Retirement age 55

How much has the average 55-year-old saved and are you on track?

Retirement age 55 – Average Savings

Let’s face it, most financial professionals want to talk about fancy Sharpe ratios, standard deviations, drawdowns…

In our experience most people want two simple questions answered:

(1) Am I okay?

(2) Am I going to run out of money?

Here we break down one simple exercise every retiree should go through.

Oops! We could not locate your form.

Show Notes:

Full transcript:

SPEAKERS

Full Transcript:

Anthony Saffer 0:00

Are you behind in building your retirement nest egg? Today we’re discussing how much you should have saved for retirement. Stay tuned.

Hey there, it’s Anthony and Alex here from One Degree Advisors. We want to help you retire successfully. All right, Alex. So a lot of folks, just want to make sure they’re on track for retirement. Am I saving enough? I mean, we could talk about optimal asset allocation, drawdowns, Sharpe ratios, all these great things, but people want to know, am I saving enough? Am I on track? Am I going to run out of money?

Alex Okugawa 0:32

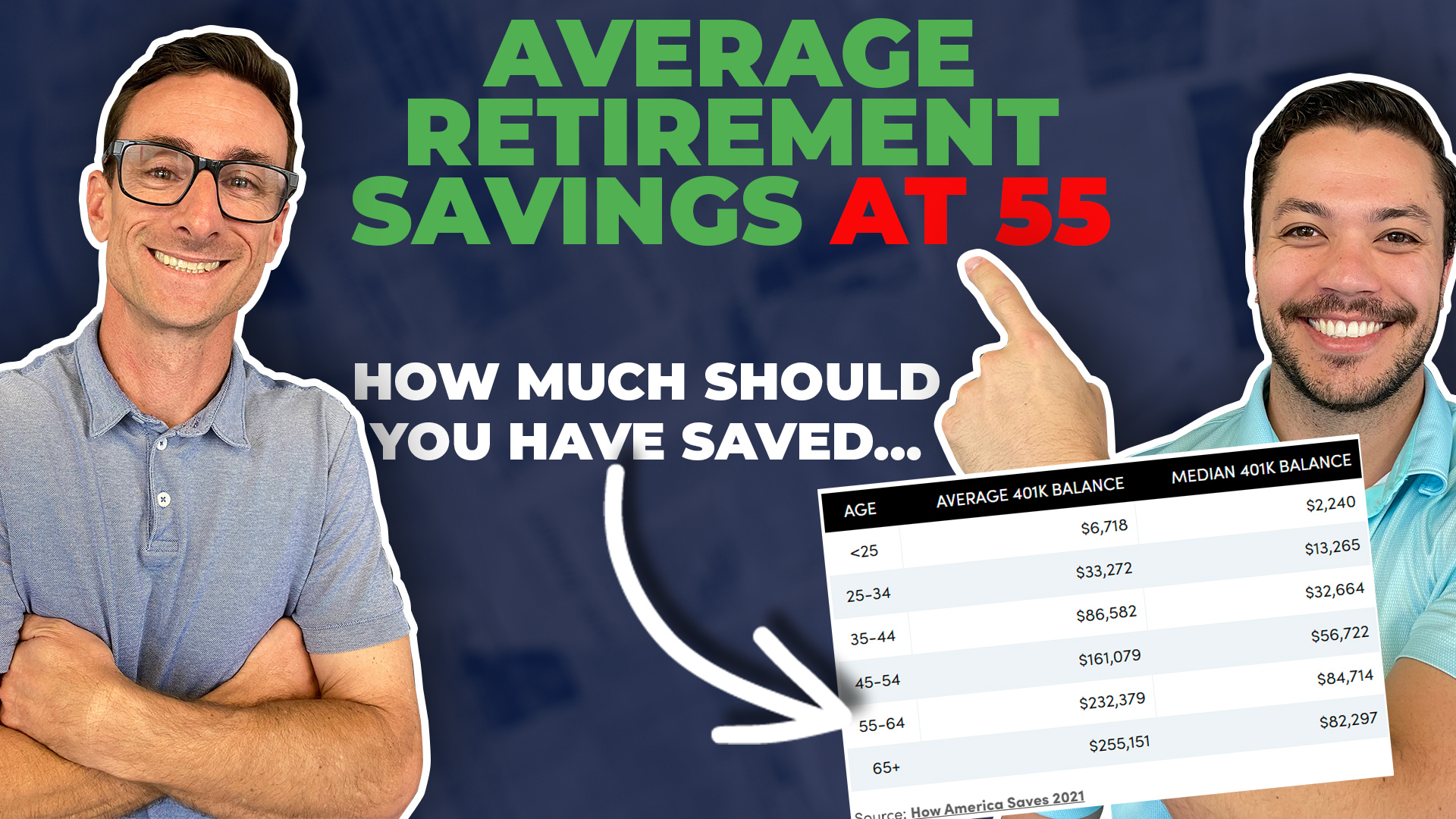

That’s what’s really important. And those are the million-dollar questions. So Personal Capital summarized the findings from the Vanguard report “Jow America saves 2021.”. So we’ll put this on the screen so people can follow along. In today’s video, we’re talking about folks that are in that retirement age 55 to maybe 60 range, and you’ll see that the average 401k balance for that age group is about $232,000. Of course, if you get a little bit older age 65. And up, that balance goes up to about $255,000. So Anthony here’s my question. Does that seem like a lot to you? Does that seem right?

Anthony Saffer 1:12

Yeah, those averages definitely are pulled up by people that take retirement savings seriously. And the numbers really are probably low than what people really need. And to know, if you’re on track, you really need to know three numbers. One is your expenses. Number two is other sources of income, such as Social Security, do you have a pension? Do you have rental income coming in? And then third would be the number of investments that can help create income to make up that gap?

Alex Okugawa 1:38

Exactly. So what we’re going to do here is we’re going to put up an example on the screen. There are a lot of numbers here, don’t worry, I’m going to walk us through everything. But as Anthony said, the first thing we have to do is figure out our expenses, right? This is probably the most important part of a financial plan is getting down, what are you spending? What are your expenses? And so you’ll see, you’ll see here, I put need in the bank $7,000. So in this example, this person needs $7,000 in their bank every single month to meet their lifestyle needs meet in the bank, that’s an after-tax number, right? What do I get deposited in, for my lifestyle for maybe if I have a mortgage, eating out gas, gas, for the grandkids, all that good stuff that makes up the life that you want to live? So once we know what we need, then we get down into the other income piece. In this specific example, I’m saying this person has so much security and a small pension, okay. And in Social Security, their amount is $2,500 A month after-tax, and their pension is $1,500 A month after tax. So if I take hey, I need $7,000 in the bank every single month, minus 2500 minus 1500. What that means is I’m left over with a need of $3,000 that I have to make up somewhere else. In this specific example, I’m saying this person is in a combined tax rate of 25%. Cash is a rough estimate. And if that’s true, then they need to take out $4,000 A month from their portfolio, right? If I take out $4,000 a month, and I withhold 25% for taxes, and send it to the federal or the state, what’s left is $3,000 a month for my bank account. Now I look at my assets, something the sum total of their investments, that would be things like a 401k, maybe an IRA, maybe a small Roth, a taxable brokerage account, the sum total of those investments is $1.3 million. Okay, so now we’re off to the races. Now we can figure this all out. So if I need $40,000, a year of withdrawals from my portfolio, and my portfolio is worth $1.3 million, that’s a withdrawal rate of 3.7%. A lot of folks might be familiar with the very common and very popular 4% rule. Now the 4% rule is not the Bible. It’s not the be-all-end-all. But it is a good starting point. And it gives us a good framework to say are we in the ballpark? Are we headed in the right direction? And answering that million-dollar question? Am I okay? Am I going to run out of money it can help answer help us answer those questions?

Anthony Saffer 4:20

When we do financial plans, including retirement projections, that’s where we can be more customized. Of course, we’re gonna put in assumptions for inflation for tax rates. It but we can then plan to say how can we be more tax efficient to make your money go further? When’s the optimal time to take Social Security? All those types of questions where we can try to prove the picture?

Alex Okugawa 4:41

If folks want to know if they’re on track or not, if they want greater confidence, of course, they can reach out to us we love helping folks with that. But we’ve also created a free guide called “Five Retirement Mistakes to Avoid” This is a free guide. There are no strings attached. You can get that guide in the comments down below. And really the findings are the result of coaching hundreds of families to and through retirement successfully.

Anthony Saffer 5:06

And now let us know what you think. What should people do before they take the plunge into retirement? Leave your thoughts in the comments below. And if you have ideas for future videos as well, if you like today’s content, please like and subscribe for more. Thanks for watching.

Want tax, investment, and planning strategies like this right to your inbox? Subscribe below!

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures