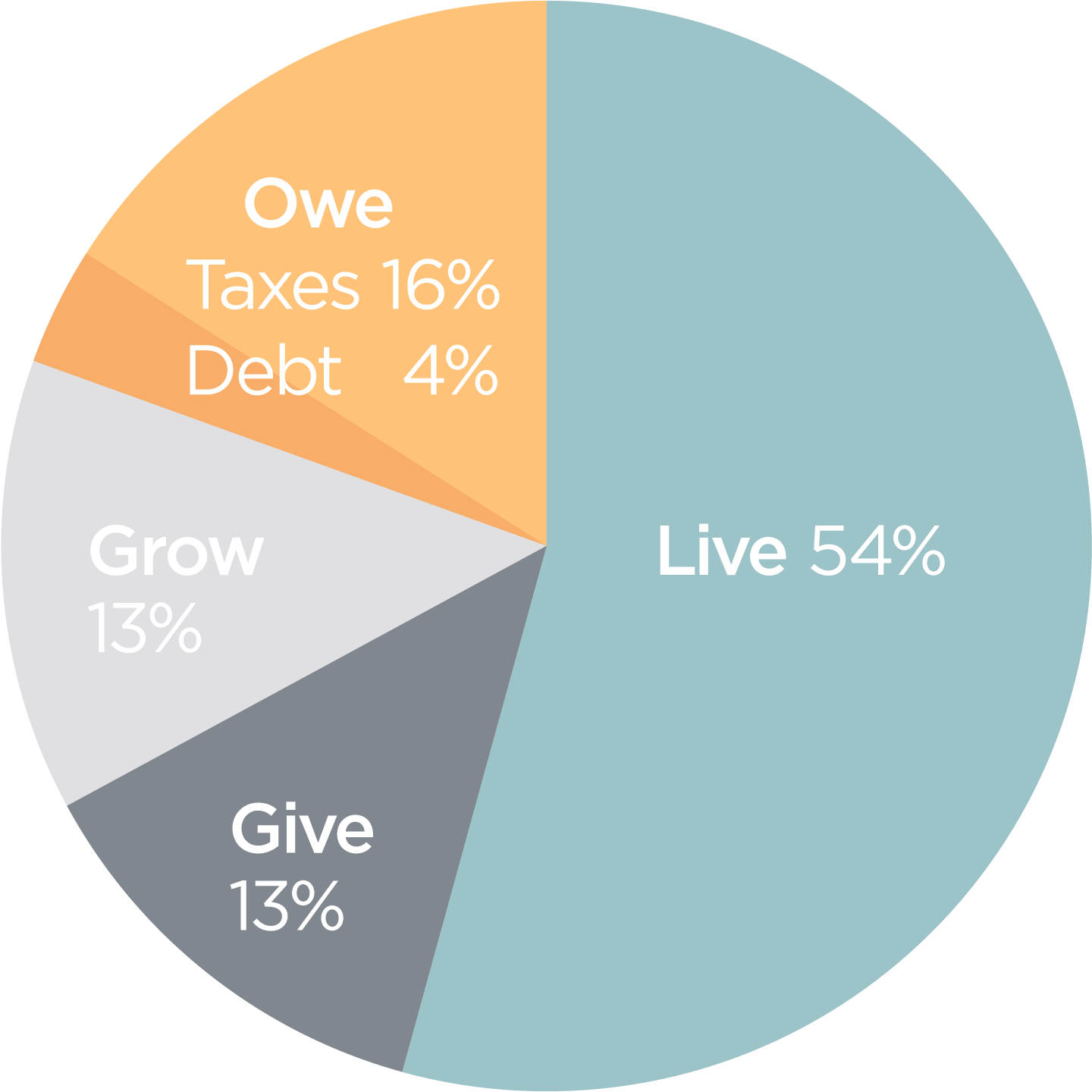

Live, Give, Owe, Grow

Let’s face it — budgets are boring! I prefer to call this necessary exercise a “cash flow plan.” Money comes in and goes out, but we should control our money, not the other way around.

Over time, if we spend less than we earn, we can pursue financial success. Inherent in this principle is sending our money to the right places.

For as complicated as money may seem, it only has four potential uses:

- Live on it.

- Give it away.

- Pay what we owe in debt or taxes.

- Make it grow through saving.

Since we control our money and not the other way around, which of these uses is most important to you? Which do you want to see as a smaller portion of your plan? The Live, Give, Owe, Grow exercise puts you in control. Let me explain how this works.

Live :

This is often the largest portion of someone’s personal pie chart at least at the start. Include housing, food, utilities, entertainment, etc. here. The societal default is that higher income increases one’s standard of living. Others ask themselves if an increase in standard of living is necessary and instead set boundaries to their living expenses.

Give :

It’s helpful to me when doing this exercise, to separate “productive” uses of money and “consumptive” uses. What has lasting value? What is simply “consumed”?

Giving, to me, is the ultimate productive use because of its eternal impact. Serving people and furthering God’s truth have eternal value. (Many people see giving as a guilt offering of sorts — that would equate to a consumptive perspective.)

Owe :

Financially successful people minimize or avoid the use of consumer debt. Paying interest to someone else is not in their plan. Debt can increase risk because of the obligation it causes.

Proverbs 22:7, “The rich rule over the poor, and the borrower is slave to the lender.”

Borrowing is not wrong, however, it’s not always wise because it presumes upon the future. When borrowing takes place, it should include a way to pay it back, such as with a mortgage when the property serves as collateral.

Taxes are symptomatic of God’s provision as they increase based on a rise in income.

“And Jesus said to them, ‘Render to Caesar the things that are Caesar’s, and to God the things that are God’s.’” (Mark 12:17).

We are to pay our fair share of taxes, which means not cheating the system, nor paying more than what we are prescribed.

Grow :

To meet long-term goals, we need to set aside a portion of our earnings. Proverbs 6:6–8 instructs us to save,

“Go to the ant, O sluggard, observe her ways and be wise, which, having no chief, officer or ruler, prepares her food in the summer and gathers her provision in the harvest.”

Your short and long-term priorities should guide how you save and invest. A comprehensive financial plan can provide context for sound decisions today based on an uncertain future.

“Growing” can be viewed as a productive use of money because it allows for future flexibility and freedom. Increasing the “grow” portion is encouraged.

However, you might also consider tapering off this allocation as savings becomes reasonably adequate. You must ask the question, “How much is enough?” I suggest reading the Parable of the Rich Landowner in Luke 12:13–34 to see how a complete focus on accumulating more is harmful.

Take steps to improve your financial future:

1. Make your own chart and see where you stand.

2. Note which portions need to be increased or decreased for the coming year. Plan the action steps to make this happen.

3. After one year, adjust your chart based on your money usage.

4. Continue to repeat the process.

What’s your chart look like? How do you want it to look?

The Live, Give, Owe, Grow exercise has been inspired by authors, Ron Blue (“Master your Money”) and Mitch Anthony (“The New Retirementality”). The simplicity is exactly the point. Financial decisions can be complex, but the overarching uses of money are not.

Take actionable steps toward the Live, Give, Owe, Grow plan you want to pursue….

Talk with us about your portfolio or financial plan here: Talk with an advisor

More Reading: 7 Questions to Wisely Grow Finances

Anthony Saffer

Principled Prosperity is focused on equipping those who choose to ignore the noise. The world of finances can be complex, but basic truths have persevered over time, across cultures, and in spite of changing circumstances. Anthony Saffer writes on his experiences in personally working with families to coordinate principled financial and investment solutions.

1 Comment

Comments are closed.

[…] More Reading: Life, Give, Owe, Grow […]