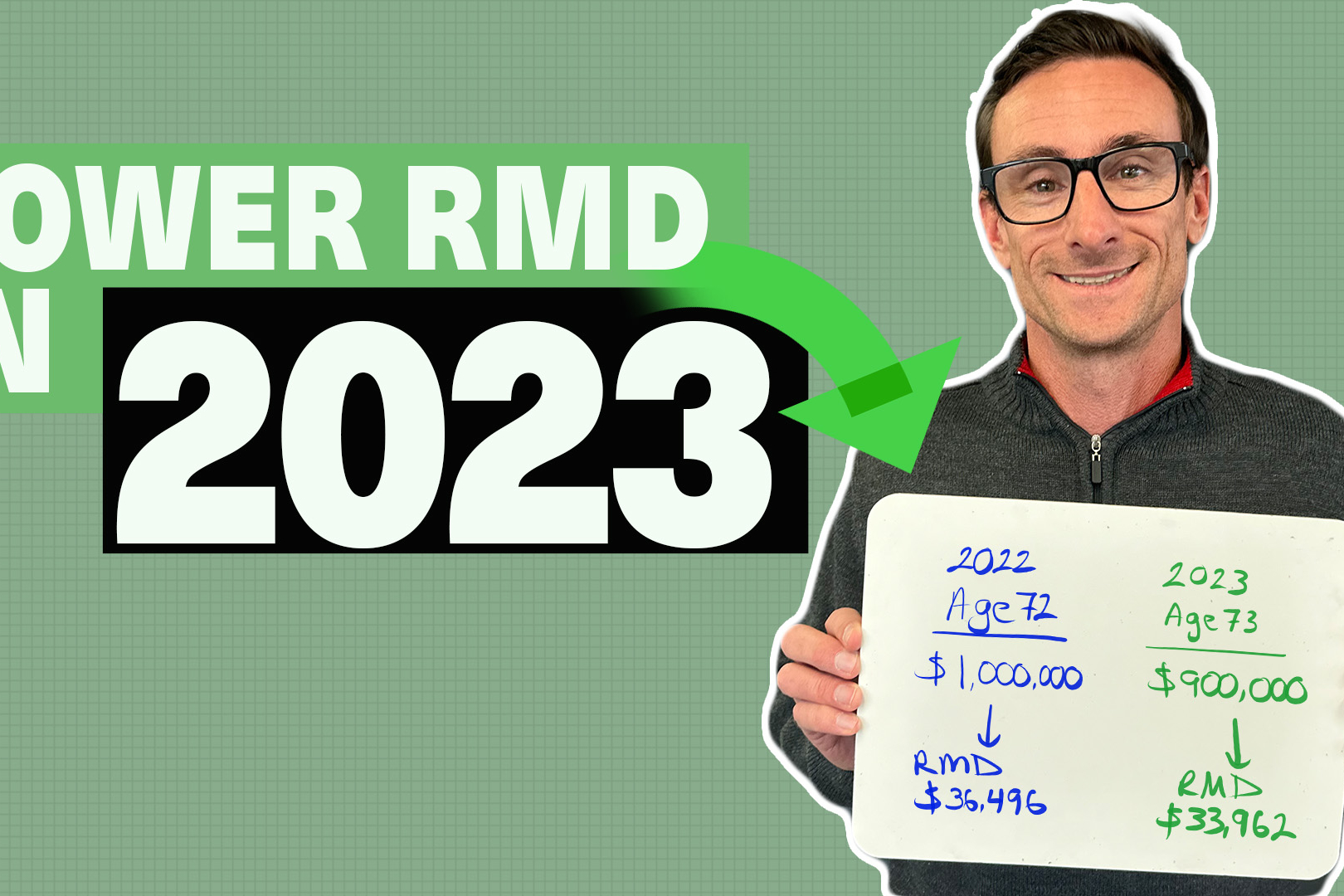

Lower RMD in 2023? 3 Things Retirees Can Do

Will your required minimum distribution from your IRA be lower in 2023? Today, Anthony & Alex discuss 3 things retirees can do.

December 8, 2022

The Truth About Paying Off Your Mortgage Before You Retire (2023)

The truth about paying off your mortgage before you retire is that it’s not purely a mathematical decision. Today Alex & Matt discuss the advantages,…

December 1, 2022

STOP Timing the Stock Market – 5 Better Solutions for Retirees

In this video, we discuss why retirees should stop timing the stock market. We then go through 5 better solutions to consider.

November 28, 2022

How Retirees Can Benefit From Dynamic Financial Planning (with real examples!)

In this video, we walk through a case study of how a retired couple can benefit from dynamic financial planning.

November 24, 2022

Should I Collect Social Security and Invest it? (Before Social Security Runs Out)

Should I collect social security and invest? Today we discuss what happens when/if the social security reserve fund “runs out.”

November 21, 2022

Should Retirees Sell Stocks and Move to High-Interest Savings? (2022 Stock Market)

Should retirees sell stocks and move money into safe, interest-bearing investments like CDs, treasury bills, or high-yield savings accounts?

November 17, 2022

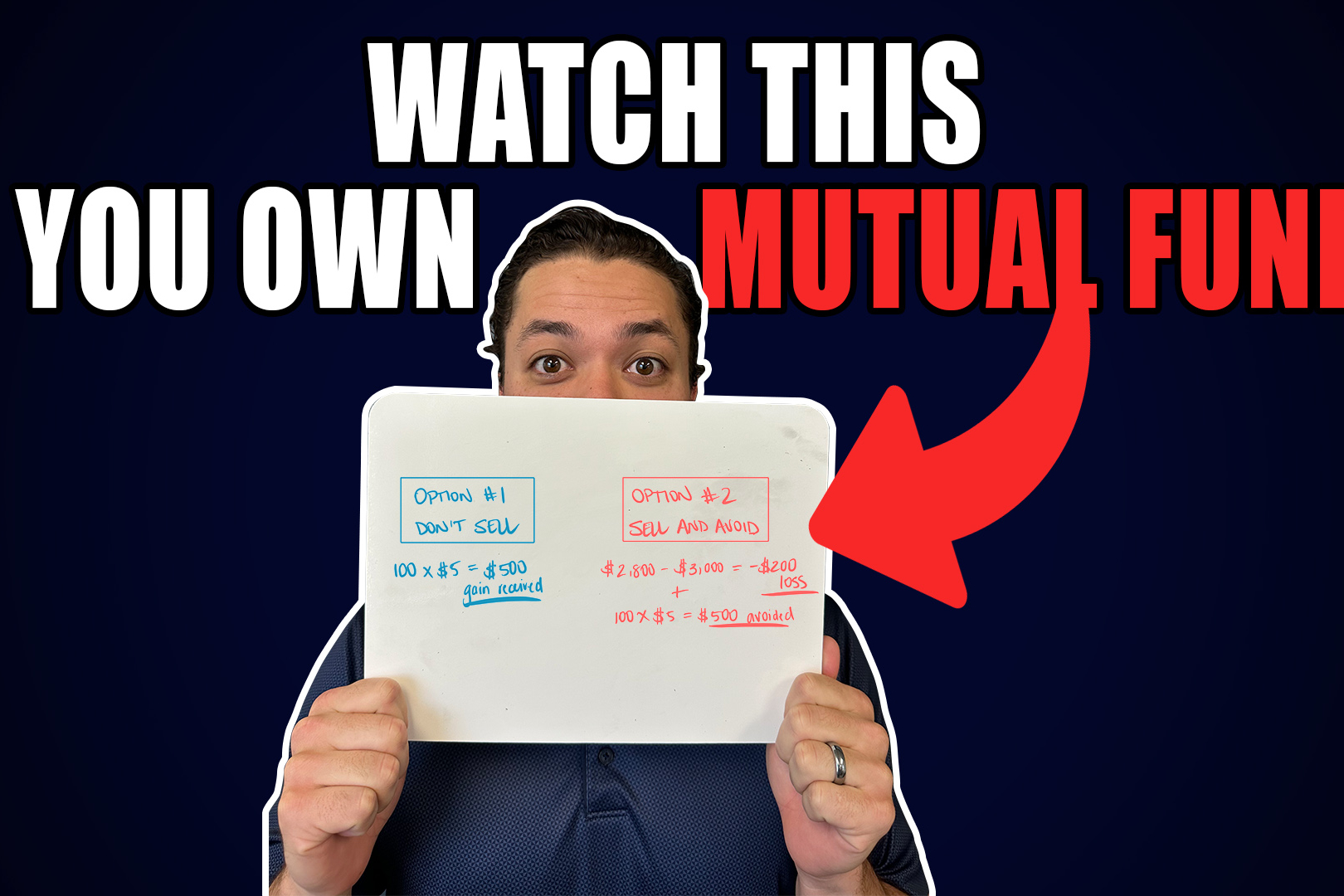

How to Avoid Capital Gain Distributions – The ETF Secret

Today we discuss how to avoid capital gain distributions from your mutual funds, and alternatives to be more tax efficient in the future.

November 14, 2022

10 Years Out From Retirement (Do These Three Things!)

10 Years Out From Retirement? After helping hundreds of families cross the finish line, we are going to discuss 3 areas to focus on.

How Much Do I Need to Retire?

Get your free retirement readiness report to find out!

Is your family set up to succeed or fail?

6 Keys To Create An Impactful Legacy