The stock market is down so far in 2022, and the last thing people want is to pay taxes on their losing investments.

Today we are going to discuss how you can avoid capital gain distributions from mutual funds, and alternatives to be more tax efficient in the future.

Avoid Capital Gain Distributions 2022

Full transcript:

SPEAKERS

Anthony Saffer 0:00

The stock market is down and 2022. And the last thing people want is to pay taxes on their losing investments. Today we’re going to talk about how to avoid mutual fund capital gain distributions and be more tax efficient in the future. Stay tuned. Hey there, it’s Anthony and Alex from One Degree advisors. And if you’re new here, we’re certified financial planners that help folks with all things retirement tax and investments. So Alex here with the stock market down and 2022, many people are going to be surprised that they are still paying taxes on their losing investments. Now, this may not apply to retirement accounts like IRAs, and 401ks.

Alex Okugawa 0:42

It’s important to remember that mutual funds typically hold hundreds if not 1000s, of investments inside of that mutual fund. And when those investments inside of the mutual fund are sold, if they’re at a gain, right, the position has grown, that can create a taxable event. Conversely, if you sell a position at a loss, right, you bought it here and it goes down to here, that can create a loss. And sometimes those gains and losses can offset each other. But what typically happens is there are more gains and losses. And those gains must be biology distributed out to the individual shareholders. Now, it’s important to remember that distributions usually occur at the end of the year, typically in mid-November through the end of the year.

Anthony Saffer 1:28

Yeah, and especially for growth types of investments like stock funds. So where can people find out if their specific fund is distributing capital?

Alex Okugawa 1:36

That’s right, if you hold mutual funds, especially in brokerage accounts, people can go directly to the fund company’s website. So you can really go to Google search, you know, your fund company, capital gain distributions for 2022. And the company on their website should list out the expected date of the distribution, along with the amount. And so at the time of this recording, which is in the second week of November, we’ve already begun this process for our clients beginning to look at the mutual funds that they hold in brokerage accounts, what is expected to be distributed, and what action may we want to take,

Anthony Saffer 2:11

yet most people don’t realize that they do have a little bit of control as far as if they plan properly. Now, not all of you don’t always have a ton of flexibility. But how can folks avoid these capital gain distributions?

Alex Okugawa 2:25

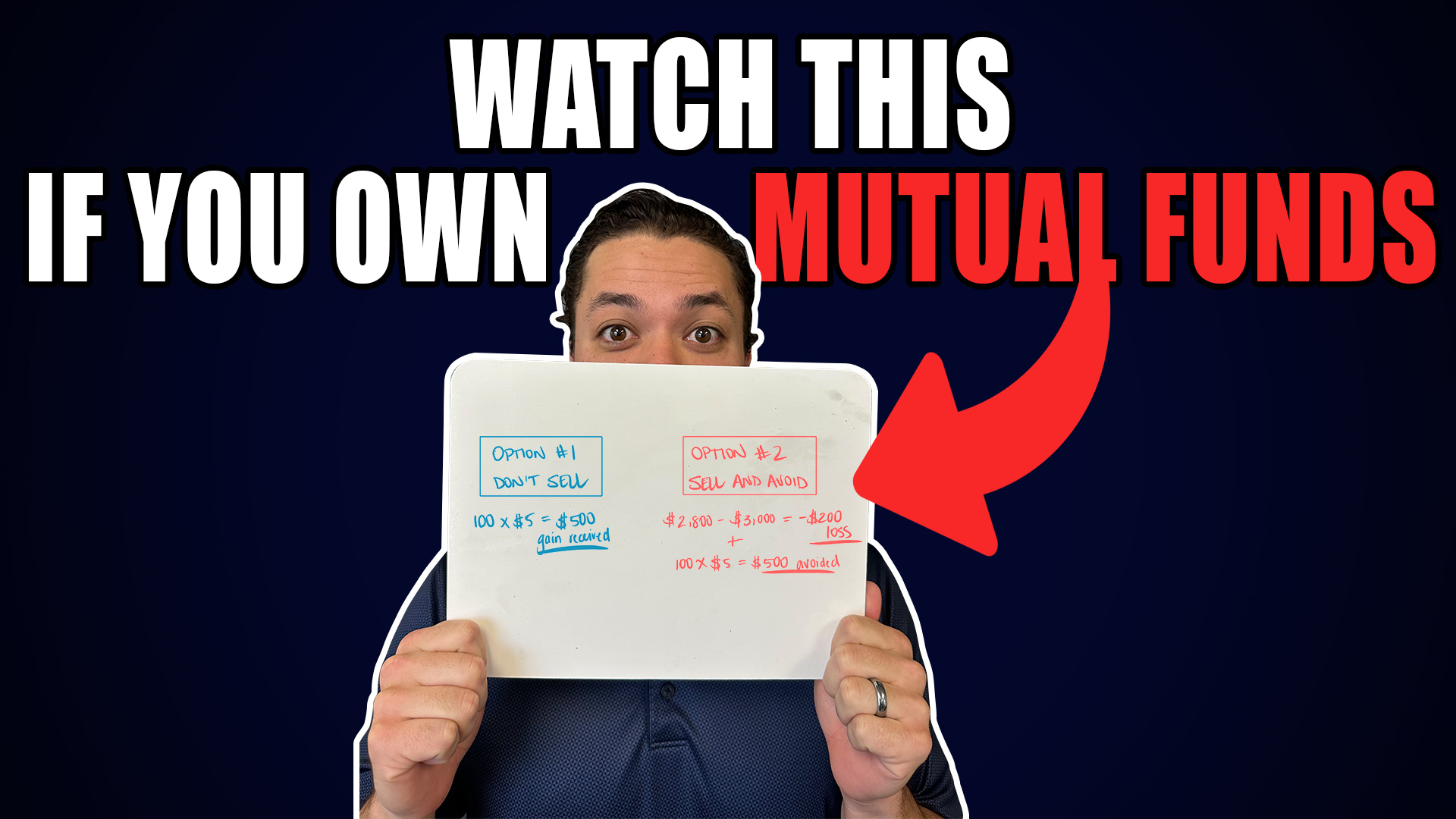

Yeah, so let’s take a look at an example if you should basically continue to hold your mutual fund and receive that distribution, or what you may look to do is sell your mutual fund before that distribution date to avoid the distribution. And again, many, many positions are in the last year in 2022. So this example can apply to a lot of people. So let’s say you bought 100 shares of ABC for $30. And so that’s a total of $3,000. But now the shares are worth $28. So that’s a total of $2,800. And, you find out that ABC is expected to pay a capital gain of $5 a share. So this is going to be a pretty big distribution. Your first option is you just hold the investment you don’t sell now what will happen on the distribution date, you’re gonna get $500 of taxable capital gains sent out to you an option to what you can do is you can look to strategically say, you know, I’m going to sell this fund before the distribution date. And what that does is it allows you to capture a capital loss, and then it helps you avoid that $500 distribution from the mutual fund. Now, again, this is a simple example. But I think it paints a powerful picture where again as you said, you can be in the driver’s seat, and sometimes you can control these things to avoid taxes.

Anthony Saffer 3:45

Yeah, so if viewers want to be more tax efficient for the future, ETFs can provide a good solution for this. Absolutely. You

Alex Okugawa 3:51

want to analyze your funds each year. And if you’re able to consider using ETFs, especially your taxable brokerage accounts, they can usually avoid this problem. Just by the way an ETF structure works is pretty complicated. We’ll put this illustration on screen so people can follow along. But by and large, an investor doesn’t care. They want to say how can I get the most tax-efficient investment inside my brokerage account.

Anthony Saffer 4:16

Yeah, a little bit of planning can go a long way. Absolutely. Once again, this is Anthony Saffer from One Degree Advisors. What are you doing to limit your tax liability as we close out 2022? Leave your thoughts in the comments down below. And if you’re interested in learning how we help clients with year-end tax plans, visit us at one degree advisors.com

Transcribed by https://otter.ai

The One Degree Blog

Not signed up yet? Get weekly financial insights right to your inbox.

Subscribers also gain access to our private monthly client memo.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures