Updated to reflect new figures and limitations in 2020

Many investors face the dilemma of investing in their company 401k or seeking outside options like an IRA or Roth IRA. This dilemma is exacerbated by the current investment industry climate. Companies like Vanguard offer investments with internal expenses close to zero and major custodians like Schwab and TD Ameritrade now offer trading on stocks and ETFs at no expense. On the other hand, retirement plans through work, such as a 401(k), often have higher expenses and limited investment selections. So, you may be wondering if you should contribute to an IRA or 401(k) in the same year. What seems like a simple question can quickly become complex with limitations and phaseout rules. Here are three important considerations when determining if you should invest outside of your retirement plan at work.

See Tips for the Young Investor’s 401(k)

401(k) Matching Contributions

If your employer matches your contributions into your 401(k), this is almost a no-brainer. You need a very good reason not to contribute enough when you can get free money from your employer. A match works exactly like it sounds. If you defer 3% of your salary, your employer may match your deferral up to 3% of your salary. Ensure you invest to receive the match if the benefit is offered.

IRA and 401(k) Contribution Limits

After taking care of any matching contributions, the second item to consider is contribution limits.

The lower contribution limit for an IRA or Roth IRA is typically an issue for many people who need to save more on an annual basis for retirement. But, investing in your 401(k) or an IRA/Roth is not an all or nothing decision. You can invest in both but doing so requires careful navigation of rules and limitations

IRA Contribution Income Limitations

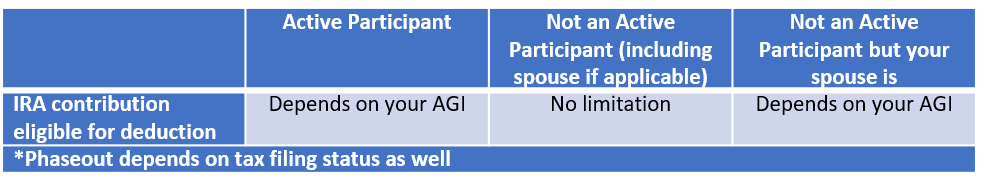

When saving outside your 401(k) into an IRA, certain rules must be followed if you are considered an ‘active participant.’ It’s important to note that you are considered an active participant if you or your employer puts money into a retirement plan for your benefit.

As an example, let’s say you have an open retirement plan at work, but you do not contribute for the calendar year. In December, your company makes a small profit-sharing contribution to your account. You will be considered an active participant for that calendar year. You will then fall under a different set of rules.

For 2020, if you are considered an active participant, the amount of your IRA contribution eligible for deduction can be reduced or completely eliminated based upon your modified adjusted gross income (MAGI). To make matters even more complex, different limits apply if one spouse is considered an active participant and the other is not! It’s important to note if you contribute to an IRA within or above the phaseout limits to be sure to file Form 8606 to keep track of your non-deductible IRA contributions.

Thankfully, Roth IRAs are more straightforward. Contributions are made on an after-tax basis which eliminates the need to assess active participant status. However, there are phaseouts which can reduce or eliminate your ability to make contributions.

Conclusion

What starts as a simple question, “Should I invest outside of my 401(k) plan?” can turn into a complex myriad of choices. A lack of understanding of the rules can have adverse consequences and penalties. While 401(k) plans through work often have higher expenses and limitations, they offer simplicity for the employee. If you choose to invest in an IRA or Roth IRA while working, it’s important to see a qualified financial planner and tax professional to ensure accuracy and compliance.

Go tell others what you think.