The introduction of a bill to replace the current income tax system with a fair tax, or a national sales tax is making headlines. This concept has been introduced before unsuccessfully, but would be a major change affecting tax and financial planning.

We’ll discuss how the Fair Tax could work, some planning ideas you’ll want to keep in mind, and the key tax planning takeaway.

Fair Tax Act: Should you change your tax strategy?

Resources:

- Click here to watch our video: Hidden Taxes in Retirement

- Click here to watch Travis Sickle Flat Tax Video

Full transcript:

SPEAKERS

Alex Okugawa 0:00

The introduction of a bill to replace the current income tax system called a fair tax or a national sales tax is making headlines. And this would have some major implications for both tax planning and financial planning. This concept has been tossed around before unsuccessfully. But today we’re going to talk about what the fair tax act might look like, and some planning ideas that you may want to consider in a key planning takeaway. Stay tuned. Hey, there, it’s Alex and Anthony, from One Degree Advisors, and we help you gain confidence in your retirement. So Anthony, the Fair Tax Act is on the table right now. I believe it’s being proposed by the House of Republicans. I mean, the thing is, this isn’t necessarily new. This whole idea of air quotes, fair tax, has been proposed before, and it’s very likely, it’s not going to go anywhere. Nonetheless, I think it’s still interesting. And it’s not a bad idea to be thinking about some potential planning ideas, because it would be a huge, huge tax change. So let’s just talk about some key planning takeaways in regards to a fair tax act.

Anthony Saffer 1:01

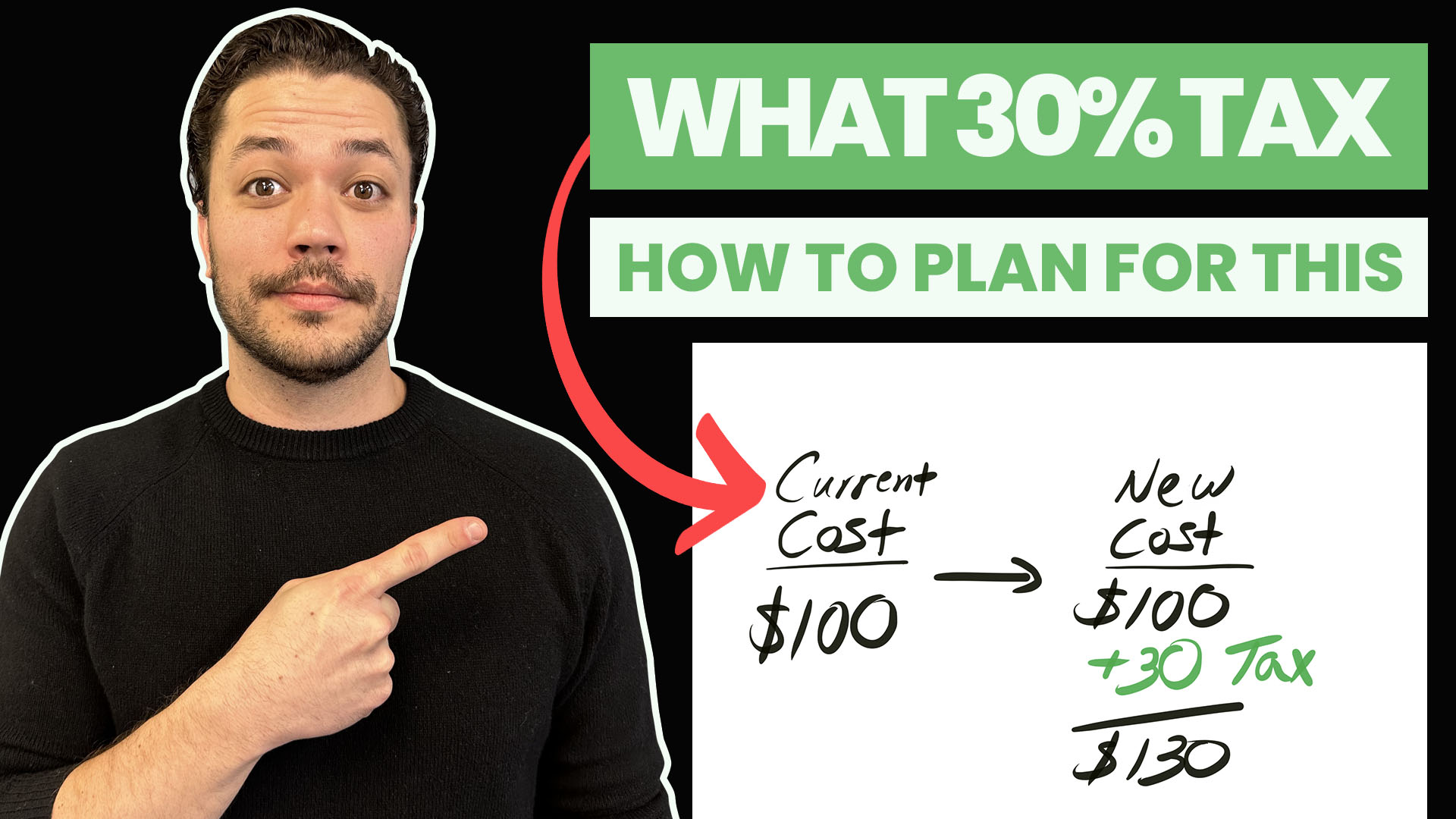

Yeah, you’re right, it would significantly change tax planning because what it does is it replaces the income tax system, and replaces it with basically a national sales tax, it’s a tax on consumption. I’ll put a chart up here just to show you just a brief example of what this will look like. So if you take the current cost, say something costs $100, today, a $30 tax would be added on top of that. And so you’ll see how it’s calculated different ways people will call it a 23% tax, depending on how it’s calculated, it’s really 30% on top of that. This would include when we’re talking about income tax being replaced, it would include replacing payroll taxes, Social Security, and Medicare, even corporate taxes.

Alex Okugawa 1:44

So those would go away. So it’s not just federal income tax, but it also applies payroll taxes, for those that are still working things like social security, Medicare would also not be taxed anymore.

Anthony Saffer 1:54

Yeah. And then Travis Sickle posted a really good video on this where he looks at a hypothetical example of the current income tax system versus the fair tax as it’s proposed, there’s more that goes into it. It’s worth a watch. We’ll post a link to that in our show notes.

Alex Okugawa 2:09

Yeah, that’s a good idea. So what would a flat tax incentivize? Because as you’re talking about this, right now, I’m going, I’m not going to be enjoying paying California sales tax as it is, I would not enjoy paying a potential 30% sales tax on things. I mean, my Costco bill is large enough.

Anthony Saffer 2:26

Right, you’d have to think that it would encourage savings because if you go out and spend that you’re gonna get taxed on it more people are at least going to think about it a bit more. It should encourage productivity, I mean, from the fact that there’s no tax on added income, you’re gonna go out there, and you’re gonna earn and not have to think about the additional tax. The other thing is that it could encourage more resale because I think, as it’s proposed, and obviously, that could differ just a little bit that the tax would not be on resale items.

Alex Okugawa 2:52

So what would we want to do if a fair tax were implemented? Again, it’s kind of like it’s it’s an offshoot, I mean, it’s not likely to happen. But if it were, what would we want to do?

Anthony Saffer 3:02

Right, so it is good to learn from these types of things. And we’re gonna get to actually the key takeaway, but if this something like this were to pass, number one is that you’d want to save pre-tax now. So like putting into the traditional IRAs, into the pre-tax 401k, as opposed to a Roth or even doing other Roth conversions, because there’s no point in getting tax-free later, if there is no income tax, you’d want to get the benefit now. The other thing that you’d want to happen is if say, this really did go through Congress, is there would be a rush to buy new cars before this came about, you’d go out, you’d buy those big purchase items before the tax spiking consumption. Yeah, exactly. And then the third thing I would think would be that there would really be this push to grow income. And we think now like, well, of course, you want to grow your income, you want to earn more, but there are people where they’re paying high percentages of income tax, where it does really limit their benefit of earning more income.

Alex Okugawa 3:56

I had a dual-income household, husband, and wife are both working. And let’s say they’re spending a lot on childcare. And they have these discussions where they’re like one of the spouses, let’s say it’s the wife, she’s like, why am I still working, we are paying all these taxes on my wages, and most of my salary right now, if we hadn’t divided up is going towards child care costs like, so if I stopped working we don’t have to pay for those childcare costs. Plus, we’re not going to keep taking a bath in taxes and keep getting pushed up into higher brackets. So, you can definitely see that. But I’d say the key takeaway here is that like we discussed at the beginning, it’s not likely to pass anytime soon, but that doesn’t mean that you can’t kind of plan and make good strategic decisions around this. I think this is a really good reminder that this is why tax flexibility is so important. And when we say tax flexibility, I mean having assets both in pre-tax accounts, post-tax accounts, and then taxable brokerage accounts, so many people are so focused on shoving as much money into a Roth as possible at the expense of paying a lot of taxes today, right? That’s the big push right now. But like you’re bringing up if something like this were to pass even though it’s rare, you’d actually not want to be doing all these Roth conversions. Now you’d want to wait till later. So, that’s where not making any big changes is so important. But thinking strategically having that tax flexibility is so huge. And speaking of taxes, we did create a video called beware of the hidden taxes in retirement, specifically talking about things like Medicare premium surcharges, folks that watch that video above. Once again, this is Alex Okugawa with One Degree Advisors. And if you’d like to learn more about how we can help you with your retirement, visit our website at onedegreeadvisors.com/getstarted/ forward slash get s

Transcribed by https://otter.ai

The One Degree Blog

Not signed up yet? Get weekly financial insights right to your inbox.

Subscribers also gain access to our private monthly client memo.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures