How to Invest During COVID: Should I Be Optimistic? What do I need to do not just in the long term, but during times of uncertainty? This week Anthony Saffer, CFP®,CKA® and Alex Okugawa, CFP®, CEPA®, CKA® share a few timeless lessons on investment success.

Watch here:

Full Transcript:

How to invest during coronavirus

Alex: So Anthony, let’s face it. You know, there’s a lot of bad news out there. There’s some good news sprinkled in but then it just, you know, it turns out it will be swallowed up by bad news sooner or later. And I think what people really want to know more than anything is what do I need to do to be successful, not just long-term, but during times of heightened uncertainty?

Anthony: I bring up this quote by Morgan Housel in the Psychology of money Timeless lessons on wealth greed and happiness. He says,

“It’s easier to create a narrative around pessimism because the the story pieces tend to be fresher and more recent. Optimistic narratives require looking at long stretch of history and developments which people tend to forget and take more effort to piece together.”

Alex: Absolutely. I think that’s the scary part, right, you know, just knowing that fear will sell that’s the thing that sticks in our mind at the most we can have good news, but we tend to focus and gravitate towards the bad news. So knowing that, you know, it’s good to have a plan and continuing to be planning going forward right.

Anthony: So how do you operate the this is one just write down your priorities write down your values. What are important to you? That way you have Direction that’s step number one and then you can start creating a financial plan really those strategies to help grow and protect your wealth so that you can work towards those those purposes and as that is is in motion then the behavior becomes really important because it’s very easy to get thrown off no matter how good your strategies are because not only are we on uncertain times now, but those bad circumstances those uncertainties. They’re always going to appear.

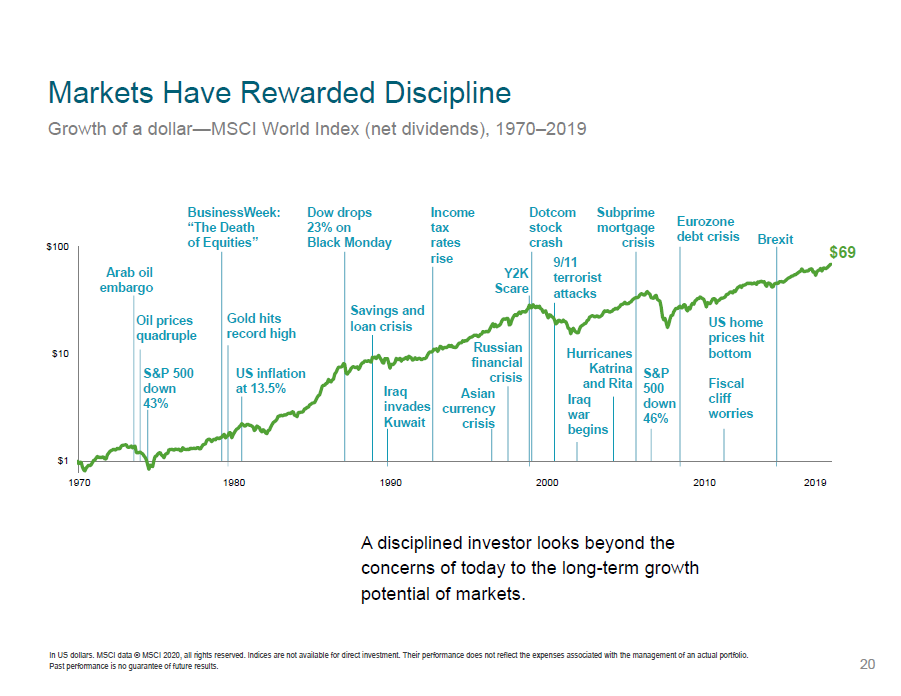

Alex: Yeah, and I think what’s really cool is if you look at a chart, right and we’ll put it up right now is if you look at a chart of Market history and look at all the different Market Cycles through you know numerous decades. There’s a lot of scary things showing up on this chart right a lot of things that make people very nervous and that worry and that fear was certainly warranted but I think the overall theme here is that look long term we can be optimistic as long as we’re grounded in sound principles guiding principles taking us forward. We do have reason to be optimistic over the long term.

Anthony: Exactly. And that’s the process that we help people with is to establish their priorities build strategies off of that and then most importantly walk them through the circumstances that they’re going to face so that they can achieve those goals.

Alex: Absolutely. Well again if you would like to talk With us, maybe take a look at your investment plan. See how you’re setting yourself up even helping you address the questions going forward.

Am I set up for Success? Do I need to be doing anything different? Am I paying too much in taxes? Is my portfolio aligned with my values and my goals going forward? These are the things that we help folks with.

Give us a call visit our website. We’d love to talk with you.

Let’s get to know you better. Schedule a complimentary call with an advisor here

More Reading: Health Risks: Do I Need Long-term Care Insurance?