4 Things I’ve learned after 20 years as a financial advisor

4 Things I’ve learned after 20 years as a financial advisor

In 1999 at age 22 (looking perhaps 16 on a good day) and straight out of college with two internships under my belt, I started as a financial advisor.

For investors, it was a euphoric time with technology stocks skyrocketing. I remember people in the industry with far more experience than me getting caught up in that euphoria. It didn’t seem right to me, and I kept clients more diversified. And faster than the market climbed, it fell.

It was hard building a business on my own. I didn’t have good mentors until years later but I never thought about a fallback plan knowing I was called to this career. That kept me going. Even in the midst of financial turmoil, clients stayed with me and took my advice. I remained focused on serving them the best I knew how. Those families became the foundation of my work and most significantly, it has been a tremendous blessing for me to go through life with them.

I remember always thinking it would be so great to have 20 years of experience in this business, mainly for credibility’s sake. I realized recently that the desired 20-year mark had been met. The church bells didn’t chime. There was no press conference or even a press release. A financial advisor hitting a 20-year milestone is not newsworthy. That said, it provides me an opportunity to reflect on a few things that I have learned over the last two decades.

These are some of the standouts that come to mind.

1. Always do the right thing for clients. In whatever industry, trying to do what is right for those you serve is a worthy and controllable goal. Everyone wins when you strive to do the right thing. The same standard should (and I believe does) apply over the long-term to other industries. I go to the same auto mechanic because I know he’s good at what he does and is a stand-up guy. It is simple criteria. Success will follow.

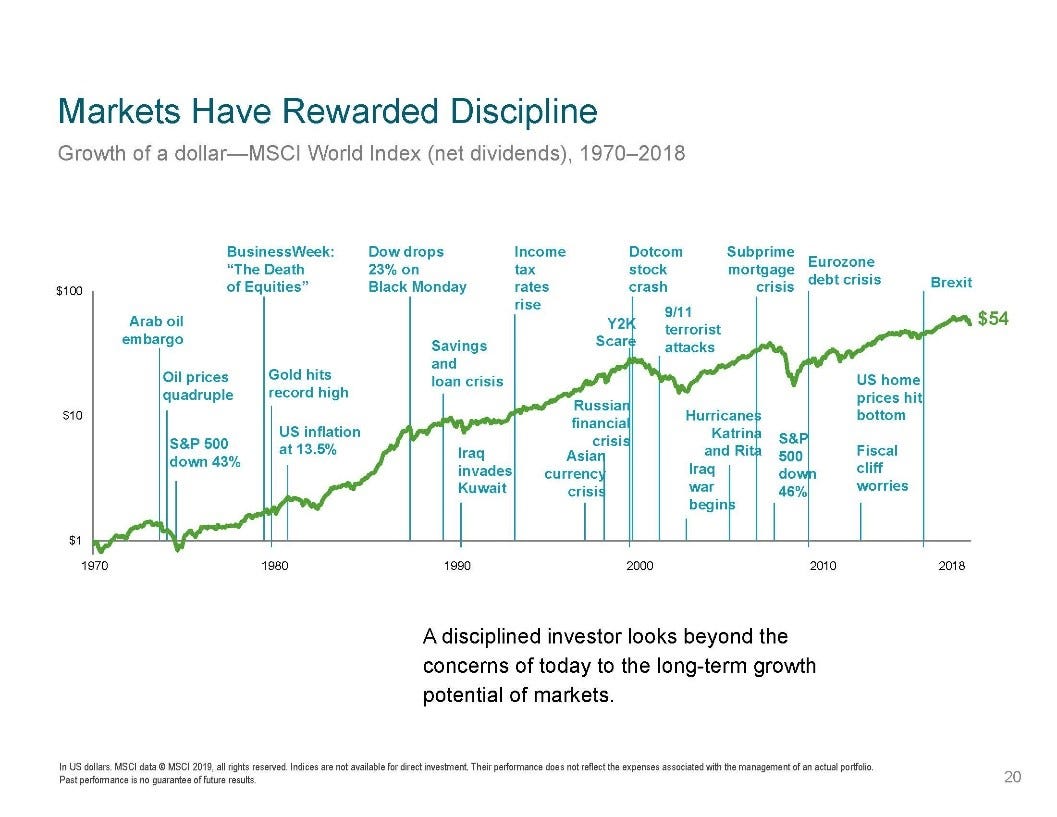

2. Don’t wait for “certainty.” Times are always uncertain. The news is the worst indicator for financial decision-making. The chart below from Dimensional Fund Advisors is common, but helpful to illustrate the importance of having discipline through potentially emotional news.

For example, in 2007 people felt wealthy from real estate and stock values and then suddenly the stock market crashed in 2008. More recently in 2017, we were supposedly on the brink of war with North Korea and the stock market had one of, if not the greatest combinations of growth without downside fluctuation in market history. Is it worth trying to guess? If you are waiting for certainty from the news, it’s likely you will never find that ‘perfect’ moment. Instead, follow principles that have always worked. That theme has been the bedrock of my writing for the last fifteen years — follow sound principles to help you succeed over the long-term.

3. You don’t know what you don’t know. Jesus said, “For everyone who exalts himself will be humbled, and he who humbles himself will be exalted.” Over the last 20 years, I know I’ve grown wiser, but part of that wisdom is the understanding that I can’t know everything. Sticking to principles that work is the best I can offer. If a prospective client is looking for me to prognosticate the investment markets, they’ll be quite disappointed. That relationship would not be a good fit. I believe that aligning your financial plan with your investment plan is foundational. In 2008, guiding clients with their financial plans in the midst of terrible news and declining account values provided perspective and context. If we needed to adjust something, we did. But more importantly, this foundation prevented so many families from making the wrong decisions during an emotional time.

4. Surround yourself with good people. During the first part of my career working for a national firm, there was zero local leadership. It was chaos in an office suite. They finally brought in someone who was knowledgeable and could lead and my career advanced. We all have strengths and weaknesses and need others to fill in the gaps. Few accomplish lasting success alone. This translates to every area of life. As for me, I don’t try to be a superhero and “go it alone.” I focus on surrounding myself with people who are going to make me better. And as much as possible, we need those people with whom we work closely to have rock solid characters. I’m thankful for those people in my past who have provided this for me and those presently in my life. We need good people around us!

These points are simply a few takeaways from my 20 years in the financial industry. I’m more convinced than ever about the importance and need for sound financial planning. I am more optimistic about the direction of our industry and the many advisors who are looking to serve people well. And, I’m energized by my role here at One Degree Advisors and our amazing staff. Thanks to you all for your part!

Anthony Saffer

Principled Prosperity is focused on equipping those who choose to ignore the noise. The world of finances can be complex, but basic truths have persevered over time, across cultures, and in spite of changing circumstances. Anthony Saffer writes on his experiences in personally working with families to coordinate principled financial and investment solutions.