Growing wealth requires a carefully crafted investment and financial plan over the long-term

Building a consistently successful investment plan requires a sound strategy and discipline beyond picking the hottest stock. Every investor wants to be successful but many will struggle because of bad habits, alluring narratives and misconceptions. Here are a few basic tips to becoming a successful investor.

- Allocate investments to match objectives and time horizon. Before comparing your portfolio to what you see in the news, first consider your objectives and time horizon. Also, investment risk and return have a significant and direct correlation. This means investing in higher risk assets will typically result in higher returns over the long-run, while lower returns are typically the long-term trade-off for less fluctuation. Older investors and those taking or close to taking a steady stream of income from their portfolio should allocate a higher percentage to fixed income assets such as bonds. Younger investors and those who can leave portfolio assets untouched for many years should allocate an increased percentage to higher-risk securities such as stocks. Of course, these are generalities and each investor should analyze their situation to determine a plan that best suits his or her goals, objectives, and risk tolerance.

- Allocate accounts tax sensitively. It’s not just how much you make but how much you keep. Carefully consider the types of investment accounts you have. Accounts such as Traditional IRA’s or 401(k)’s are tax-deferred — meaning the growth within the account is not taxed until withdrawn. If tax-inefficient assets such as taxable bonds or mutual funds with high turnover are being utilized, they are better suited for these accounts. Taxable accounts (i.e. Individual, Joint or Trust accounts) are better suited to hold tax-efficient assets such as municipal bonds or mutual funds with lower turnover.

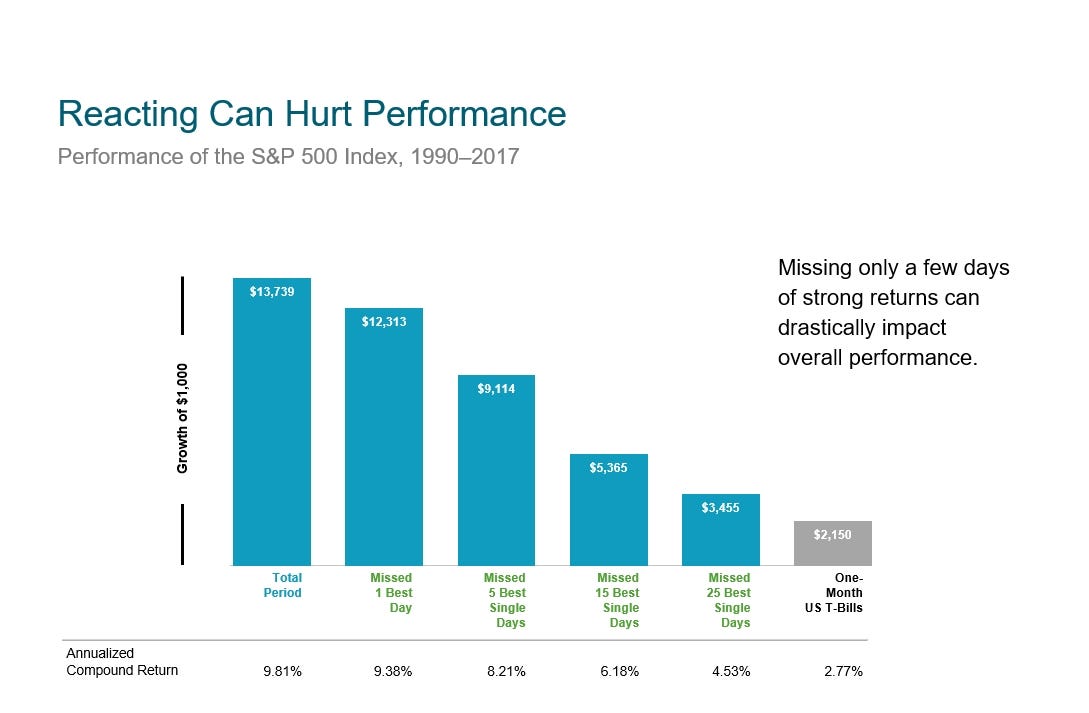

- Be aware of timing. The idea behind investing is relatively simple: buy low and sell high. In the pursuit of success, investors typically follow their emotions when making decisions. This results in clouded judgment and reactive decision making due to an inability to separate emotions from factual research. Getting out of the market before declines and reinvesting at the bottom is extremely difficult. Consider the chart below:

An investor who missed the five single best days in the market over 1990–2017 would have reduced annual returns by 1.6%. Missing fifteen days would have reduced annual returns by 3.63% and missing the twenty-five best days would have reduced annual returns by 5.28%. The performance of the stock market can be wildly different day-to-day and even year-to-year. Ensure you have a strong investment philosophy to guide your decisions and avoid jumping in and out of the market.

Without solid principles and the coordination of investments with a financial plan, investors could be tempted to deviate from sound investment principles. Growing wealth requires a carefully crafted investment and financial plan over the long-term.

Talk with us about your portfolio or financial plan here: Talk with an advisor

More Reading: Three Keys to Deflect Questionable Financial Advice

One Degree

We help families cut through the noise to make confident financial decisions.