Focus on What You Can Control

Focus on What you can control: Much of the future is uncontrollable, which can create unnecessary stress in our lives.

You don’t control:

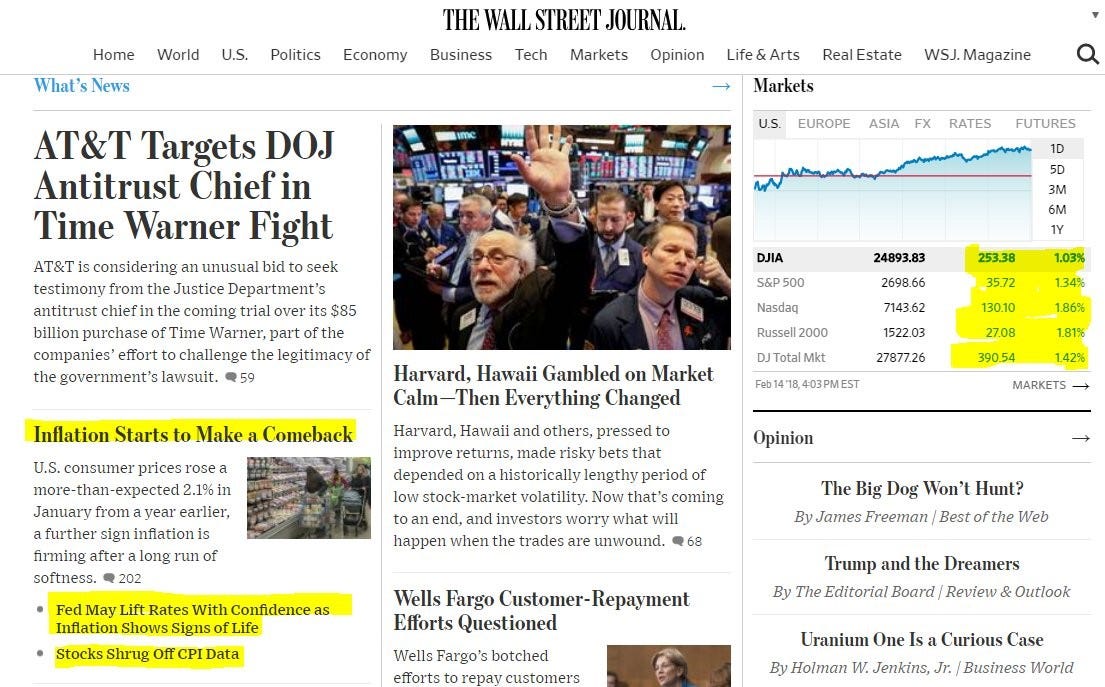

The market: Turning on the news you will see a flood of commentary confidently dissecting why the market behaved the way it did. Often, contradicting comments are made just days or weeks later adding to the confusion. Recent market commentary emphasized the fear of rising interest rates and inflation, yet the Wall Street Journal later credited the rebounding markets with those same issues. See for yourself:

You do control:

Your investment diversification: It may not be flashy, but diversification is a well-researched and time-tested approach to long-term investing. It adds a layer of importance when taking income from investments.

Spending less than you earn: This will have a much larger impact on your net worth than simply investment returns. Keeping spending under control can have the greatest long-term impact to your finances. You get to control the amount you save so start early and let compound interest work for you.

Setting goals: Goals will help you answer the “why” in your life and provide guidance for planning strategies.

Focusing on controllable things requires diligence but will have the greatest and most consistent impact on your future.

Talk with us about your portfolio or financial plan here: Talk with an advisor

More Reading: Four Keys to Overcoming Anxiety about Money

One Degree

We help families cut through the noise to make confident financial decisions.