Investment Strategy Basics: How to think about portfolio construction

Here we will discuss the basics of an investment strategy. These concepts are important if you’re a beginner or a seasoned veteran to investing!

Investing can be rewarding and frustrating! At times, it feels like two steps forward and one step back. Whether you’re a beginner or a seasoned veteran, investors can constantly feel like they are playing catch up or not earning what they should. Put simply, there is no single investment strategy that ‘works’ 100% of the time. As the saying goes, “diversification means always having to say you are sorry” because something unquestionably underperformed. (That is the point!)

A Problem

If you’re interested in the stock market or nearing retirement, you might check the market frequently. Perhaps you see the S&P 500 has dropped 2% and think to yourself, “Oh no, my portfolio has dropped 2%!” Unless you’re only invested in the S&P 500, this is likely not the case. The problem is, a majority of people translate the performance of a few stock market indices into how their unique portfolio should perform – good or bad. Most people shouldn’t compare their portfolio to a simple stock market index. Why? For many investors, only investing in a handful of domestic stocks is not advisable.

The ‘Right’ Investment Strategy Mix

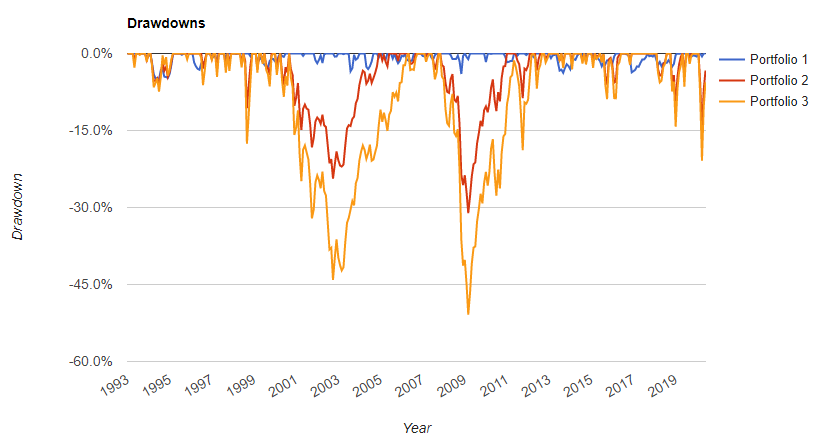

Let’s take a look at drawdowns going back to 1993. A drawdown is simply showing how much an investment has dropped from its peak.

- Portfolio 1: 100% Bonds (VBMFX)

- Portfolio 2: 50% Stocks (VTSMX) and 50% Bonds (VBMFX)

- Portfolio 3: 100% Stocks (VTSMX)

As you will see, since 1993 there are two major market drawdowns that standout. The dot-com bubble and Great Recession. Let’s take a closer look at the Great Recession.

Maximum Drawdowns :

- Portfolio 1: -3.99% from April 2008 – October 2008 (Recovery time: 2 months)

- Portfolio 2: -31.10% from November 2007 – February 2009 (Recovery time: 1 year and 10 months)

- Portfolio 3: -50.89% from November 2007 – February 2009 (Recovery time: 3 year and 1 month)

Adding more conservative investments, such as bonds, to a portfolio can substantially decrease risk and losses in a down market. However, this reduction in risk comes at the cost of long-term compounding returns.

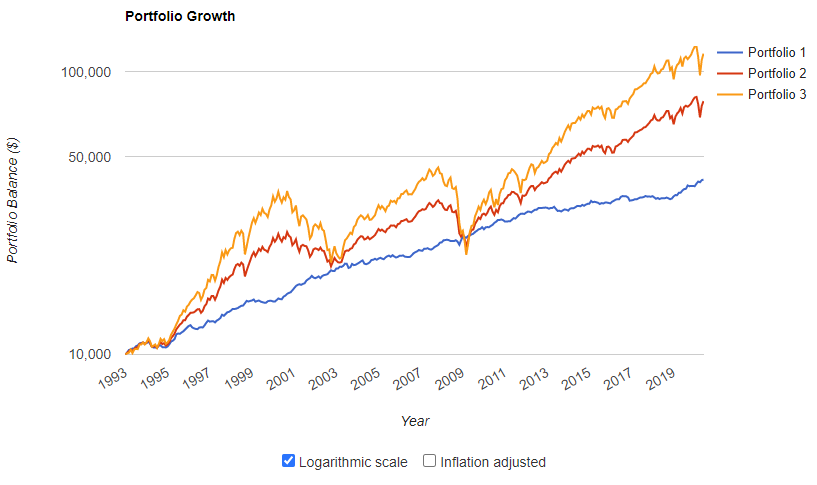

As you see, limiting your downside losses can impact your growth potential. Everyone wants to limit their downside and capture all of the growth – but there’s no free lunch.

The Takeaway

It’s important to understand that portfolios should be built for a person’s specific investment needs. This is accomplished by understanding goals, priorities, risk tolerance, and how the investments relate to their overall financial plan.

- Think in dollars: Talking about percentages tends to create dislocation from reality. A 30% drop in your portfolio might not sound so bad. A $300,000 loss on the other hand, might be terrifying.

- Understand your financial plan: Without a plan, you may not know how much risk you should be taking on. Perhaps you could take a more conservative investment strategy and meet all your goals and objectives. Would you still want to take on more risk than necessary? Probably not, and your health will thank you for it.

- Calculate how much you need in bonds: You’ll notice in the chart, bonds have historically held up their value quite well. If you’re approaching or are in retirement, take a look at your income needs on a monthly basis from your portfolio. If you had to only take your income from bonds, how long would it last you? Determine the right mix for you to feel comfortable and stick to your investment and financial plan.

Creating a plan with the right mixture of investments and balancing risk to achieve the highest risk-adjusted returns is an important step. That means, simply benchmarking your portfolio’s performance to a stock index may not be such a good idea.

So, if you have a diversified portfolio and have hired a fiduciary financial advisor working in your best interest, it’s important to realize your portfolio will likely behave differently than a few stocks you see in the news. And that’s a good thing.

Alex Okugawa

San Diego Financial Planner. I write about financial planning topics to guide families in making a greater impact with their wealth.

1 Comment

Comments are closed.

[…] Read: Investment Strategy Basics: How to think about portfolio construction […]