An Alternative to Budgeting: A Simple, Easy, and Successful Framework

Let’s face it – budgets are boring! Inherent in this principle is sending our money to the right places.

With a proven and sustainable budgeting framework, we can improve our financial future.

This week Anthony Saffer CFP®, CKA® & Alex Okugawa CFP®, CKA®,CEPA® discuss simple, proven and sustainable budgeting alternatives:

Full Transcript:

Alex: Hi there, and welcome to One Degree Advisors where we help families cut through the noise to make confident financial decisions. You know Anthony. I know there’s a source of frustration with a lot of people they don’t exactly know how to spend their money or where they’re spending their money. And so a lot of people A. They don’t want to budget and B. They just don’t know how to. I think of a really good analogy you know it’s like someone who wants to get in shape and they know they need to get in shape. They’ve heard about what People do so they go. I’m just going to throw on some running shoes. And I’m going to go start running. They don’t have a real plan and it’s not something that they’re likely to stay consistent with so it just falls apart and I see the same thing with budgets, you know, people that get these fancy spreadsheets all these different tabs. It looks really good. They stick with it for a month and month after month after month. It’s like, oh my gosh, I can’t believe that to keep doing this.

So you’re going to walk us through a framework of understanding where money is going and something that is sustainable.

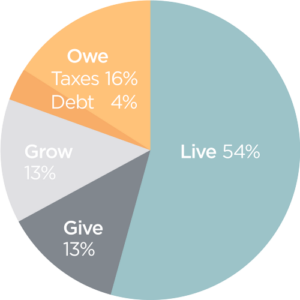

Anthony: Well, yeah, budgets do work for some people we’re not we’re not knocking that at all, but they’re boring for many of us and they can tend to get a little bit frustrating. So there’s this concept that we use called live give owe grow and we can’t take full credit for because Mitch Anthony who’s the author of the New Retirementality. Great book and Ron blue the author of many books including Master your money and get those get those online. They came up with this concept called live give owe grow And really under the auspices here that you can really only do five things with your money. You can live on it. You can give it away. Okay, you can owe it in the form of debt and taxes or you can grow it which is basically saving or investing it for later.

Alex: So why don’t we start at a place of just you know, kind of order of operation. Let’s start at the top. Let’s start with “Give” that’s like the first thing you want to do with your money. Yeah, so we at least hold that out to a lot of people and a lot of people find that is like hey if I want to if I want to give money away if I want to help my community help Society help Ministries that are that are out there. I got to build my cash flow up on what I’m what I plan to give away. And so it’s really setting that that goal that objective is here’s what I want to give to First. Here’s how much I want to give and I want to be able to prioritize that right from the very beginning.

Alex: It helps ensure that you have the cash flow to be able to do this.So that’s great.

Anthony: The second thing we have here is “Grow” so what does that mean? A lot of times people, you know put it under like the heading of pay yourself and so saving and investing if you’re putting away money towards your cash reserves your savings account towards your 401k any other Investments that you have ensuring that hey, here’s what I really want to allocate towards my future and towards emergency funds and putting that second in line.

Alex: Alright, the next thing we have here is “Owe” I know that can be broken down into two categories which is debt and taxes. Y

Anthony: yeah, I like to think of those first two categories as giving and growing as more productive uses of our money. And then you kind of get into the more consumptive uses which is like when we owe debt, we’re not really putting ourselves forward in any way. We’re not being productive with that money. So we really want to try and minimize that now taxes you could look at it I guess as a productive use of money in that, you know, we’re furthering our society and paying the government so they help but in most cases we want to try and minimize our taxes, right so it is when we have taxes to pay since we’re on an income tax based system. At least mostly that way when we owe more taxes. It’s really symptomatic of earning an income. So it’s not a it’s not a bad thing. We just want to do the proper planning to try and minimize those taxes.

Alex: Yeah. Well Ron blue always makes this joke. I think it goes well, if you know if you want to pay less taxes, all you have to do is make less Money or give more money away. I mean, it’s really that simple right but in a way, you know, it is very true. I mean taxes is a symptom of the money we make now, of course you want to you don’t want to leave a tip to the tax man, but pay no more than need is necessary.

Okay, and then finally, I think this is where people get hung up on is the “Live” category.

Anthony: Yeah, and that’s why we save it for last and like you said the mode of operations in terms of you know, we’re thinking about okay, what do we need to eat? We need to put gas in the car. We need to keep the lights on even other, you know, entertainment travel all these things kind of come under this big bucket.

And the reason we put it last in the mode of operation is because we’ve already taken care of everything else. So there still as you know, a certain amount of planning that may need to go into like here’s how much my bills are. Here’s how much I need for food. But when we’ve done the priorities the giving the saving we paid our taxes we’ve made sure if we if we do have any debt like a mortgage or hopefully not other consumptive type debts that we get those paid off. Everything else is meant for that living piece of the pie and then we don’t have to feel bad about it because everything is already meant to be in that.

Alex: Well and this is why I love the framework is that it does give the hardest thing is just knowing where your money’s going. You have to know where your money is going know whether or not you want to track things down to the penny. I think that’s a personal preference. But if you don’t know where your money’s going, how could you possibly make any progress in your financial life, you know, the thing with budgets here that’s always kind of it’s been a unique relationship with me is it’s like okay if I budget, you know $200 for going out and doing whatever. Okay, well family and relatives have come into town. Am I not going to go beyond my budget because people come into town I want to celebrate and have fun, you know, like it’s understanding where your money’s going not being out of control of things.

But spending in the areas that are most important to you in understanding that if we put ourselves in boxes 24/7 very often it’s not likely a system that we can maintain on a routine basis. So I really like this framework and just understanding where your money is going is so important.

Anthony: And then if you if you’re categorizing your expenses based on this simple framework, then you can look at it and say okay and this year maybe we spent 50% on living expenses 10% towards giving you know, all these different pieces of the pie and then you can make the objectives to say, you know what I really want to grow what I’m putting into giving for instance or I want to add to what I’m saving and investing for my future and you can really deal with bigger pieces of the pie there and what and then also what you want to try and minimize.

Alex: Yeah things have moved the needle. I love it. This is the kind of stuff that that again we do help people with it’s the overall framework that we use to help people get into retirement, you know understanding what they’re spending. But also folks that are still working, you know, helping them in their working years make the biggest impact, you know, do you know where your money’s going? Let’s see how we can move the needle different areas.

So there’s a very powerful framework. Hope you found it helpful. Again, Mitch Anthony and Ron blue really are kind of like creators of this philosophy and promoters of it. So be sure to look them up.

If you would like help in the areas of financial planning Investment Management knowing where your money’s going. Those are the areas that we can help you with give us a call visit our website we’d love to talk with you.

Let’s get to know you better. Schedule a complimentary call with an advisor here

More Reading: Life, Give, Owe, Grow

One Degree

We help families cut through the noise to make confident financial decisions.