Resources:

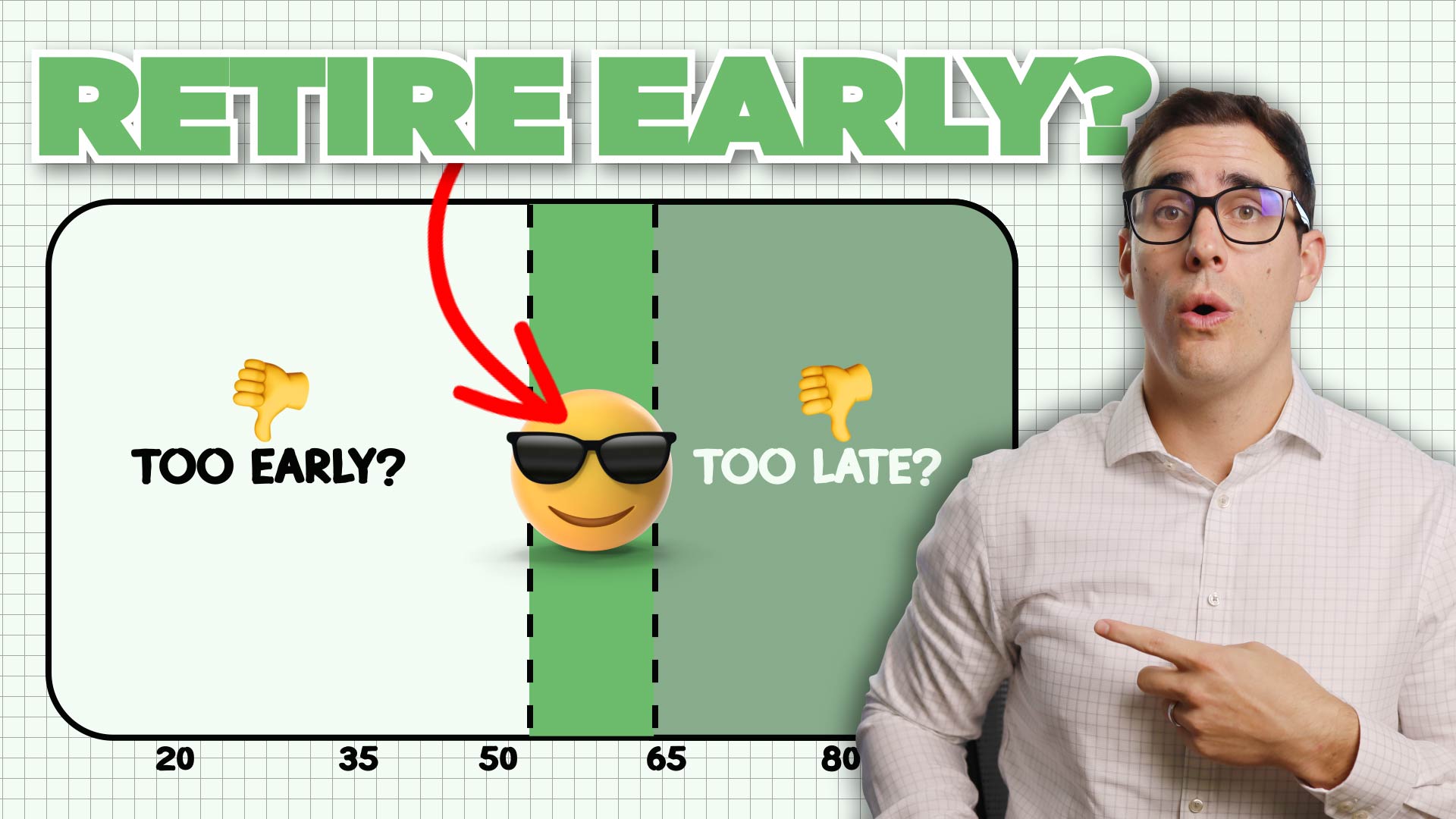

Are you dreaming of an early retirement but not sure where to start?

In this simple Early Retirement Planning Guide, we’ll break down the simple fundamentals to help you work towards early retirement.

The Fundamental Principles of Early Retirement Planning

To retire early, you must either have substantial savings or little need for substantial savings. Ideally, a combination of both is the key. In this Early Retirement Planning Guide, we’ll explore the simple math behind early retirement and set the foundation for your planning.

Five Essential Planning Elements for Your Early Retirement

Before diving into the nitty-gritty of early retirement, we’ll discuss five crucial aspects to plan for in this Early Retirement Planning Guide:

- Managing Lifestyle Creep: Learn to combat the tendency to spend more as your income grows. I provide a practical expense spreadsheet in this Early Retirement Planning Guide to help you track and control your spending.

- Prioritizing Your Goals: Discover the importance of setting clear priorities for your post-retirement life, focusing on financial flexibility rather than complete cessation of work.

- Keeping Options Open: Explore the significance of developing marketable skills that make you highly employable, giving you the flexibility to pursue different forms of work during retirement.

- Planning for Longevity: Understand the impact of increasing life expectancy on early retirement and develop a strategy to ensure your investments last throughout your retirement years.

The Boring, Yet Crucial Considerations in Early Retirement Planning

Now, let’s delve into the less glamorous but vital aspects of early retirement planning in this Early Retirement Planning Guide:

- Income Strategy: Establish an income plan that considers early withdrawal penalties and delayed Social Security benefits, ensuring a smooth financial transition into retirement.

- Healthcare Costs: Plan for healthcare expenses, especially if you retire before Medicare kicks in. I provide a link in this Early Retirement Planning Guide to help estimate pre-Medicare healthcare costs.

- Debt-Free Living: Prioritize paying off debts like student loans, mortgages, and credit cards to maximize financial flexibility during retirement.

Conclusion:

Achieving early retirement requires careful planning and a realistic approach. By addressing these fundamental principles and considerations in this Early Retirement Planning Guide, you’ll be better equipped to embark on your journey toward work optional living. Remember, it’s not just about the destination but the fulfillment and happiness that come with the journey.

The Retirement Recap

Join the 964+ other retirees and get weekly articles and videos to help you retire with confidence.

Subscribers also gain access to our private monthly client memo.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures