In this video, we discuss gifting strategies to avoid taxes.

Gifting Money to Children Without Paying Tax?

Resources:

- https://www.taxpolicycenter.org/briefing-book/how-do-estate-gift-and-generation-skipping-transfer-taxes-work

Full transcript:

SPEAKERS

Anthony Saffer 0:00

Many folks want to give money to their children or grandchildren as an early inheritance but are not sure if this will cause a tax problem. Today we’re going to discuss how the estate tax exclusion works, how you can gift money annually to a person and how you can give to multiple people in one year. Hey there it’s Anthony and Alex with One Degree Advisors and we help you gain confidence in your retirement. So Alex, many folks, want to make gifts to the next generation to their children and grandchildren. But they want to do it without paying taxes, they want to do it simply if they can.

Alex Okugawa 0:32

And it’s important to remember when we say, making gift, we don’t mean making a qualified charitable gift. Gifts to a qualified 501c 3 can be tax deductible, and there’s no limit really on how much you can give gifts to a non-qualified charity such as it is just an individual itself is not tax deductible.

Anthony Saffer 0:52

That’s right. So if you’ve given to an organization that sponsors a child in a foreign country, then that would be a charitable gift. That’s really not what we’re talking about here. And you always want to run these things by your tax pro.

Alex Okugawa 1:02

Now, again, under current law here in 2023, a person can gift to a non-charity $12.92 million, and not pay what’s called an estate tax and estate taxes can be very hefty, they start as low as 18%. And they can go all the way up to 40%. I know a lot of people are going to $12.92 million. That seems like a lot it really is. The problem is that this very high amount is set to revert at the end of 2025. Unless some changes are made.

Anthony Saffer 1:32

so and even if it reverts, say to $5m or $6 million, people might be thinking, Oh, I’m not giving a gift that big, I’m in the clear,

Alex Okugawa 1:40

it’s important to remember that the vernacular we use is really important. This is an estate and gift tax exclusion amount, meaning that gifts you make above your annual exclusion amount that you can give every single year will start to eat into your lifetime estate and tax exclusion amount. And again, this is important because that estate tax amount comes into play when you eventually pass away. And again, although these numbers are high, they can go down in the future and potentially cause more of your estate tax to be taxed.

Anthony Saffer 2:12

Okay so, if people don’t want to pay taxes, and they don’t want to also eat into that lifetime gift and estate tax exclusion, what should they be thinking about

Alex Okugawa 2:20

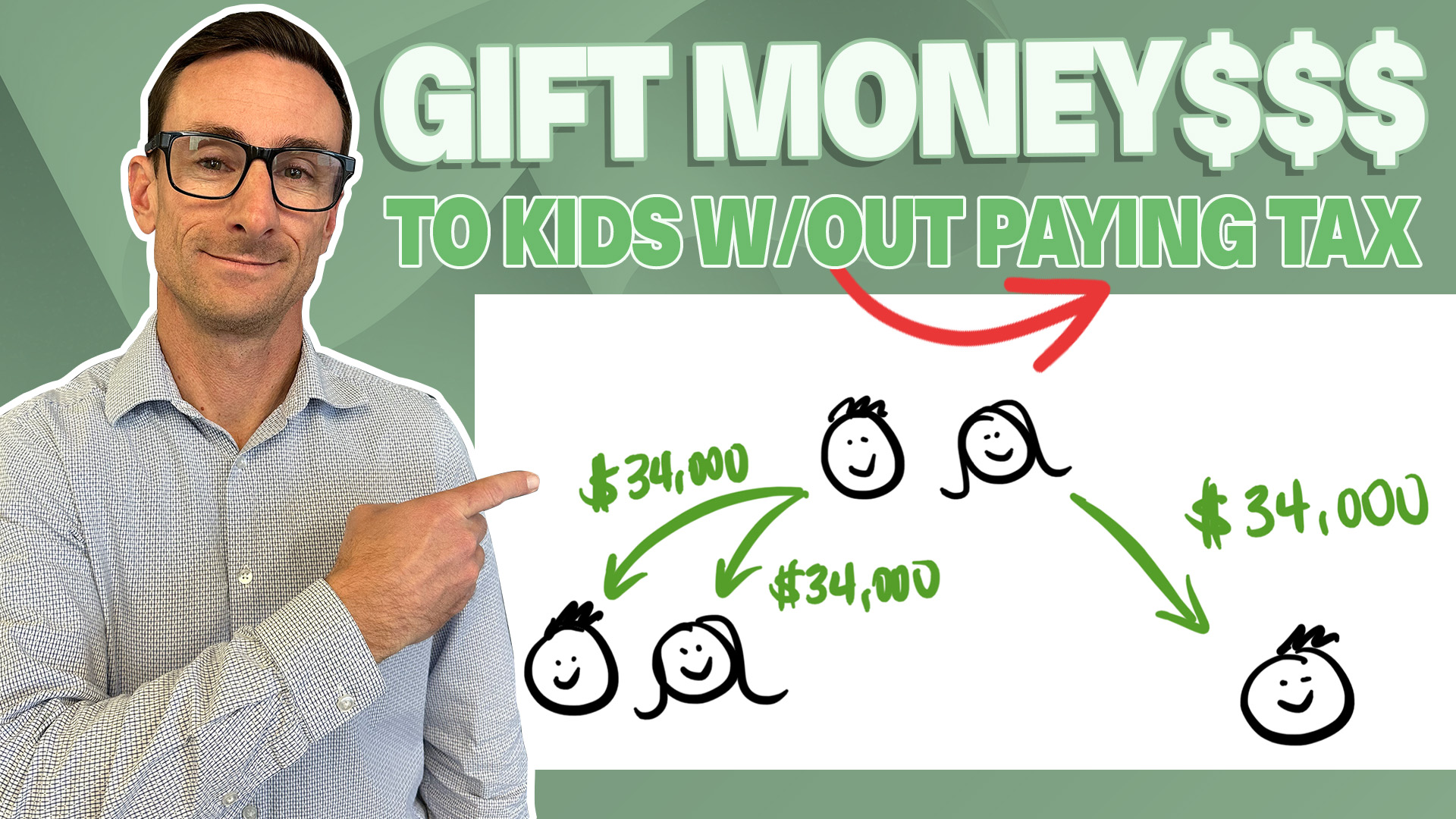

in 2023, folks can give up to $17,000 per person, per beneficiary, and not have to worry about filing any tax reports or making any other type of report. So we’ll put this example up on the screen so people can see how this works. Let’s say you have a husband and wife, and together they have two kids. So the child one, they’re able to give, let’s say, him, $34,000, each of them, the husband and the wife are each able to give $17,000 for a combined total of $34,000. Now, let’s say for child two, they have a daughter and she’s married, they’re able to give their daughter $34,000. And then they can also give her husband $34,000 as well for a grand total of $68,000. And again, the reason why I’m gonna go through this is because a lot of confusion around this is like it’s not a gift per household, to another household, right? It’s per person, per beneficiary. And understanding those rules is really helpful because then you can see how you actually can give quite a bit of money away without running into filing stuff.

Anthony Saffer 3:26

Yeah, and if someone does find themselves over that annual gift exclusion that file form 709 needs to be filed a tax pro can help with that.

Alex Okugawa 3:35

Now, folks may also consider gifting things other than cash. So for example, you may want to gift appreciated stock to the next generation since they’re likely in a lower tax bracket. You may also look at gifting interest in your business. Really, there’s a lot of nuance here. And there are ways to do it the right way and the wrong way. And that’s something that we help folks with. But the point is, it doesn’t always have to be cash. There are other ways to give to the next generation very tax efficiently.

Anthony Saffer 4:02

Yeah, the financial planning is really important here and we’re talking about some of the technical issues, but looking at okay, how much can I give away including charity to family these can be great objectives to have as part of a plan knowing I am going to run out of money if I give away too much. This is all coordinated including giving away assets. We posted a video before about how to address this endless pursuit of money. We’ll post that up as well. Again, this is Anthony Saffer with One Degree Advisors. If you’d like to learn more about how we can help with your retirement planning, go to onedegreeadvisors.com/getstarted.

Transcribed by https://otter.ai

The One Degree Blog

Not signed up yet? Get weekly financial insights right to your inbox.

Subscribers also gain access to our private monthly client memo.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures