The key to being a successful investor during a bear market isn’t intelligence, it’s temperament.

It doesn’t require a Ph.D., an MBA, intellectual brilliance, or infinite talent, but rather the temperament and discipline to stick with your plan when others are running for the exits.

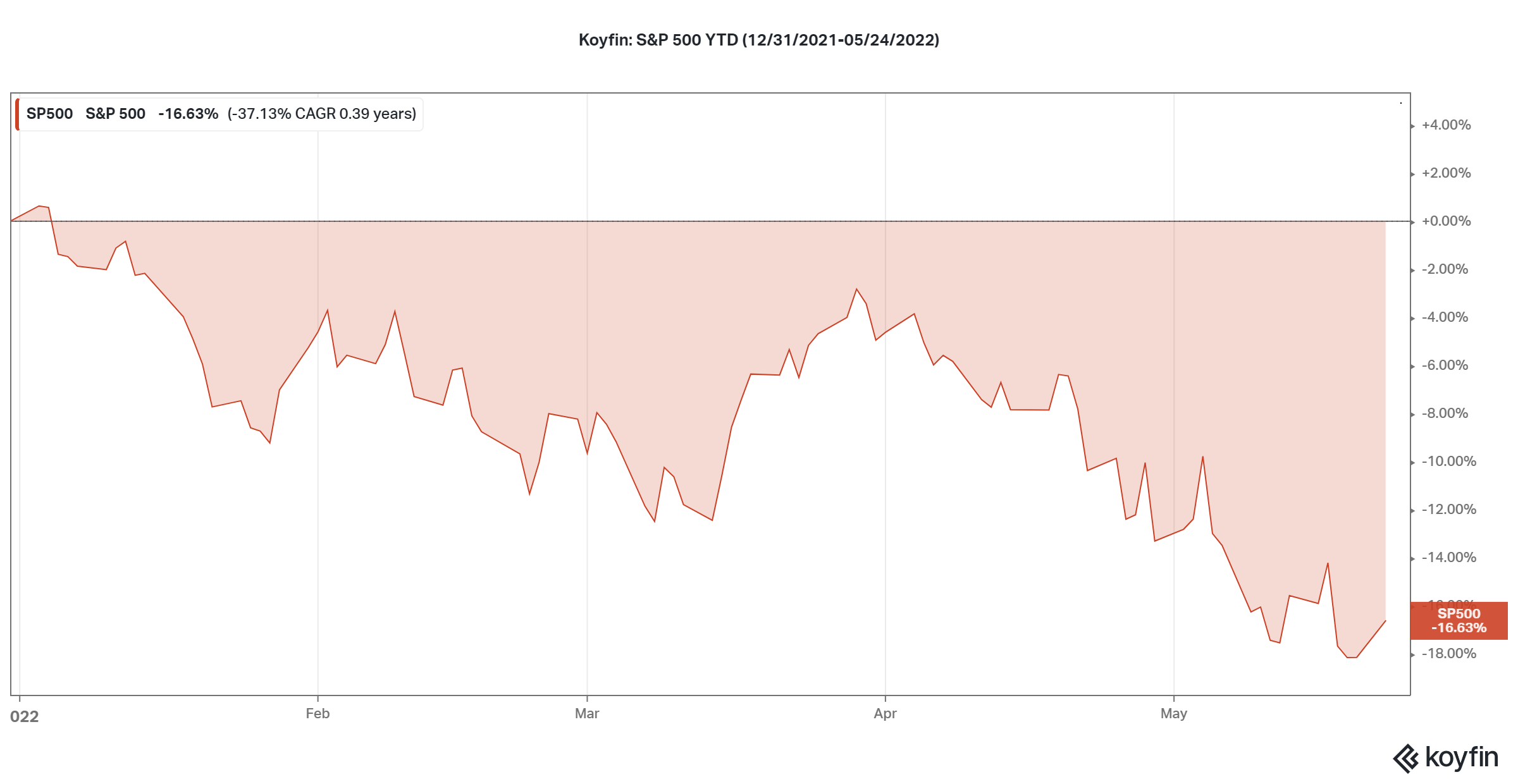

Unfortunately, the average investor tends to lose their cool during bear markets & cannot handle periods of poor stock returns.

Over the years I’ve learned small (but powerful) investing rules that you can use in any market, no matter how ugly, to build wealth for the long term.

Successful Investing Requires Rules, Procedures, and an Unwavering Philosophy

So here are 10 rules you can bookmark for every ugly market:

- Market selloffs are usually bad news for the average investor, but not the case for disciplined investors.

- All past declines look like opportunities and future declines look like risks.

- Diversification is usually the best answer to an unpredictable future. If everything is up in your portfolio, you’re not really diversified.

- There is no one size fits all inflation hedge. Not gold, stocks, crypto, or cash. Different inflation hedges work in different inflationary regimes.

- Focus on what you can control: Savings rate, cash reserves, and asset allocation.

- Too much debt will eventually come back to bite you.

- Stop trying to time the bottom.

- Force yourself into good decisions: Dollar Cost Averaging.

- You’re not a genius on the way up or an idiot on the way down.

- Doing nothing, is doing something.

Bottom Line

The important thing to remember is that investing when emotions run high requires the ability to force yourself into good decisions. Having a core philosophy for your investment decisions can help remove the emotional and often impulsive reactions we as humans are capable of making during a bear market.

At One Degree we have a playbook we stick with, under all market regimes. Check it out here.