The US government has more surprises for retirees on the horizon!

There are a slew of proposals in Secure Act 2.0 that could impact those in or close to retirement for years to come.

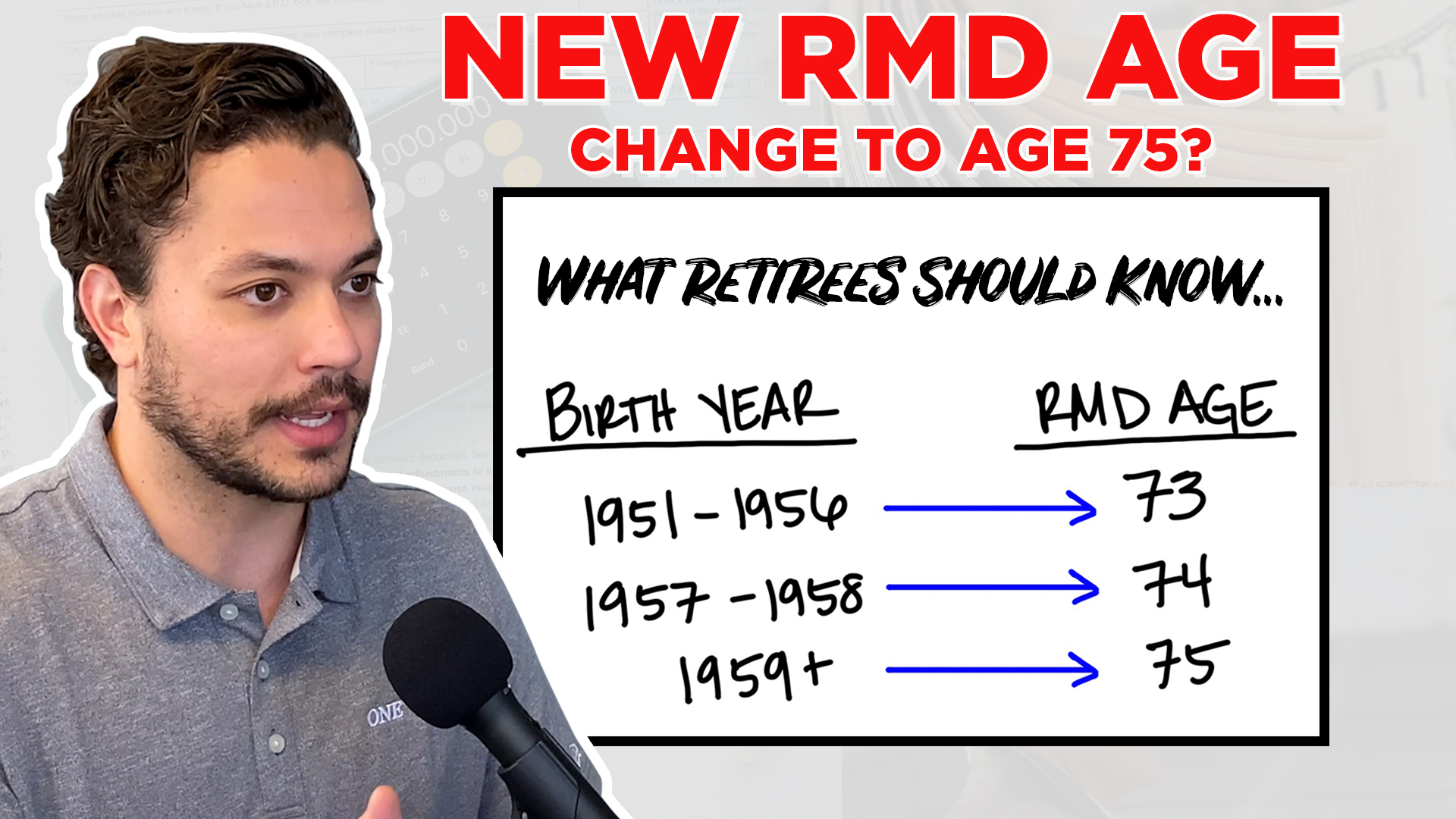

New RMD Change to Age 75??

A few highlights include: Pushing the Required Minimum Distribution (RMD) age for some folks to 75 and a new supercharged age bracket for retirement catch up contributions.

Show Notes:

- Summary of Secure Act 2.0 Bill

- What is a Qualified Charitable Distribution?

- Jamie Hopkins 2 minute video

Full transcript:

SPEAKERS

Anthony Saffer 0:00

Hi there, it’s Anthony and Alex. Today we’re discussing secure act 2.0, some of the biggest highlights that are affecting those in or near retirement. If you liked today’s content, please like and share.

All right, so the bill was recently passed in the House of Representatives by a wide bipartisan margin. This is important and is now being reviewed in the Senate when we’re talking about secure act 2.0.

Alex Okugawa 0:27

Now there are over 50 proposal retirement proposals in this bill. But really, what we’re going to focus on at least right now is the discussion of or at least the proposal of pushing back the required minimum distribution age to 75.

Anthony Saffer 0:43

Yeah, a real quick list. So let’s explain what an RMD is required minimum distribution, retirees, when they hit a certain age, need to pull out a certain amount from their retirement accounts, which becomes taxable income to them.

Alex Okugawa 0:54

Yeah, and a lot of folks might be wondering, like, didn’t we just have this change, which we did. So the RMD age, when the security act and 2020 were passed, got bumped up from 70 and a half, seven to 72. So there have been a lot of changes recently. And if this proposal goes through, again, we’re gonna be bumping up from 70 and a half to 72. Now all the way up to 75. For some folks. Now, the good news is that this won’t change anything for people that are already taking RMDs. So if you’re already taking an RMD, there is no change. But it will have an impact on people that haven’t started. So we’re going to put this up on the screen so everyone can see this. Really, what we’re looking at here is three groups of people. So in the first group, you have people that were born between 1951 and 1956, they will have their arms, the age pushed to 73. For those that were born between 1957 and 1958, we’ll have the RMD, age pushed to 74. And those that were born after 1959, will have their RMD, age pushed to 75. So again, what this is going to allow people to do is to continue to defer taking required minimum distributions from their account. Probably the only thing I like about this is that we don’t have to deal with half ages. I never liked that 70 and a half, right.

Anthony Saffer 2:15

So you know, and it’s interesting how they come up with these age bands. I don’t know that anyone will actually know. But it is important to get it right because there’s a big penalty for not taking the proper RMD.

Alex Okugawa 2:26

So we definitely want to avoid that big penalty to not take out enough. And you also don’t want to take out more than you need to Yeah, you don’t want to pay taxes on that if you don’t need to withdraw.

Anthony Saffer 2:33

All right. So the next thing is indexing qualified charitable distributions, the maximum amount, this is one of our favorite strategies, indexing it for inflation. Yeah, exactly.

Alex Okugawa 2:43

Now, again, sticking a step back, what is the qualified charitable distribution, often abbreviated as QCD. Essentially, what it allows you to do is give money directly from your IRA account to a qualified charity, and this is a great tool, it’s a great way to give tax efficiently. Now, under the current rule, folks can give up to $100,000 in a given year to any amount of charities of their choice. Now, what this will do under the proposal, if it’s passed in 2023, that $100,000 will start to be indexed for inflation.

Anthony Saffer 3:20

And the reason we liked this strategy quite a bit, we’ll post previous content that we have is because it’s very efficient from a tax standpoint, to give out of a retirement account, you got it. All right, so the next thing is increasing the ketchup contributions for employer retirement plans and IRAs.

Alex Okugawa 3:36

So in 2022, folks can give up to $6,000, or I’m sorry, not give contribute up to $6,000 into their IRA or Roth IRA. And then if their age 50 and above, they can contribute an additional $1,000. Now, what’s happened is right now that $1,000 Ketchup is not indexed for inflation, right? Our tax code is written in such a way that our tax brackets and those amounts will go up over time, increasing cost of living adjustments, etc. Right now, it’s not indexed for inflation. But if this bill is passed, starting in 2023, that $1,000 Ketchup will be indexed for inflation. The bigger piece I’d argue is that there’s going to be an increase in ketchup contributions for folks with retirement plans at work, specifically things like a 401k or 403b, or 457. And we’ll put this picture on the screen so people can follow along. Right now, folks, that are at least age 50 can contribute an additional $6,500 as a catch-up into their retirement plan like a 401k. Under this new proposal, it’s almost going to be like ketchup to the ketchup. So what folks can do is between ages 62 and 64 their ketchup contribution will be bumped up to $10,000 and this is a nice benefit for folks, you know, especially as you get closer to retirement, you want to boost up that savings right before you retire, this can be a nice benefit.

Anthony Saffer 5:06

And the way it’s written is that that will index with inflation, which means there are these automatic increases built into the bill.

Alex Okugawa 5:11

And I want to remind folks, I mean, this is just a proposal at this point, this still has to go through the Senate. But as it’s looking right now, it’s still good to know this information, maybe plan ahead and know what’s coming, so you don’t get surprised along the way.

Anthony Saffer 5:23

Yeah, so definitely stay tuned. Watch as it goes through if it gets passed, and we just covered three big highlights. Jamie Hopkins did a nice two-minute video on 10 highlights which we’ll also post and we found a lot of value in that as well. And now let us know what you think. How do you feel about the RMD age being pushed back to age 75? Leave your comments down below. And if you like this content, please like and subscribe for more. Thanks for watching.

Want tax, investment, and planning strategies like this right to your inbox? Subscribe below!

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures