How to Be Successful at Investing

The year 2020 has provided key lessons in how to be successful at investing. It’s a masterclass for those paying attention.

Here are four key lessons:

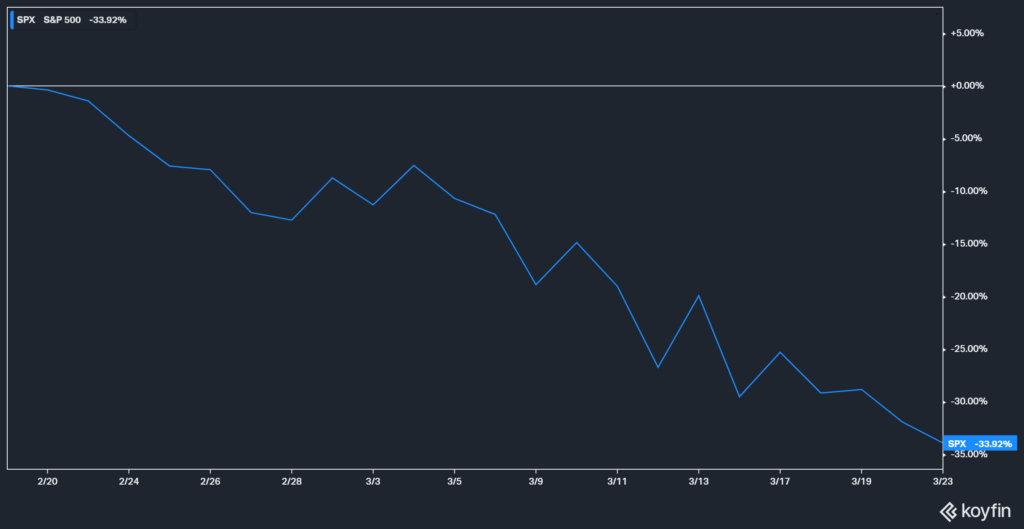

1. STOCKS OFTEN GO DOWN MUCH FASTER THAN THEY GO UP.

On February 19, 2020 the stock market began a 33.9% plunge in just over a month while recording the fastest 30% drop in history taking only 22 days.

Losing a third of its value in a month, the stock market is an unrelenting force not for the faint.

Remember that February 19, 2020 was an all-time market high. It did not include a warning sign after the market closed. Things were good.

As Warren Buffett has said, “Only when the tide goes out do you discover who’s been swimming naked.”

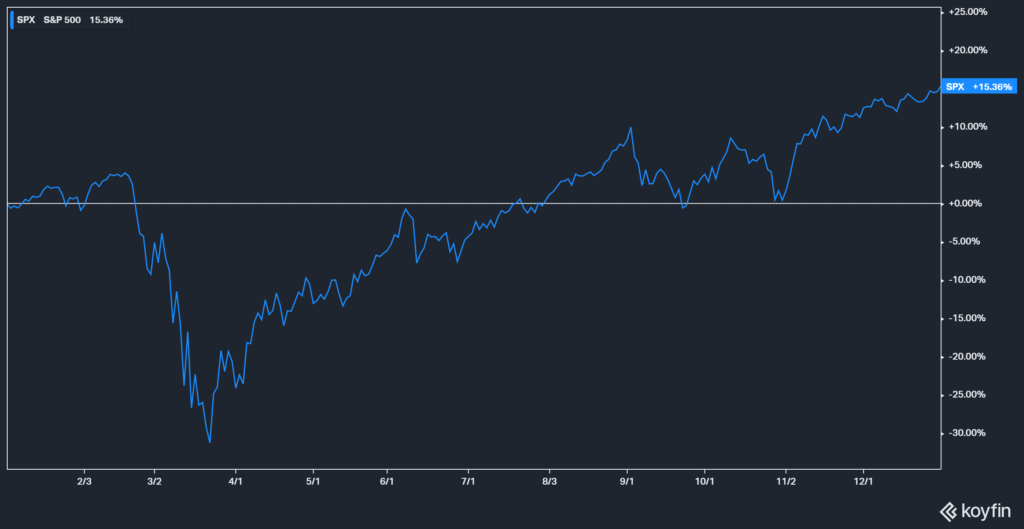

Many investors were not prepared. But thanks to a swift recovery (still 5 times as long for it to recover than fall), and if you did not sell, you can capitalize on this lesson to be prepared ahead of time.

Holding a predetermined amount in conservative assets, like bonds or cash, prepares for a downturn in stocks and provides two primary benefits:

- To help you sleep better at night.

- To provide for income needs, if any, so you do not need to sell stocks at a substantial discount.

2. STOCKS OFTEN BEGIN RECOVERY IN THE PIT OF BAD NEWS.

On March 23, 2020 stocks hit bottom. Not that it matters but hardly anyone (maybe there was someone somewhere) was saying stocks would start going up.

It really seemed like they would go down further because there was no good news – not on COVID or employment or people getting back to spending money in the economy. Everything was at a standstill.

But, in the pit of pessimism, the stock market started its recovery.

Those who sell near the bottom regret it. Stay invested because if you did not sell stocks, you did not lose. The history books will show a profitable stock market return for 2020, but that statistic does not show the journey.

When we look back at 2020 to determine how to be successful at investing, we’ll remember that stocks most often begin recovery in the pit of bad news.

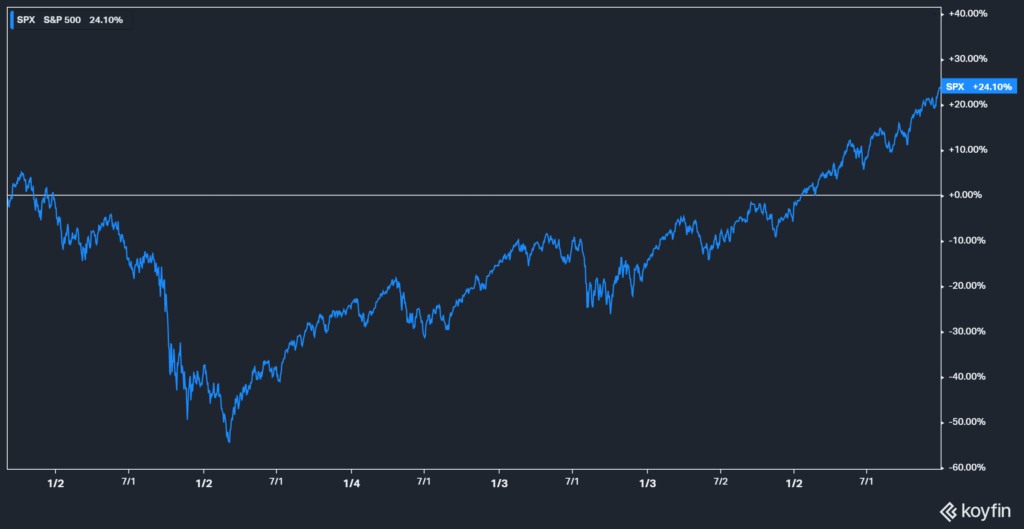

3. DON’T WAIT FOR AN “ALL CLEAR” SIGN.

After the 2008 Great Financial Crisis, stocks began recovery in March of 2009. Many did not believe in the recovery. The calls of a “double-dip recession” were everywhere.

After years into recovery, stocks were still beset by the “two steps forward, one step back” path constantly frustrating investors who were late to “get in” and still waiting for the second drop.

It took five years to get back to even. That was five years of news about currency failures, liquidity issues, municipality bankruptcies and all the looming consequences.

The “all clear” sign never came. It never comes.

There is always a looming threat of downturn because uncertainty is the price of admission to invest in the stock market. 2020 provided a faster relative recovery, and it was a heck of a run.

The problems were not solved, but the market persisted in recovery never providing an “all clear” sign.

4. REBALANCE.

Buy low, sell high. It’s the old adage that’s more easily said than done.

The truth is few investors have the courage to ratchet down risk when stocks are making money. Fewer have the courage to buy stocks when the news is horrible and stocks are on sale.

Instead, take the guesswork out of it. Rebalance (or simply reset to your predetermined plan) systematically.

Alex Okugawa and I discuss on this video why you should rebalance. In short, it helps optimize that ever-conflicting battle between risk and return.

I’ve talked to many people throughout the years who want zero risk but all the return of the stock market. It’s not going to happen just because you want it.

Neither is there a magic financial product that solves this – sorry index annuity pushers. But, if you are open to the truth that return requires risk, rebalancing can help you in the pursuit to minimize risk and maximize return.

Rebalancing helps because it resets your plan.

It generally sells stocks after they have increased, creating a surplus, and buys stocks after they have decreased creating a deficit to your plan.

Rebalancing is the antidote to market cycles. It’s not a perfect science, but consistency over time can help.

The volatility of the 2020 market served rebalancers well, whether that was reducing stock allocation (getting more defensive) while the market was high or increasing stock allocations (buying stock at discounts) when the market was low.

I wouldn’t be concerned with picking the perfect time to rebalance. Nobody has consistent, perfect timing.

Keep it simple and do it systematically – either by timetable (e.g., once per year on a set date, or when allocations drift by a predetermined percentage). Michael Kitces provides a deeper dive on rebalancing frequency in his blog.

LEARN FROM YOUR EXPERIENCE

What did you learn in 2020 for how to be successful at investing?

Take note from each experience to improve your strategy and discipline going forward.