If you do not already know, a lot of people made tons of money investing in speculative stocks during the GameStop mania.

Perhaps you too want to have fun testing your investment wit and instincts. You want to find the next GameStop.

Here I am going to breakdown why investing in individual, speculative stocks is perfectly fine with thoughtful guidelines in place.

What Happened With GameStop?

The full story of what happened with GameStop is quite lengthy. In short, a group of investors on a Reddit forum discovered GameStop had a large short position. They theorized if enough people bought GameStop it would push the price upwards.

This would accomplish two things: Cause investors betting against the stock to lose money, and investors buying the stock to make money.

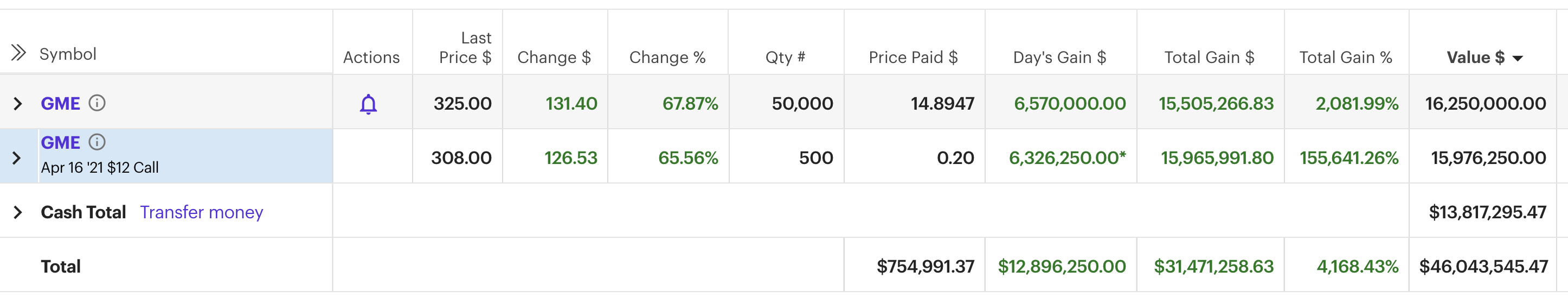

As we have discovered, the theory worked and the stock price rocketed upwards. On January 4, GameStop closed at $17.25 a share. On January 27, the stock closed at $347.51 share. Some people became millionaires in a very short period of time.

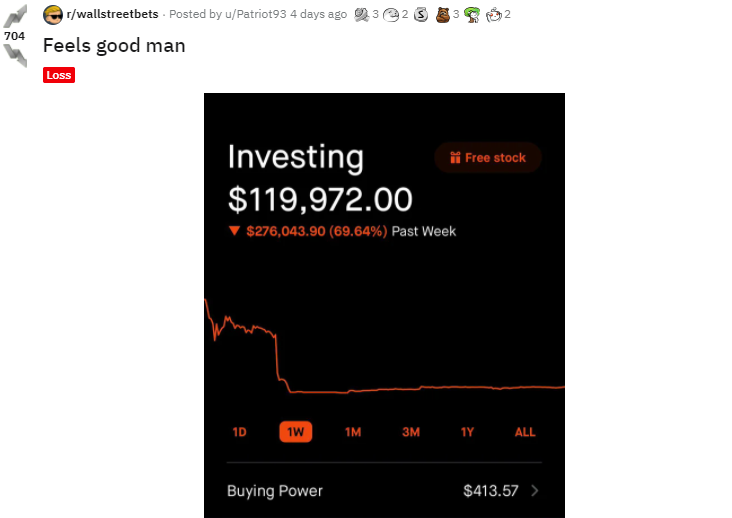

As people began to make money, others joined the action and piled into the buying frenzy. Kudos to the people who caught the wave and made their money. After all, sometimes it is better to be lucky than good. But there were others that lost a lot of money.

What Happened to Everyone Else?

It is important to remember, for every buyer there is a seller on the other end of that trade.

There were some people that timed the GameStop rally and got out before it was too late. There are many people, however, that have lost thousands of dollars. GameStop is down nearly 85% from its peak.

There are a lot of people who bought at or near the top. Unfortunately, they believed everything they read off Reddit or heard on TikTok.

They are not “dumb” investors. They have been mislead. Unfortunately, this might be their last experience with investing for a long time.

That is a huge opportunity cost.

Creating Your Investment Foundation

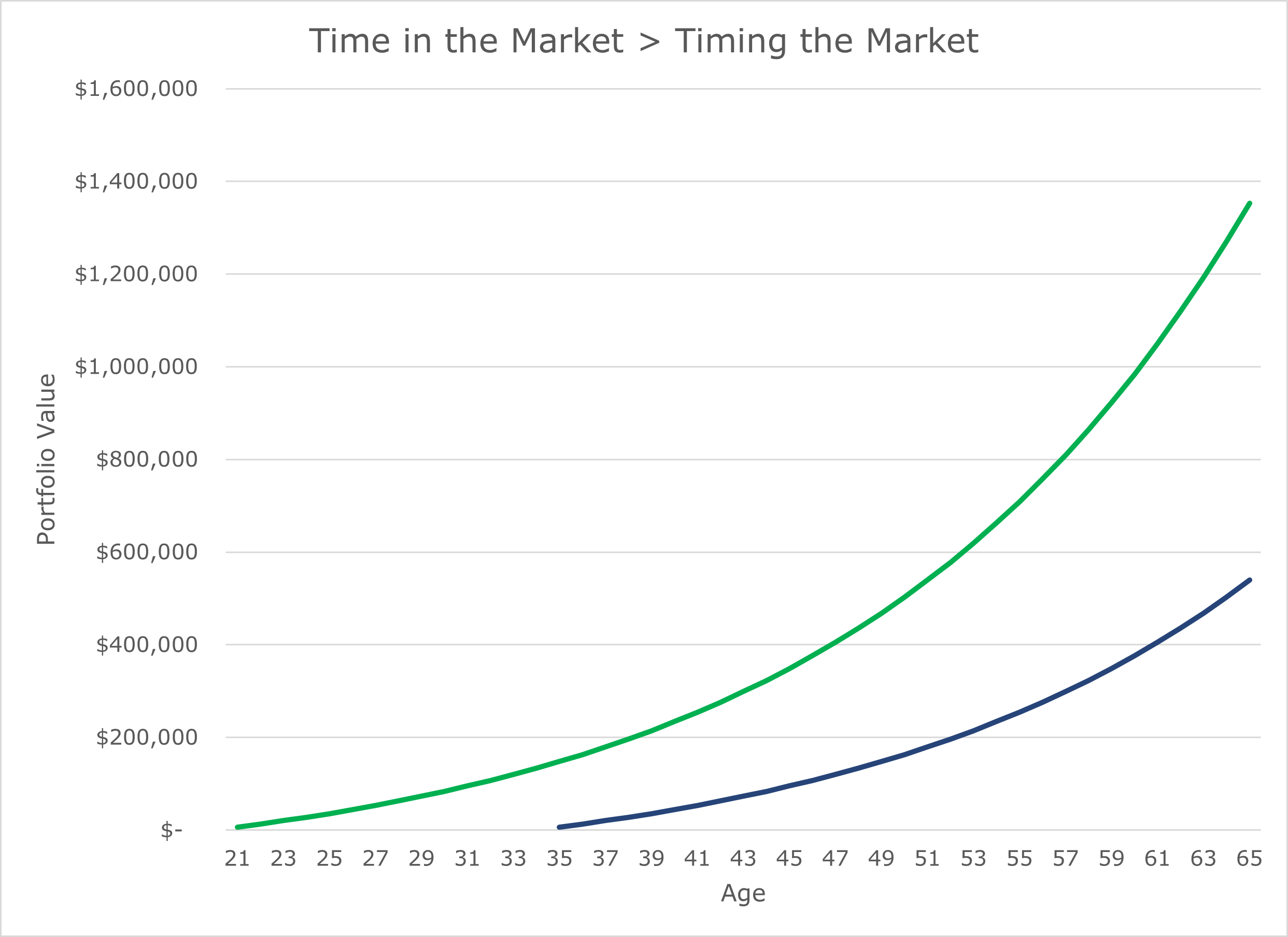

Investing early and investing often is the key to long-term success. You do not need to hit homeruns to build substantial wealth.

In baseball there is a saying “Get’em On, Get’em Over, Get’em In”. It refers to simply getting on base, moving the runner to the next base with a bunt or steal, and advancing them to home plate with a base hit.

No home runs needed. Just a simple, repeatable plan.

Let’s assume you start investing $6,000 a year when you start working at age 21. Assuming a modest 6% annual growth rate, that would turn into nearly $1.35M by the time your 65. Alternatively, if you wait until you are age 35, your balance only grows to about $540,000.

You do not need to time the market. You need to spend time in the market. Achieving broad stock and bond market exposure is easier than ever through the use of low cost ETFs and Mutual Funds.

How to Invest in Speculative Stocks

After you create an investment foundation, it is perfectly fine to invest in some speculative, risky stocks.

Before you do, consider establishing rules and guidelines. Earmark a specific amount you want to invest.

This should be money you can afford to lose. If it vanished overnight, it would not harm your financial security or long-term plan.

As a general rule of thumb, the size of this account should be no more than 5% of your investments.

John has a 401(k) at work worth $500,000, an IRA worth $180,000, and a taxable brokerage account worth $60,000. In total, his liquid investment portfolio is worth $740,000.

Using the 5% rule, this would mean John should consider investing no more than $37,000 into the stocks he thinks will hit it big.

Importantly, John also determined that if this $37,000 were to be lost, it would not put his long-term financial plan in jeopardy. If it did, he should lower the amount.

Some people call this their ‘play account’ or ‘fun account.’ It does not matter what you call it, as long as it remains separate from your investment foundation.

Read: Investment Strategy Basics: How to think about portfolio construction

Should You Invest in Speculative Stocks?

It is perfectly fine to have fun investing in your favorite names and trying to time a few perfect trades. Just make sure it is kept in check and you have a system in place.

Opening a play account is not necessary to achieve investment success. But if it keeps your investment foundation intact, it is better to lose all of your 5% play account than raid your investment foundation.

Unfortunately, as long as the market continues to trend upwards it may take a major market correction for people to realize they should not gamble with foundational money.

We may have had a correction in March 2020, but it recovered swiftly. A quick cut is painful, but with quickly applied stitches the healing process begins rapidly. It is painful, but manageable.

Corrections like 2008 and the early 2000’s were long, drawn out periods. A cut that is left open is excruciating. And the longer you see the open wound, the more desperate you become.

“Only when the tide goes out do you discover who’s been swimming naked.” – Warren Buffett