For most young investors, a 401(k) is their first experience investing. It’s understandable that most have no legitimate investment strategy. Typically they glance over the list of funds and then whatever sounds good and has solid past performance is chosen. Your 401(k) may become one of your largest assets as you age. Neglecting the importance of asset allocation, savings rates, and choosing between Traditional or Roth contributions can impact your future considerably. Here are some tips for the young investor’s 401(k). Planning and forethought today can dramatically change your tomorrow.

The Basics

For the young investor, there should be a basic comprehension of how investing works. Understanding the relationship between risk and reward is incredibly important. Fundamentally there are two types of investments — stocks and bonds:

Stocks are investments in companies. When you buy a stock, you are purchasing a share of ownership in that company. If the value of the business increases, your stock value increases. Conversely, if the value of the business decreases, your stock value decreases.

Bonds are investments in debt. For example, when you take on a mortgage you pay interest on the loan to the bank. A bond is simply a way for the government or business to take on loans. When you invest in bonds, you are lending money to a company or government entity. Over time, you can earn interest, and when the bond matures receive the loan principal.

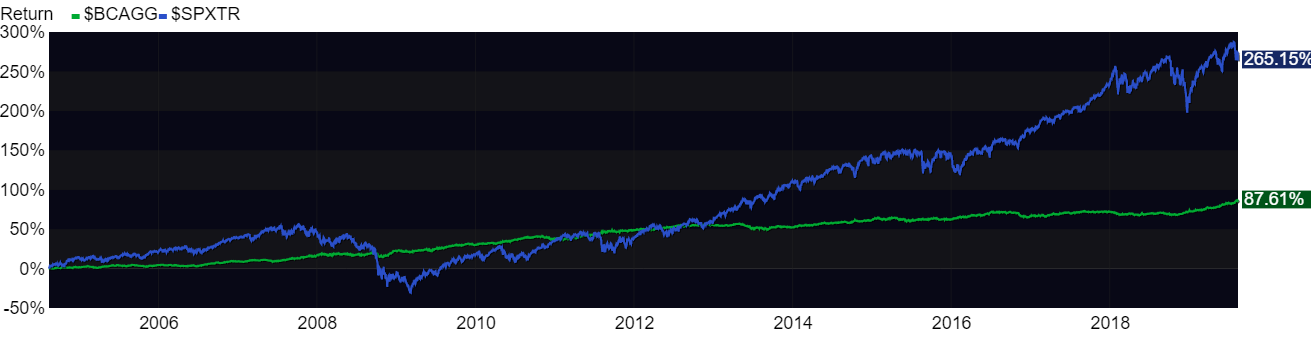

Historically, stocks provide higher returns but fluctuate more in value. Bonds, on the other hand, usually provide relatively lower returns with the benefit of lower risk. In employer retirement plans, investing in stocks and bonds usually comes in the form of mutual funds which bundle the individual stocks and bonds together. In the chart below, the blue line represents stocks and the green line represents bonds.

Proper Investment Allocation

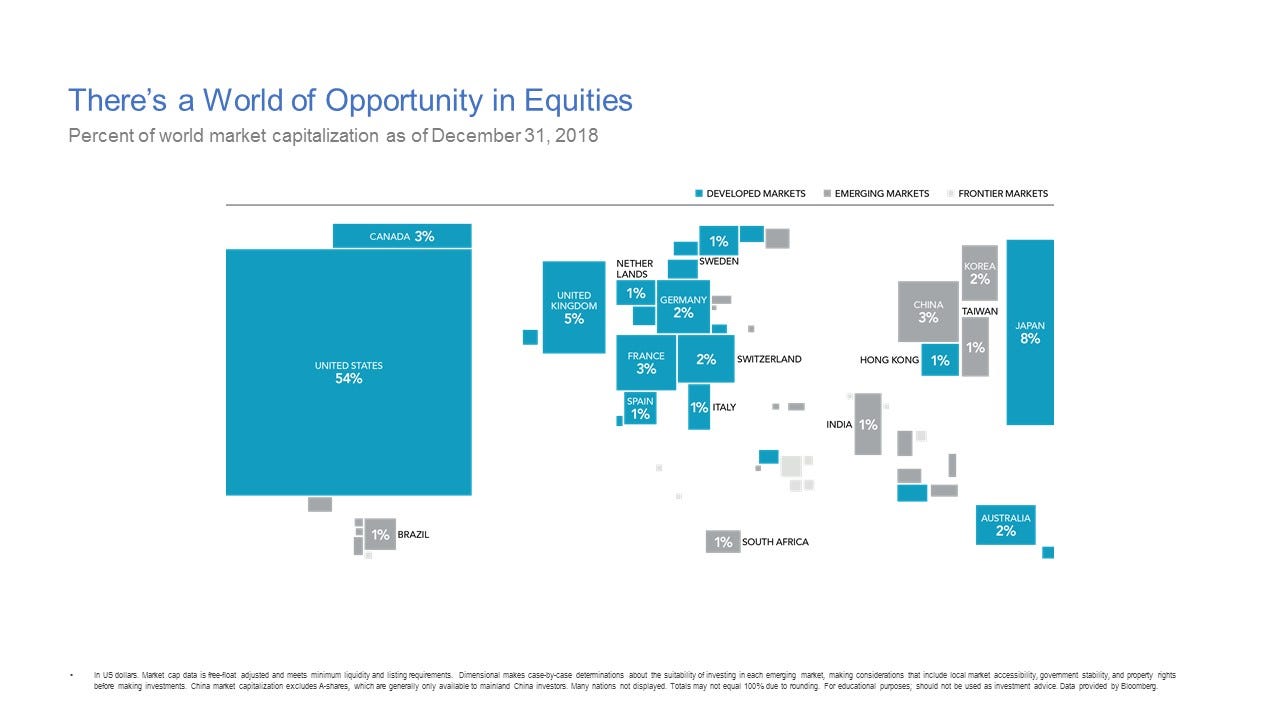

A first step to creating a proper investment allocation, or mixture of stocks and bonds, is considering your timeframe. It’s a basic rule of investing: the shorter your timeframe the less risk you should take. If you’re young and have decades until retirement, allocating enough to stocks is a key ingredient to success. A common practice is to allocate roughly 40% of your equity exposure to international investments. The chart below shows the world market by size broken down into countries. It’s very common for the United States and International markets to tradeoff taking the lead. [How do you know what category an investment falls into? Your 401(k) should have a list of investments labeled with their respective asset class. You can also search for the fund using Morningstar].

Now for the golden question: How much equity exposure should a young investor have? Unfortunately, it’s not a black and white answer. Regarding risk, a ‘moderate’ portfolio will have around 60% equity. For investors with time on their side and enough tolerance to stomach 30–40% downturns, there’s nothing wrong with 70–90% equity. Make sure you’re taking on the right amount of risk to achieve long-term growth.

Thankfully, target-date funds were introduced in the early 1990’s. These mutual funds have simplified asset allocation and diversification for many investors. In simple terms, target-date funds are used to autopilot investing. They invest in a diversified portfolio and adjust the strategy as the investor approaches a fixed date. For example, someone in the year 2019 who chooses a target-date fund 2050 may initially invest in 90% stocks and 10% bonds. The allocation will slowly reduce risk by investing in more conservative securities such as bonds as the year 2050 approaches. While target-date funds may have higher expenses and are not customized to each investor, they are a solid choice for those unable to meet with a qualified financial advisor. Note that not all employer retirement plans offer target-date funds.

Whether you manually choose individual funds or select target-date funds, one of the most damaging things you can do is try and time the market or change your allocation too frequently. For most young investors, changing your investment strategy every year is unnecessary. Tune out the noise, stay invested, and be disciplined.

Things You Can Control

Investors may not be able to control the market, but there are things you can control. As a basic rule, always choose to receive a company match if available. It’s common for employers to contribute to your 401(k), but only if you invest your own money as well. For example, if you put in 3% of your salary your employer may match your 3% contribution dollar for dollar. Investors who fail to contribute may not receive company matches, essentially wasting money. Even if you’re in debt and have student loans, make it a high priority to save and receive the match to let compounding work for you.

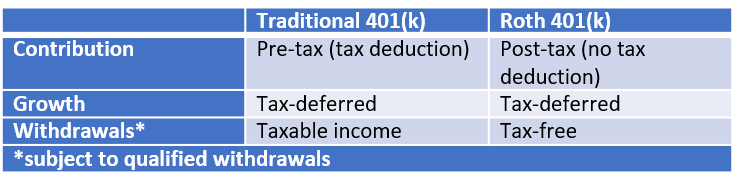

Some employers may offer a Traditional 401(k) and a Roth 401(k). To keep things simple, a Traditional 401(k) allows you to make pre-tax contributions, meaning you don’t immediately pay income tax on the amount you contribute. When you eventually take withdrawals you will pay income taxes on the amount you take out. Roth 401(k) contributions are post-tax, meaning you pay taxes on the amount you contribute. As a benefit for paying taxes up front, withdrawals you eventually take are tax free. So which type of account should you choose? While the answer isn’t always straightforward, there are general rules of thumb. If you expect your current tax rate to be higher or equal to what it will be in retirement, make Roth 401(k) contributions. If you expect your tax rate to be lower in retirement, then make Traditional 401(k) contributions. No one can know what tax rates will be in the future. Much of planning is making the best decisions possible with available information at the time and not worrying about perfection. It’s important to note you can typically mix Traditional and Roth contributions. It’s not all or nothing, but contribution limits are shared.

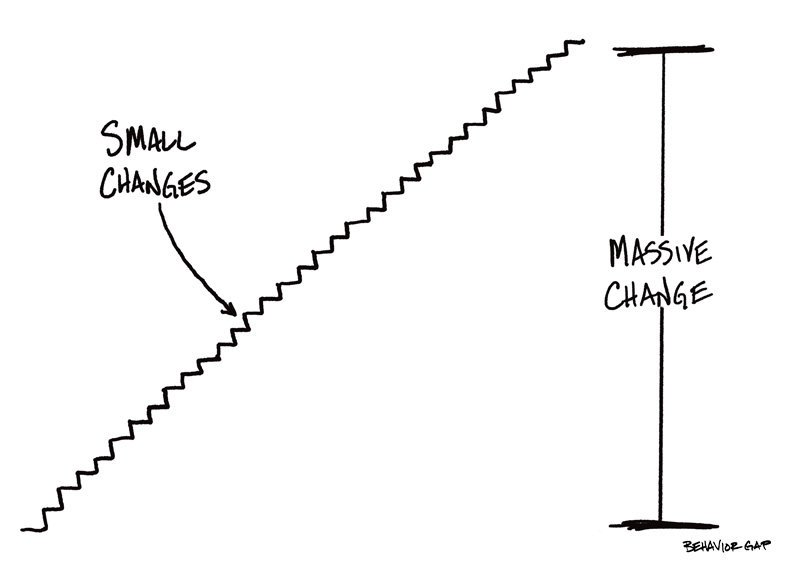

A common rule of thumb is to save at least 10% of your salary. Advice to increase retirement contributions is often met with reluctance. Most people think they’ll never get there. Too often I see investors contributing 3% of salary which hasn’t increased in decades. The unfortunate mindset is, “If I need to save 10% and I’m currently at 3%, increasing my saving rate by 7% would be too much.” I agree that a change from 3% to 10% would likely require substantial lifestyle adjustments and be difficult. Instead of becoming paralyzed by large changes, consider making a 1% adjustment. This is much more palatable and easier to handle. The following year see if you can make another 1% increase. The important thing is to make slow progress over time. Carl Richards has a simple but inspiring image that demonstrates this mindset.

How I Invest My 401(k)

In the end, investing is a highly individual activity. So, how do I personally invest in my own 401(k)? Currently, I invest in a Roth 401(k) for the simple reason I expect my tax bracket to be higher in the future. I currently put 5% of my salary away and the company contributes 3%. I invest in a mix of individual mutual funds that target 90% stocks and 10% bonds because time is on my side. Knowing my account could be halved at any time due to market volatility isn’t a concern since I won’t touch this money for decades. For my stock allocation, I target about 55% to US equities and 45% to International equities.

Of course, your situation will be different than mine and this is not a recommendation to invest in a similar fashion. I do hope, though, that the information and guidelines provided in this column help you on your journey as you apply them to your own unique circumstances.

Happy, informed investing!

More Reading: Investment Strategy Basics: How to think about portfolio construction

Alex Okugawa

San Diego Financial Planner. I write about financial planning topics to guide families in making a greater impact with their wealth.