Should you buy high dividend yield stocks?

Today, we are going to discuss why getting paid a high dividend income to own stock may NOT be the best choice…

Dividend Investing 2022

Show Notes:

- Warren Buffet on Dividend Investing

-

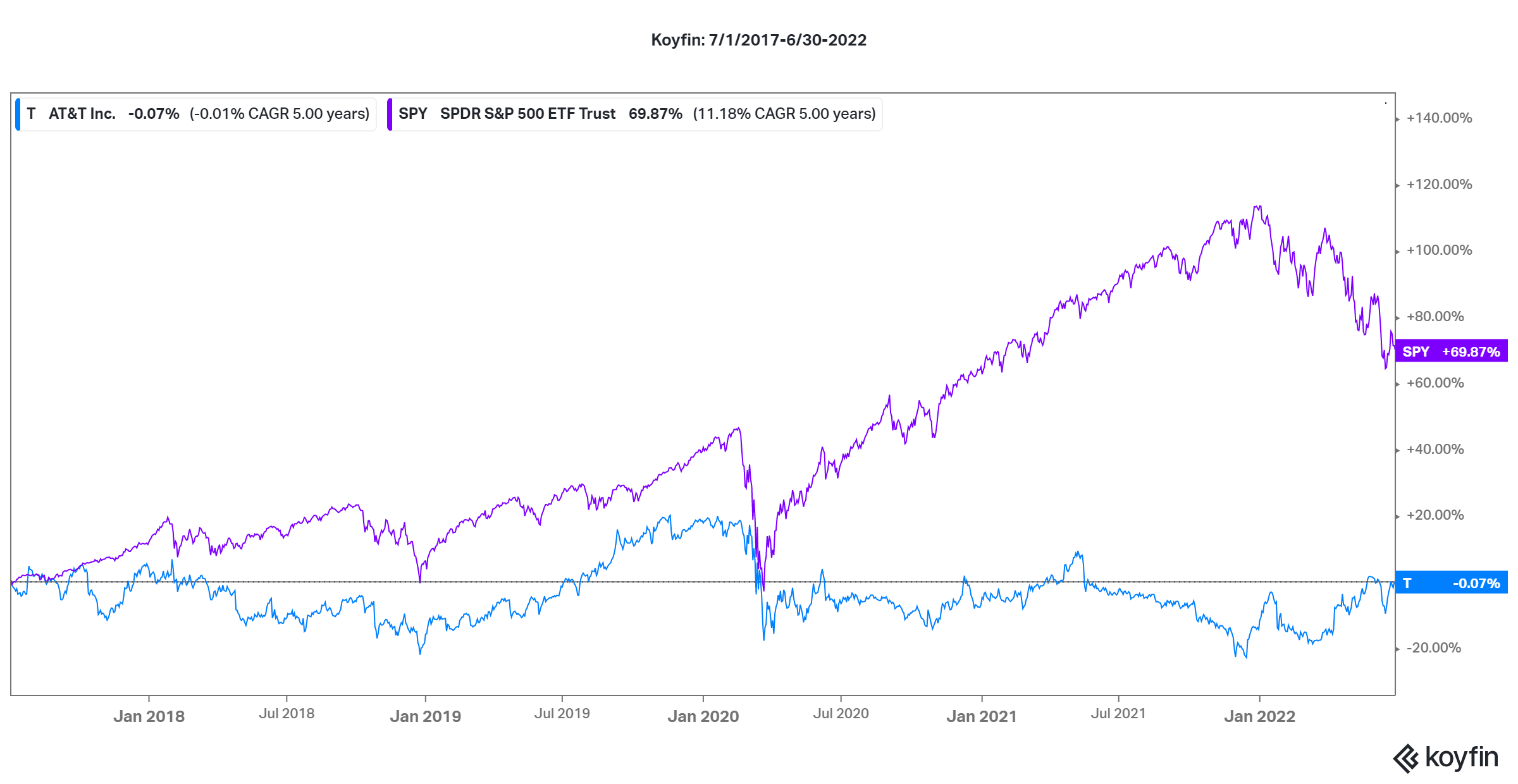

Koyfin Chart $T & $SPY 07/2017-06/30/2022

Full transcript:

SPEAKERS

Alex Okugawa 0:00

Should you buy a high dividend-yielding stock? Today we are going to discuss why getting paid a high dividend to own stock may not be the best choice. Stay tuned.

Hey, there’s Alex and Anthony from One Degree Advisors. If you’re new here, we are Certified Financial Planners that help folks with all things investment, tax, and retirement-related. So, Anthony, many stocks will pay you an income called a dividend for the shares that you own. But by simply looking at the stocks that you own, and picking them based on the yield, or the income that they can generate, really can be a disaster for folks. So maybe we’ll start with a real-world example, I think people can grasp that just by comparing like AT&T versus the broad S&P 500 index.

Anthony Saffer 0:49

So the S&P that’s made up of 500 different companies versus AT&T is not to dog on it, but it has a yield above 5%. That sounds great. But if you take a look at this chart over the past five years, we cut it off halfway in 2022. Basically, it has no return over a five-year period compared to the S&P 500. So even with that high yield, compared to the broader index, it’s done significantly lesser.

Alex Okugawa 1:14

Now we started the video saying by just focusing on the income or the yield solely can be a disaster for folks, I think, for us to understand that we need to take a step back and go, you know, to understand why it could be a disaster, we need to know how do you make money in a stock.

Anthony Saffer 1:30

So there are really two components, there’s the price appreciation or depreciation that can go along with the stock, if I buy a stock at $10, it can go up to 12, it can go down to eight, that’s going to function as part of my return. And then I also may or may not get a dividend yield, if the company pays something out, that’s an income stream that comes to me.

Alex Okugawa 1:51

So again, a lot of people, only look at that dividend and they go, Oh, they’re paying a 5% dividend. And here’s my dividend. Meanwhile, in many cases, they will often neglect that other component, which is the price appreciation standpoint. So yeah, your stock might, you know, pay 5% yield. But if it’s down 20 30%, or it’s flat, over a period of time, that’s not necessarily a good thing and what you want in your portfolio.

Anthony Saffer 2:14

So like, why would a company pay a dividend in the first place? Or why would they not I mean, Warren Buffett talks about this love, there’s actually a good video, we’ll post that in the show notes, where he talks about, you know, a company if they have something better to do with the money if they’re earning revenue, they’re paying their staff, they’re paying their bills, and they’re turning around and taking more of that cash flow, and putting it back into research into other investments to grow, then they can get a higher return through the price appreciation. Another good common example is Amazon, people have seen the growth of Amazon through the years, they’re not paying a dividend because they’re taking their revenue, and they’re reinvesting it back into their growth.

Alex Okugawa 2:52

So in many ways, a higher dividend yield can simply mean that the company is reinvesting less in its growth.

Anthony Saffer 2:59

Exactly. And Warren Buffett even talks about that, with like a steadier company like a Coca Cola, he says they’re doing exactly what they should be doing, because the money that they are getting, they’re reinvesting everything they need to do and they still have free cash flow, that’s not going to materially help them any more than it already is. So that gets paid to shareholders and owners of the company.

Alex Okugawa 3:19

So if we’re not going to pick stocks based upon their dividend yield, either to like compound your wealth or even to create income in retirement, right, if we’re not going to pick stocks based on those characteristics, what’s the alternative? Then what do we do?

Anthony Saffer 3:33

So obviously, looking at it from a total return standpoint, we think is important. If dividends are a part of that then that can be a good thing, but looking at the total return. Now one of the questions I get a lot is well, why don’t I just invest in a dividend-paying stock that’s yielding three four or 5% instead of bonds which are yielding very little right now? The problem with that is stocks can appreciate or depreciate in this case much much more now. We’ve seen bonds come down more this year so it’s it you know, from a timely example standpoint, it’s a little bit hard to see but bonds tend to be more steady. You can have a high-yielding dividend-paying stock that can go down 30% in price.

Alex Okugawa 4:12

And now let us know what you think. Are you investing in high dividend-yielding paying stocks? Why or why not? Let us know in the comments down below and if you enjoy today’s video, please like and subscribe for more. Thanks for watching.

Transcribed by https://otter.ai

Join our private client memo that we don’t share anywhere else.

This does not constitute an investment recommendation. Investing involves risk. Past performance is no guarantee of future results. Consult your financial advisor for what is appropriate for you. Disclosures: https://onedegreeadvisors.com/solutions/#disclosures